This report is an updated version of the report published on 19 February 2024 at 3:55 PM AEDT.

Orora Limited (ASX: ORA)

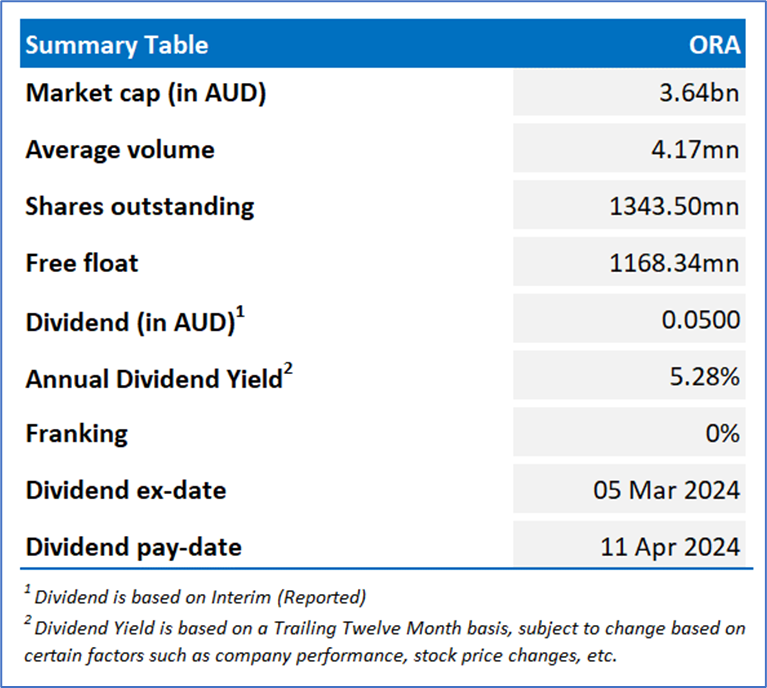

ORA is a manufacturer, distributor, and visual communication solutions company. ORA operates through three businesses, namely Orora Beverage, Orora Packaging Solutions (OPS) and Saverglass. It is supported by more than 8.5K team members globally.

Recommendation Rationale – SELL at AUD 2.960

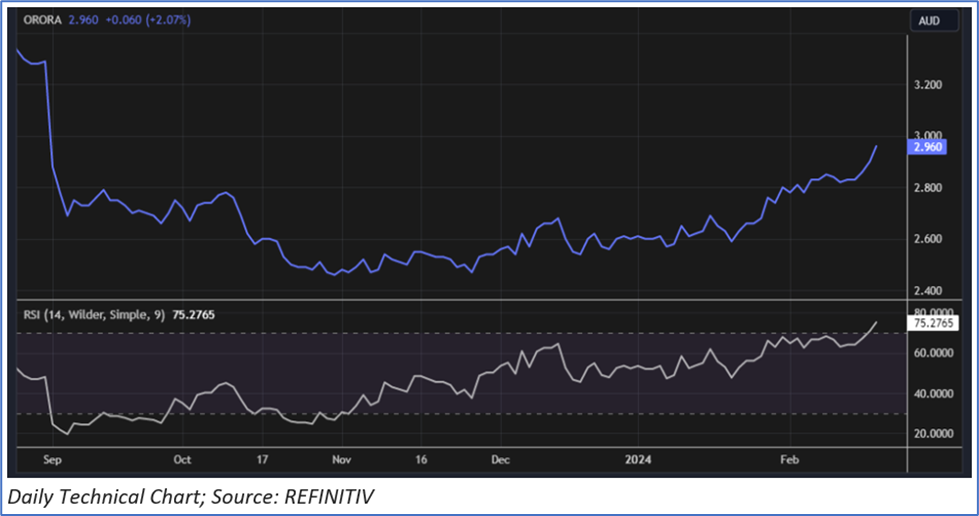

- Profit Booking: ORA has surpassed the R1 level recommended on 11 January 2024; and thus, it is giving a profit booking opportunity.

- Financial Performance: ORA’s revenue declined by nearly 10.6% YoY to AUD 2,139.1mn in 1HFY24 vs 2,264.5mn in 1HFY23, due to 13.6% revenue decreased in North America, and 0.9% decreased in Australasia. ORA’s EBIT increased by 3% YoY in 1HFY24, supported by over 3.7% growth in North America and over 2.2 growth in Australasia.

