Working Capital Management

Updated on 2023-08-29T11:59:04.672620Z

What is working capital management?

The term "working capital management" relates to management's attempts to manage current assets and current liabilities effectively. Current liabilities are debts that are due within one year and current assets are assets that a business expects to use in the near future. Working capital management is a business technique that enables organisations to make the most out of their existing assets while also ensuring that they have enough cash flow to achieve their short-term goals and responsibilities. Companies can free up cash that might otherwise be locked on their balance sheets by successfully managing working capital. As a result, companies may lower the amount of money they need to borrow from outside sources. Working capital management is thus the management of short-term assets and loans. It ensures that a company has enough cash to execute its activities smoothly.

Summary

- The term "working capital management" relates to the effective management of current assets and current liabilities.

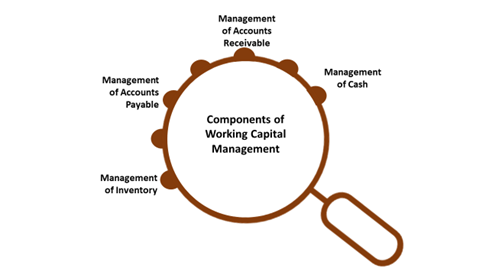

- Working capital management comprises the management of cash, accounts receivable, inventory and accounts payable.

- Working capital management ensures a smooth operating cycle and an optimal return on current asset investment.

Frequently Asked Questions

What is working capital?

The most significant current assets to handle under working capital management are cash and cash equivalents. Because cash is the most liquid type of asset, firms must manage it properly and efficiently to ensure financial stability, meet unforeseen needs, and meet regular operational expenditure on time (such as payroll). Further, proper cash management aids in maintaining a company's credit rating and helps avoid insolvency. It is, in practice, the daily, weekly, and monthly cash needed for a business's operations.

What are the components of working capital management?

Working capital management comprises the management of cash, accounts receivable, inventory and accounts payable.

Raw materials, work-in-progress products, and finished commodities made or purchased from suppliers are included in inventories. When a firm acquires too much stock, it puts a strain on its finances. Similarly, if merchandise is not available on time, firms would lose sales. As a result, inventory management entails keeping track of the stock that is produced or purchased for sale in the ordinary course of business.

Accounts Receivable is the amount due for sales. It is given to the seller by the purchasers while doing business on credit. To ensure timely recovery of accounts receivable, account receivable management necessitates effective and correct processing. In addition, because accounts receivables are a significant component of a firm's asset, they generate cash inflow for the company.

Account Payable is a short-term debt that must be paid within a short period of time. It is thus a current liability by the company that must pay it. It is the amount that firms their suppliers for goods or services used. Therefore, accounts payable must be managed effectively since it improves the company's short-term cash flow situation- this can be accomplished by determining the best time to pay the provider.

The most significant current assets to handle under working capital management are cash and cash equivalents. Because cash is the most liquid type of asset, firms must manage it properly and efficiently to ensure financial stability, meet unforeseen needs, and meet normal operational expenditure on time (such as payroll). Further, proper cash management aids in maintaining a company's credit rating and avoiding insolvency.

© Samsonov's | Megapixl.com

What are the various types of policies for working capital management?

Some commonly followed policies for working capital management are as follows: -

The fundamental idea in this policy is to maintain a bigger share of current assets on hand so that if a client places a significant order, it will not be lost due to a raw material shortage. Sales increase due to the facility of credit sales. It is also called the conservative policy.

The primary premise is to preserve as few current assets as possible so that turnover can increase. Because the volume of sales is substantially more significant, a high turnover leads to increased profitability. Inventory storage and carrying costs are considerably cheaper. It is also called an aggressive policy.

- Zero-working-capital policy

This policy is the most severe case in which current assets are kept to a bare minimum, close to zero.

The moderate policy provisions lie between the aggressive policy and the restricted policy.

© Vaeenma | Megapixl.com

What is the importance of working capital management?

Working capital management ensures a smooth operating cycle- there is never a liquidity crunch for meeting the firm's operating expenses.

It helps to minimise working capital requirements through attractive credit terms with accounts payable and accounts receivables, a shorter production cycle, and better inventory management.

Proper working capital management ensures there is an optimal return on current asset investment. Many organisations experience liquidity constraints or excess cash is prevalent in seasonal businesses. When there is extra liquidity, management should have strong short-term investment options to take advantage of the cash.

A company that pays its suppliers on time will also benefit from a steady supply of raw materials, ensuring that production runs smoothly and that customers receive their goods on time. Enterprises with an effective supply chain will have a competitive advantage and may often sell their products at a lower price than similar firms with inefficient sourcing. Efficient management of working capital will aid a company in surviving a crisis or ramping up production in the event of a huge order. Also, favourable financing arrangements, such as discount payments from suppliers and banking partners, will be available to a company with loyal and default-free relationships with its trade partners and pays its suppliers on time.

How do we know if a company’s working capital management is efficient?

An observation about the liquidity ratios and turnover ratios can throw light on the firm's working capital management efficiency. Liquidity ratios assess a firm's ability to repay short-term loans. We can use liquidity ratios to see if the company's current assets or liquid assets are sufficient for this. The current ratio, quick ratio, and cash ratio are the most commonly used liquidity ratios.

Turnover ratios measure the efficiency of working capital management. It assesses how quickly companies convert receivables into cash or inventory into sales. The longer the firm's required financing time, the greater the short-term liquidity risk.