Collins Foods (ASX: CKF) lately announced its results for FY16 showing strong underlying earnings growth. CEO Graham Maxwell said that over the past 12 months, the company has witnessed the strong performance from its core KFC business, and the performance of KFC restaurants in Western Australia and the Northern Territory which were acquired lately has contributed to the improvement. The recent decision to acquire 13 KFC restaurants on the border area between Victoria and New South Wales now provides further opportunities to grow across the country.

Revenues grew by 0.5% to $ 574.3 million, which works out to 2.4%if the additional trading week in FY 2015 is excluded. KFC same-store sales were up by 3.1% compared to 4.8% in the previous year. Six new KFC restaurants were built and there were major remodels in 20 KFC restaurants (10 each in Queensland and Western Australia). The results showed a strong return to profitability with statutory net profit after tax at $ 29.1 million while the

underlying net profit after tax was up 22.3% to $ 30.1 million.

Underlying EBITDA rose up by 10.7% to $ 74.6 million. The balance sheet showed a strong position with net debt down as the net cash flow positive of $ 10.3 million was reported and a reduction in the next leverage ratio to 1.52 from 1.83 in the previous year.

The fully franked final dividend of 8 cents per ordinary share was up 23.1% and the total fully franked dividend of FY 2016, was up 21.7% to 14 cents per share. This result has come after posting a $10.4 million loss in FY15 following a $37.5 million write-down of its Sizzler brand.

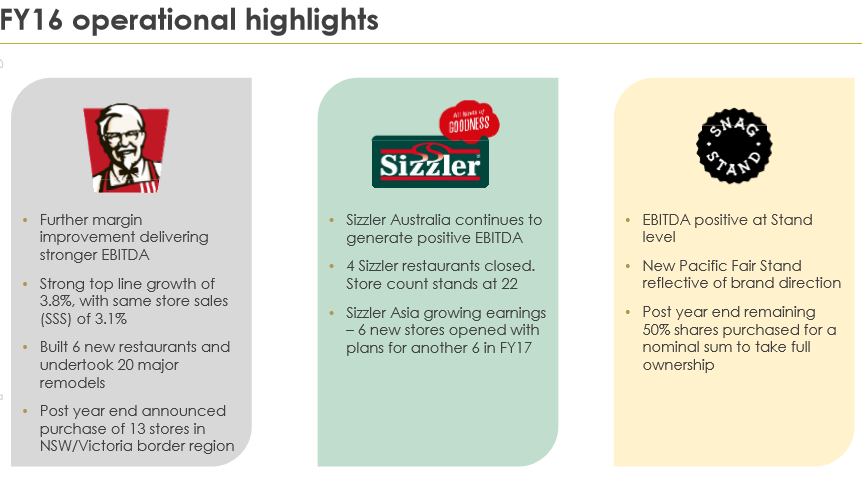

Operational Highlights (Source: Company Reports)

Mr Maxwell further added that strong sales in the KFC restaurants were driven by excellent core product offerings combined with the innovations in new products and good value offers which kept customers coming back. The company continues to use the disciplined approach in cost control and efficiency improvements achieving further margin improvements across all the restaurants.

The strategy of expanding the KFC network in regions with low market penetration continues and ensures that investment will continue at the appropriate level in existing portfolios with the objective of keeping these restaurants contemporary and providing customers with positive experiences. The investment continued with a further six new builds (three each in south-east Queensland and Perth, as well as further major remodels in Western Australia and Queensland.

Regarding the company outlook for FY 2017, the priorities for KFC are said to continue to focus on top line growth, the disciplined approach to operational management, the maintenance of margins in Queensland and the unlocking of other margin opportunities in Western Australia and Northern Territory. Investment will be maintained in the KFC business with plans for up to 8 new restaurants in addition to 14 major remodels.

On completion, the 13 KFC restaurants will be integrated into the company network and there will be continued evaluation of further acquisition opportunities. The company will also embed control of Snag Stand and continue to refine the brand positioning and economic model. Sizzler Asia will continue to grow with plans for several new restaurant openings in Thailand and China.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.