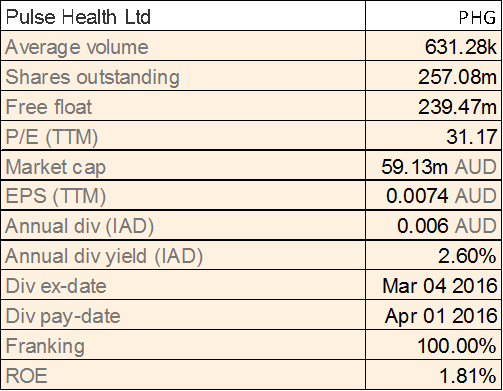

Pulse Health Limited

PHG Details

Acquisition updates: Pulse Health Limited (ASX: PHG) recently reported that they terminated the acquisition of Waikiki Private Hospital and Westminster Day Surgery (WA Assets) as there was no earnings contribution from WA Assets, which was expected to be included in Pulse Health’s FY16 results according to the earnings guidance announced on May 25, 2016. WA assets were forecasted to deliver $1.6 million of the incremental FY17 EBITDA of $6.4 million from the acquisitions as per December 07, 2015 announcement. Moreover, the company has reduced the earning forecast which now expects the FY16 underlying EBITDA to be between $8.0 - 9.2 million from the existing assets, down from the earlier forecast of $10.2 million. This reduction is due to a recent downturn in activity in three rehabilitation hospitals. As a result, the stock fell by over 16.36% (as of June 29, 2016) in the last four weeks alone. On the other hand, PHG is expanding its portfolio by acquiring Boulcott Hospital in New Zealand which is funded by the existing cash reserves of the company. PHG is expected to complete one more acquisition over the next two to three months. The company is positive on the demand outlook for rehabilitation care and focusing to enhance the utilization by adding non-rehabilitation services in each of their hospitals over the short to medium term. PHG has commissioned Gold Coast Surgical Hospital with five out of a total six theatres and has opened all 24 beds instead of the previous plan of gradual commissioning of theatres and ward beds. We believe the recent correction is a lucrative entry opportunity and give a “Speculative Buy” on the stock at the current price of $0.22

PHG Daily Chart (Source: Thomson Reuters)

Integral Diagnostics Ltd

.png)

IDX Details

Acquisition of Western District Radiology & South West MRI: Integral Diagnostics Ltd (ASX: IDX) expanded range of additional services which includes MRI at Sunbury (VIC) for the second half 2016. The group is acquiring Western District Radiology and the remaining 50% interest in South West MRI, which is expected to generate $4.3 m of revenue and EBITDA of $1.2m from FY17. Moreover, as per the changes to the rebates and incentives depending on upcoming elections, there is commitment to increase the investment in Medicare to $26 billion by 2021 while delaying the cuts to bulk billing incentives till January 01, 2017, by the government. There are also plans to invest up to $50m for improving the affordable and safe scans as well as imaging procedures.

.png)

Growth Strategy (Source: Company Reports)

IDX estimates the second half 2016 to be better than first half 2016 due to recovery in volumes and additional revenue from Toowoomba and Sunbury along with extra MRI at SJOG Geelong. On the other hand, the group was not able to achieve FY 16 forecasts due to headwinds in the industry.

The company is subject to regulatory change and could be affected by the Federal Election on 02 July 2016 as there could be changes to rebate & incentives. Given such volatility ahead, we give an “Expensive” recommendation on the stock at the current price of $1.45

IDX Daily Chart (Source: Thomson Reuters)

Capitol Health Ltd

.png)

CAJ Details

Increasing presence in China through MOUs: Capitol Health Ltd (ASX: CAJ) has signed Memorandum of Understanding (MOU) with Sunshine Insurance Group to provide tele-radiology reporting, clinical training and mentoring services to Sunshine Union Hospital (SUH) in Weifang, Shandong Province, China. CAJ has also entered into an MOU with CITIC Pharmaceutical (Shenzhen) Co., Ltd to provide design, consulting and clinic management services. The MOU is part of CAJ strategy to increase the presence in the Chinese diagnostic imaging market as the recent Chinese Government healthcare reform led to an increase in growth in the private healthcare industry in China. Meanwhile, CAJ has successfully raised the fund to pay their debt by Capitol Treasury Pty Limited, a wholly owned subsidiary of Capitol Health of A$50 million of unsecured 4-year notes at a fixed coupon of 8.25% per annum which matures on May 10, 2020.