- Outlook: Despite uncertainty in global consumer demand, ORA anticipates higher EBIT in the FY24. In Australasia, strong sales of cans are expected to compensate for reduced glass sales due to lower volumes of commercial wine Saverglass is projected to have an EBITDA in FY24 that aligns closely with the EBITDA of the FY23.

- Emerging Risks: The macroeconomic headwinds, technology changes, cyber security, and intense competition and regulatory barriers could impact the company’s financials.

ORA Daily Chart

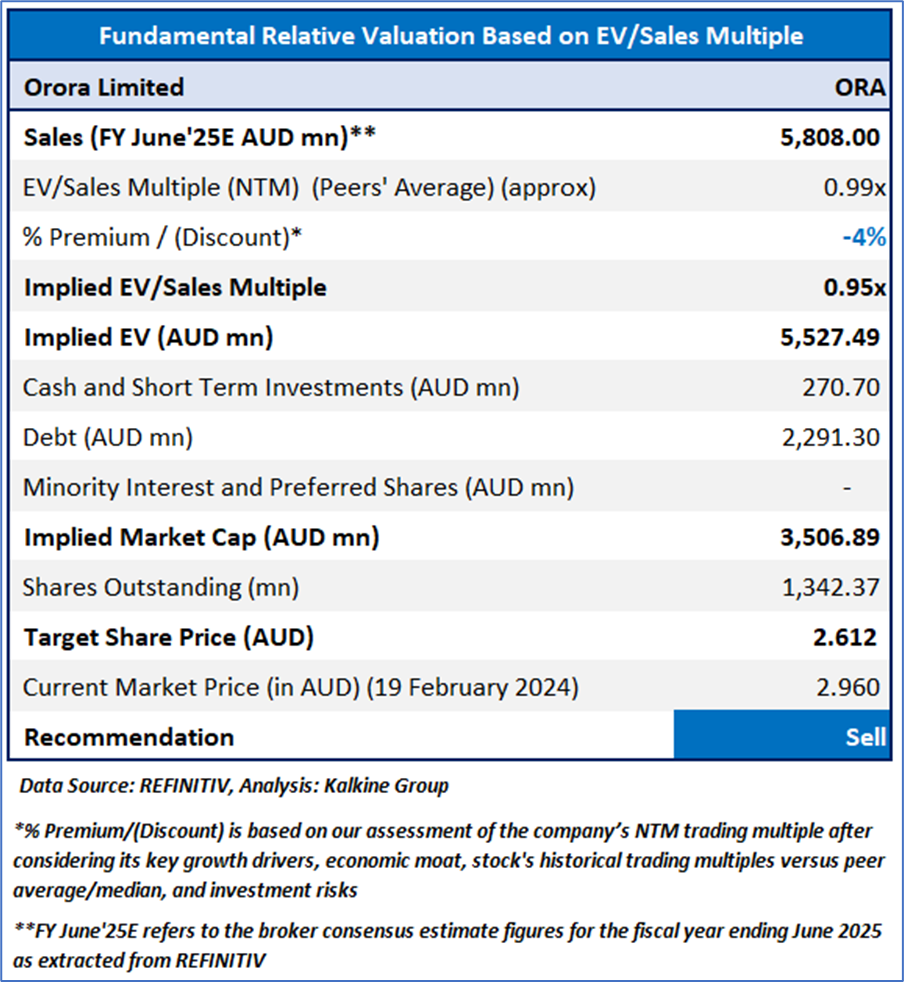

Valuation Methodology: EV/Sales Approach (FY25E) (Illustrative)

Considering declining top line, technology changes, cyber security, intense competition and regulatory barriers, etc. the company might trade at some discount to its peers. For valuation, few peers like Pact Group Holdings Ltd (ASX: PGH), Amcor PLC (ASX: AMC), and Monadelphous Group Ltd (ASX: MND), have been considered. Considering that the company has breached its R1 level, current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 2.960, as of 19 February 2024, at 10:15 AM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for price data is based on 19 February 2024, and all other data such as technical indicators, support, and resistance levels are as of 19 February 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.