Ventia Services Group Ltd

Company Overview: Ventia Services Group Ltd (ASX: VNT) is an Australia-based essential infrastructure services provider in Australia and New Zealand.

As per our previous ‘Earnings Hunter’ Report published on VNT as on 1 November 2023, Kalkine provided an ‘Attractive’ stance on the stock at AUD 2.720 based on ‘Earnings Hunter Score’, and the stock price has moved by ~11.58% since then and the price has crossed the first resistance.

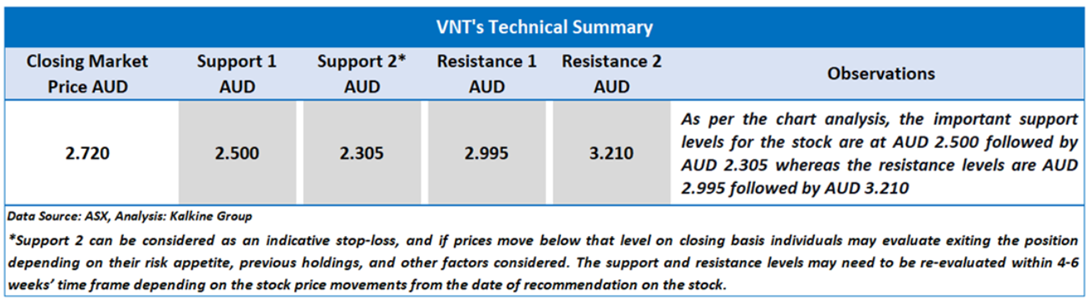

Noted below are the details of support and resistance levels provided in our previous report:

VNT’s Daily Chart

Considering the resistance, risk-reward scenario, current trading levels and uncertain macro environment, the stock seems ‘unattractive’ at the current market price of AUD 3.035 as of 12 December 2023 at 11:52 AM AEDT.

Ventia Services Group Ltd is a part of Kalkine’s Earnings Hunter Report

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 12 December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual’s appetite for upside potential, risks, holding duration, and any previous holdings. An ‘Exit’ from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.