Company Overview: Harley-Davidson, Inc. is the parent company for the groups of companies doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). The Company operates in two segments: the Motorcycles & Related Products (Motorcycles) and the Financial Services. The Motorcycles segment consists of HDMC, which designs, manufactures and sells at wholesale on-road Harley-Davidson motorcycles, as well as motorcycle parts, accessories, general merchandise and related services. The Company manufactures and sells at wholesale cruiser and touring motorcycles. The Financial Services segment consists of HDFS, which provides wholesale and retail financing and insurance-related programs to the Harley-Davidson dealers and their retail customers. HDFS is engaged in the business of financing and servicing wholesale inventory receivables and retail consumer loans for the purchase of Harley-Davidson motorcycles.

.png)

HOG Details

While Harley-Davidson Inc (NYSE: HOG) might have been slammed for its dipping sales owing to challenging motorcycle market scenario, and recently by not letting media in for its annual general meeting, the stock nevertheless is trading at low multiples and looks worth consideration. The stock has been down about 22% in last one year, but has risen about 2.89% as on May 16, 2018. The next dividend ex-date is also on the cards. Meanwhile, the company is refining plans to deliver significant value through 2022 and looks forward to improving performance in near to medium term. The group’s focus is on investing to build new riders in 2018, along with addition of new dealers outside the U.S. while it is setting to launch its first electric motorcycle and is collaborating with electric vehicle technology-leader Alta Motors. The group’s return on equity has been 9.1% as at April 2018 against 3.3% as at December 2017.

Focusing on building riders apart from Motorcycles: Harley-Davidson intends to continue to focus on building riders apart from building motorcycles and in the US, they are now embracing not only the riding season, but also the building riders' season. The group is making debut in riding and selling season for all new Softail motorcycle platform and recently launched two more 2018 motorcycles which comprise their sixth offering with an MSRP (manufacturer’s suggested retail price) under $10,000. Based on the initial dealer and customer reaction, they got good response for their new sportster model, the Iron 1200 as well as the Forty-Eight Special. Moreover, as per the data insights the group’s focus on ridership is way more than just inspiring new riders, while ridership is a bigger idea, one focused on keeping riders engaged, riding and importantly purchasing.

Decent international markets’ performance: For the first quarter of 2018, the worldwide retail sales of new Harley-Davidson motorcycles fell 7.2% against prior corresponding period (pcp) but the sales rate improved against the fourth quarter of 2017 sales rate, which was down 9.6%. In the U.S., they expect the retail sales to continue to be hurt by a very weak U.S. industry sales. On the other hand, the groups International markets’ performance was better than expected driven by retail sales in Europe and Latin America. Their Latin America growth was offset by a weak Canada performance. Europe sales rose 8.1% during the quarter while the market share enhanced by 1.3 percentage points. Harley-Davidson's retail sales and market share gains were driven by strong sales growth of the new Softail motorcycles. Asia Pacific retail sales rate delivered a sequential improvement during the quarter against Q417. Fall in sales in Australia and Japan hurt the Asia Pacific performance during the first quarter. On the other hand, the group is making efforts in these markets by focusing on national test ride campaigns and finance offers to help dealers close sales. Lack of inventory in China also hurt their emerging markets performance with the model year 2018 motorcycles not homologated and approved for shipment into China until March 29th, which was later than the year ago period.

.png)

Harley-Davidson Retail Motorcycle Sales regional performance (Source: Company reports)

Efforts to combat competition: The group’s new motorcycle market Harley-Davidson's share has 50.4% as of the quarter which fell 0.9 percentage points on limited availability of new motorcycles and a highly competitive marketplace. The group continued to focus on their approach to optimize profitability and maximize brand value. They cut the retail inventory by over 9,100 motorcycles against the prior year. They cut their supply and improve model year mix in the U.S. retail channel delivering better results while retail inventory was well positioned as they move into the selling season.

