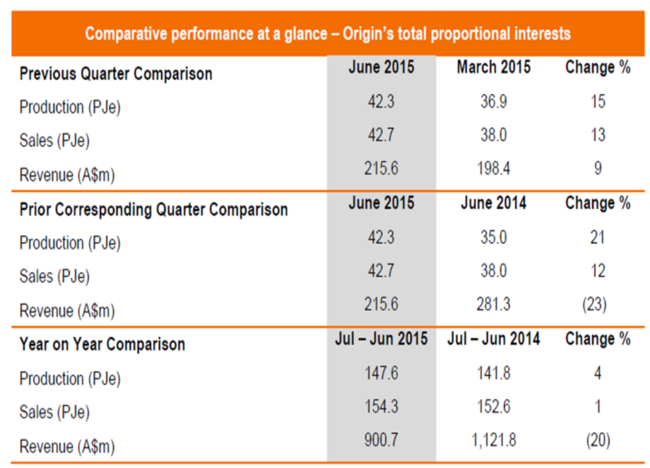

Origin Energy Ltd (ASX: ORG) reported an outstanding June quarter performance, with the production rising 15% to 42.3 PJe, as compared to the previous quarter, driven by the improved production at APLNG, BassGas, Otwar and Cooper. The APLNG production across operated as well as non-operated areas surged 29% to 218 PJe as compared to the last quarter, driven by the increase in facilities to leverage the rise in demand from LNG trains. BassGas witnessed a 37% quarter over quarter increase to 1.9 PJe, driven by the higher plant availability post a shutdown in the March Quarter. , Cooper Basin production rose 9% as compared to the previous quarter, on the back of production from new wells and improved plant availability. Otwat basis slightly increased by 3% QOQ, driven by increase in customer wins. However, the Perth Basin witnessed a 42% decline impacted by the decrease in customer nominations. As a result of improved overall production, the group’s revenue rose 9% as compared to the previous quarter in spite of falling commodity prices. Meanwhile, the APLNG CSG to LNG project upstream component is 97% finished while 92% of the downstream component is finished.

On the other hand, Origin Energy’s revenues plunged 23%m as compared to the last year’s corresponding quarter, despite rise in production and sales by 21% and 12% respectively. Even the fiscal year 2015 revenues reduced 20% to $900.7 million, as compared to $1,121.8 million in fiscal year 2014, in spite of year on year growing production and sales by 4% and 1% respectively. The falling commodity prices and decreasing third party volumes led to the decline.

Production and Revenue highlights (Source: Company Reports)

Quarterly drilling activity

Source: Data taken from Company Reports and Compiled

Solid Resource Potential

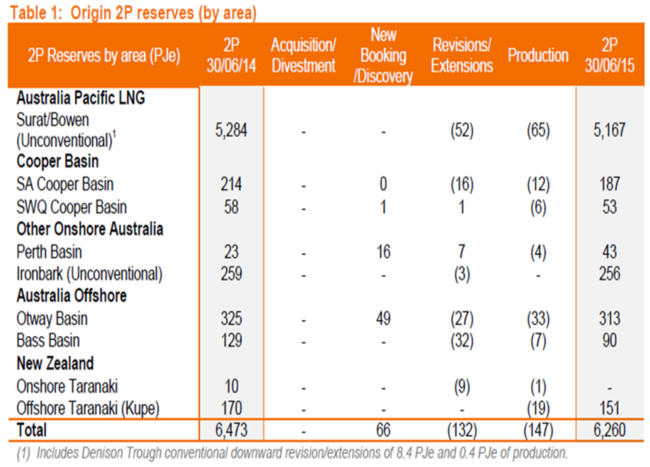

The group’s proved (1P) reserves surged by 544 PJe (post production) to a total of 2,763 PJe, against the earlier reporting period. However, the proved plus probable (2P) reserves reduced by 213 PJe (66 PJe excluding production) to a total of 6,260 PJe, against the ending of the last fiscal year.

Origin Energy’s 2P reserves (Source: Company Reports)

Outlook

Origin Energy’s stock posted 13% decline over the last three months, impacted by the reports of the potential sale of Contact Energy (Wherein Origin has 53% of interest) and falling commodity prices. However, the group has a solid resource potential and recently reported that the firm’s efforts of ramping up its APLNG project is on track. APLNG started loading refrigerants to its Curtis Island LNG facility, progressing well for the first LNG export during the second half of the year. Origin Energy is making efforts to improve its presence in the energy market to leverage the growing oppurtunity in the energy market. We belive that the group will be able to withstand the challennging market conditions, by improving its production and customer nominations.

Based on the foregoing, we reiterate our “BUY” recommendation to Origin at the current levels of $10.13.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.