Analysis

Transurban Group (ASX: TCL) shares have been in the positive mode this year, delivering a year to date returns of around 15%. Synergies from Transurban Queensland (TQ), which the group acquired in last year July, drove the group’s fiscal year 2015 performance due to improved traffic and thus the revenues.

Fiscal year 2015 highlights

-

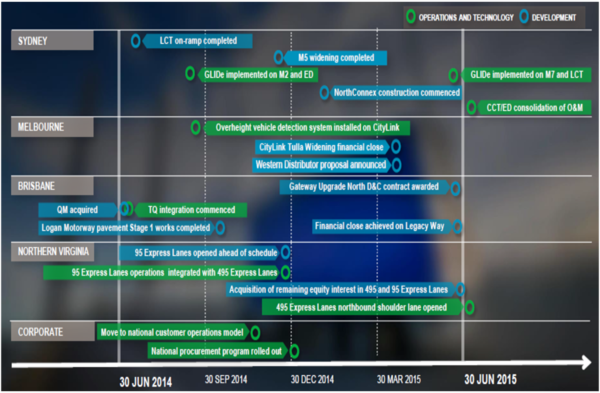

Transurban Group’s toll revenues witnessed an outstanding growth of 39.6% yoy to $1.5 billion in the fiscal year of 2015, with $524 million contributed from the TQ and CCT acquisitions as well as the US business consolidation. Sydney reported a 21.2% yoy of toll revenues increase, wherein the region represents 42.8% of the overall group’s Toll revenues. This increase in Sydney’s traffic growth was mainly on the back of further capacities generated from road widening and ramping up of projects. Moreover, the truck toll multipliers improved on LCT, M5 and M7 further driving the increase. Meanwhile, the Sydney’s northconnex construction environmental management plan was approved in June 2015, while the shaft excavation is expected to start from September 2015. New tolling system will be rolled on ED, M2, LCT and M7. As per the Melbourne highlights, the region accounts 37% of the overall group’s toll revenues, Melbourne regions toll revenues increased by 7.8% yoy driven by the average weekend/public holiday traffic growth of 5.5% during the fiscal year. Brisbane’s (which represents 15.9% of the overall toll revenues) toll revenues improved 6.8% yoy driven by traffic increase at Logan Motorway during the second of the fiscal year post the Stage 1 renovation works completion. Remarkably, Northern Virginia (accounting 4.3% of the group’s toll revenues) toll revenues soared 206.5% with the opening of 95 Express Lanes.

-

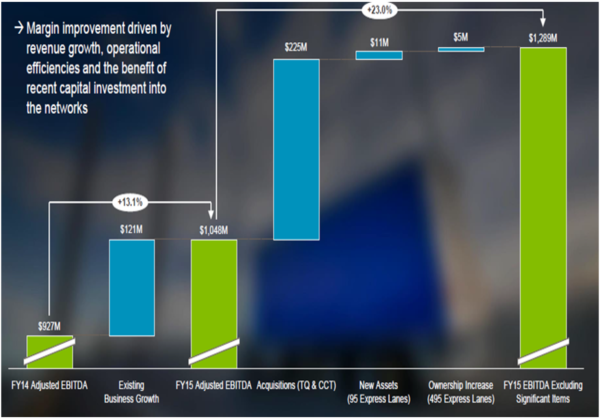

EBITDA movement during the 2015 fiscal year (Source: Company Reports)

-

Transurban Group’s EBITDA rose 38% yoy to $782 million in 2015 fiscal year, with $364 million coming from acquisitions and US business consolidation. The region wise operational efficiency also contributed to the overall EBITDA growth. Melbourne decreased its operating expenses thorough improving road operations management and incident response. Brisbane also improved around 360 bps of EBITDA margin after the acquisition. Northern Virginia generated benefits post the integration of 495 and 95 Express Lanes.

Developments across the regions during the 2015 fiscal year (Source: Company Reports)

-

On the other hand, the group reported a net loss after tax due to costs incurred from significant items which includes stamp duty ($384 million), integration costs ($23 million) and transaction costs ($22 million) for QM acquisition. The net profit after tax removing significant items also decreased to $45 million, against $252 million in 2014 fiscal year on the back of higher depreciation and amortization charges related to consolidation of TQ, the US assets and CCT.

-

Meanwhile, TCL has been consistently improving its distributions, posting a compounded annual growth of >10% from 2009 fiscal year (this included the 44.5 cents forecasted distribution for 2016 fiscal year). The group declared a distribution of 40 cents per share in 2015 fiscal year, wherein 20.5 cps would be paid on August 14th, 2015. The group’s weighted average number of securities available for distribution rose 13% to 1.91 billion from 1.69 billion in the earlier fiscal year due to equity raising for QM’s acquisition. Moreover, the rising distributions from ED, M5 and M7 as well as distributions from TQ, drove the free cash by 34.3% yoy to $768 million in 2015 fiscal year. As a result, the group’s free cash flow per share improved by 18.6% to 40.2 cents as compared to 33.9 cents in the previous fiscal year.

Outlook

-

Transurban Group’s stock touched a multiyear highs of around $10.5 in the month of May 2015 driven by the toll revenue increases for the last couple of months. However, the stock was not able to hold this level and have been consolidating since then, delivering just 0.82% in the last three months in spite of reporting solid 2015 fiscal year results.

TCL Daily Chart (Source - Thomson Reuters)

TCL Daily Chart (Source - Thomson Reuters)

-

Moreover, investors should also note that the 2015 fiscal year’s toll revenue growth was mainly coming from the acquisitions, while the adjusted toll revenues and EBITDA excluding acquisitions and 95 express lanes modestly increased 10.7% yoy and 13.1% yoy respectively. Consequently, TCL estimates a distribution of 44.5 cents per share for the next fiscal year, which is 11% increase from FY 2015.

-

We believe that triggers to drive the stock in the coming months is limited, and recommend investors to book their profits in the stock. The stock looks relatively expensive, and hence we give a “SELL” recommendation to the stock at the current levels of $9.77.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.