Decent cash generation: The group’s GAAP diluted EPS reached $1.03 as of the first quarter of 2018 while excluding manufacturing optimization costs, diluted EPS was $1.24. The group delivered a net income of $174.8 million (above consensus estimates) on consolidated revenue of $1.54 billion as compared to the net income of $186.4 million on consolidated revenue of $1.50 billion in the first quarter of 2017. As per the Motorcycles Segment, operating income fell 26.9% on a year on year (yoy) basis during the quarter but revenue rose 2.7% despite 9.7% lower shipments. The Gross margin fell 1 point for the segment to 34.7% while Operating margin fell 5.1 pts to 12.7%. Their Financial Services segment operating income rose 20.8%. On the other hand, Harley-Davidson generated a solid $191.6 million of cash from operating activities in 2018 against $159.9 million in 2017. They paid a cash dividend rise of 1.4% yoy to $0.37 per share for the first quarter, against pcp. On a discretionary basis, Harley-Davidson bought back 1.4 million shares of its common stock during the first quarter for $65.1 million. There were over 169.2 million weighted-average diluted common shares outstanding as of the quarter while 24.2 million shares remained on board-approved share repurchase authorizations.

.png)

Shareholder Returns (Source: Company Reports)

Long-term Strategy: In 2018, the group is taking further steps, to enhance their long-term strategy and boost their performance through 2022. The group is aiming to create the next-generation Harley-Davidson riders by inspiring people with new types of Harley-Davidson products and new ways to express their individuality and spirit. They are also aiming to foray into new product spaces, initiate new market channels, and make partnerships and collaborations. The group also continues to strive for a balanced supply of new motorcycles in the retail channel while their cost structure would better compete in challenging and competitive markets across the world. Their supply management actions continue to support lean retail inventory while the group witnessed a better used bike price improvement in the U.S. for the third straight quarter. Their manufacturing optimization is progressing as expected and on track to deliver expected annual ongoing savings. The group is aiming to have new Thailand manufacture plant to start production later this year. This plant would support their strategy of more competitive retail pricing by eliminating much of the tax and tariff burden that fully assembled imports carry in major growth markets in Asia. They forecast more competitive pricing to drive profitable share and a better demand.

.png)

Outlook (Source: Company reports)

Guidance: The group is boosting their investment in electric motorcycle technology to support their growth strategy and position themselves as the leader in the electrification of motorcycles. They intend to invest a further $25 million to $50 million of annual operating margin in EV technology and products over the next several years and bring their first selected motorcycle to market before 2020. Motorcycle shipments is expected to be over 231,000 to 236,000 motorcycles for full year. In the second quarter, they aim to ship over 67,500 to 72,500 motorcycles. Operating margin as a percent of revenue is expected to be over 9.5 to 10.5 percent including manufacturing optimization costs of $120 million to $140 million. The Capital expenditures is forecasted to be in the range of $250 million to $270 million including approximately $50 million to support manufacturing optimization. They see Harley-Davidson Financial Services operating income to be flat to down modestly.

Stock performance: The group approved a cash dividend of $0.37 per share which is payable on June 15, 2018. Given the weakness of their US retail sales, the shares of Harley-Davidson lost significantly in this year to date while there is some upside momentum seen these days. On the other hand, for 2018, they see retail sales to continue to be weak in the U.S. but at a slower rate against first quarter of 2018. They see U.S. declines to be partially offset by growth in international retail sales. Worldwide retail sales rate is expected to perform better in the second quarter of 2018 than the Q1 rate. The group believes that their international markets would drive their long-term objective to boost international sales to build the next generation of riders globally. As a part of their strategy to enhance brand access internationally, their expansion of international dealer network is ongoing wherein the group added seven new dealers during the quarter. The group believes that their brand, products and distribution opportunities would drive sustainable growth in international markets. We rate a “Buy” on this 3.6% dividend yield stock at the current price of $42.32.