CAJ has also invested in Enlitic Inc for which the company has made the second payment of USD$2.5 million. The group also clarified that they were not aware on the unusual volumes of their stock to ASX. CAJ stock has an outstanding dividend yield and we maintain our “Hold” recommendation on the stock at the current price of $0.16

.PNG)

CAJ Daily Chart (Source: Thomson Reuters)

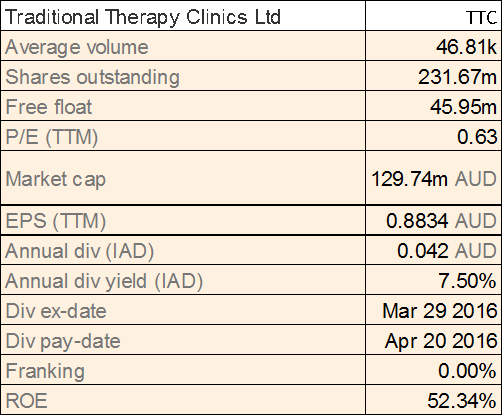

Traditional Therapy Clinics Ltd

TTC Details

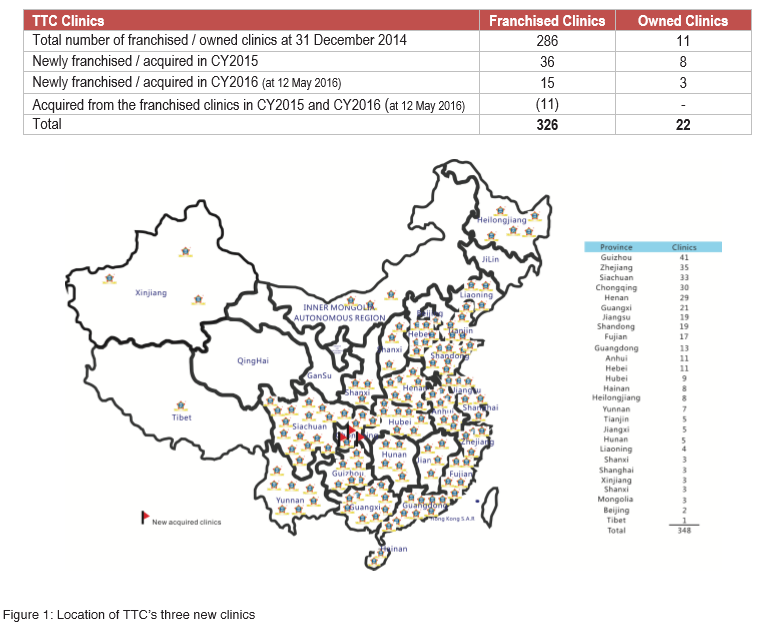

Expanding the number of clinics: Traditional Therapy Clinics Limited (ASX: TTC), through its subsidiary, Fuqiao (Chongqing) Holdings Co. Limited has acquired further three clinics to diversify its revenue stream. The total number of owned clinics of TTC is now 22. TTC has signed 15 new franchise agreements for the period from January 01, 2016 to May 11, 2016.

Franchised and Owned Clinics (Source: Company Reports)

On the other hand, TTC stock lost over 13.18% (as of June 29, 2016) in the last four weeks due to tough market conditions in China and investor’s concern over the group’s expansion mainly via acquisitions. Moreover, the group terminated the property purchase agreement for its new office in Chongqing, China and the developer is refunding money in four installments. We believe the stock would continue to be under pressure in the coming months and accordingly give an “Expensive” recommendation on the stock at the current price of $0.56

TTC Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.