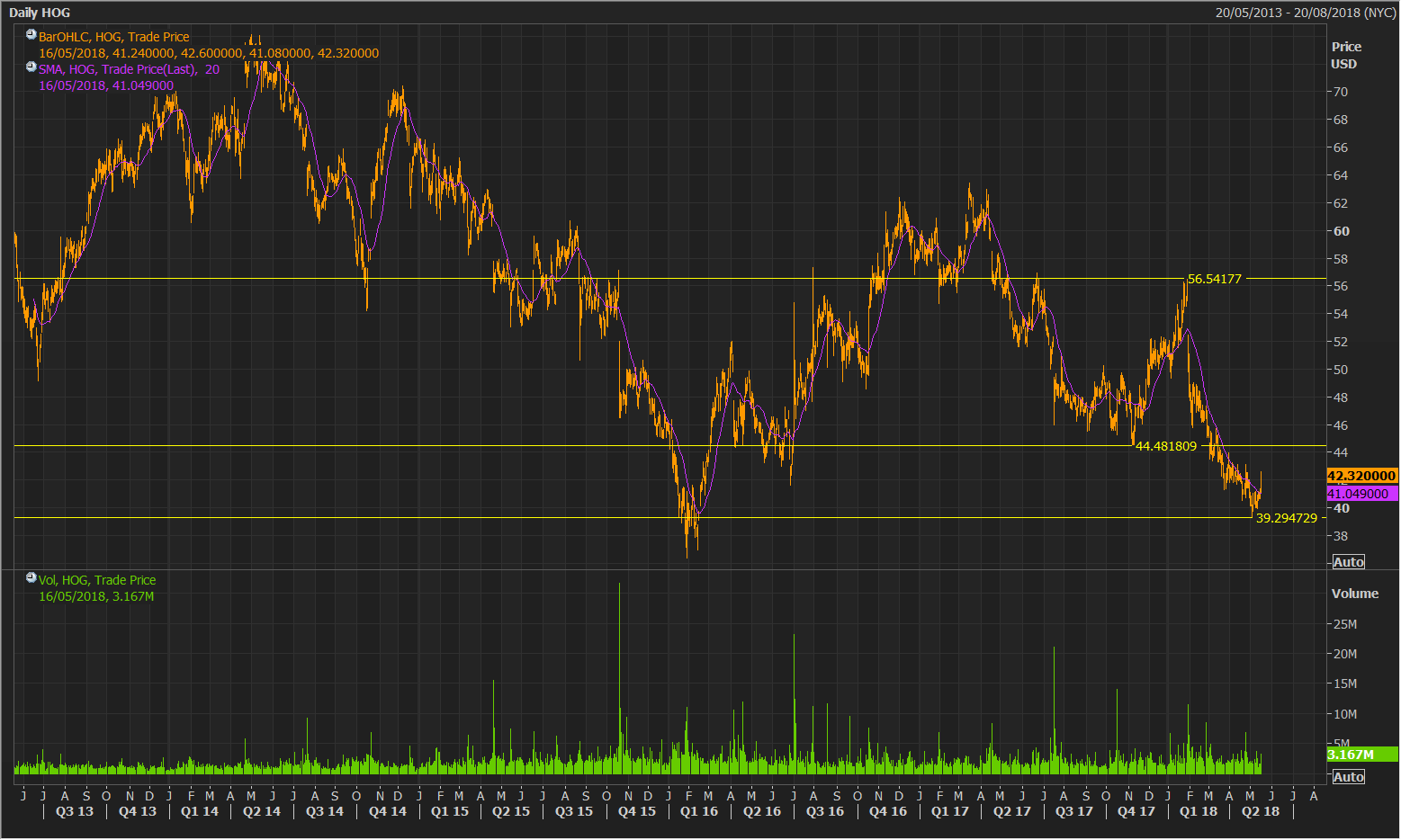

HOG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.