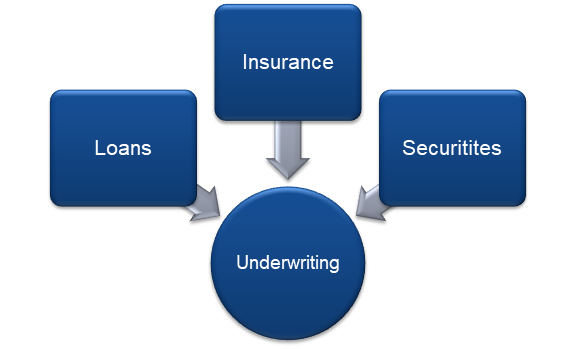

Underwriting

Updated on 2023-08-29T12:00:24.526812Z

What do mean by Underwriting?

Underwriting, in simple words, is a process in a financial world where a person or a firm will assess and take the financial risks in lieu of a certain premium or fee. The process is quite common where loan, insurance and trade of securities are involved.

From where did the term underwriters originate?

During the Industrial Revolution era, many industries were cropping up, which required huge finances from lenders. In most cases, lenders would require someone willing to take the risk for the money in case the borrower is not able to pay the amount.

A borrower or lender would then appoint a person or a firm to evaluate the financial risk involved in the project. Based on the evaluation, the rate of interest was determined. The third-party in the transaction would write his/her name below the sum sanctioned for the borrower, and the person was eventually called underwriter.

The underwriter would take the project's risks and charge a premium on the total amount insured during underwriting.

The process is used even today, but the mechanism is different. In case of loans, borrowers take the services of underwriters to get fair rate of interest from the lender, which can be a bank, financial institutions, or a private lender. The lenders would get a kind of insurance for the money they are lending in case any defaults happen.

What are the types of Underwriting services?

There are three major underwritings we encounter in the financial world more often. These include:

Copyright © 2021 Kalkine Media Pty Ltd.

Loan Underwriting

Mortgages and other kinds of loans need to be evaluated on the basis of the borrowers’ financial position. The underwriting analyses include credit history, other running loans, income sources, and the collateral value that can be put on mortgage.

The underwriter in such cases will involve a human who can visit the location of mortgage and evaluate its market value. Further evaluation includes purpose of loan and details like income, savings, credit score and credit history and so on.

Based on the evaluation, the underwriter would assign the certain degree of risks and based on that rate of interest of the loan will be decided. If the rating is not satisfactory, loan sanctions can even be declined.

Underwriting in Insurance

In the insurance sector, major risk involves too many people filing the claim together. The ongoing pandemic created one such situation where many people were admitted to hospitals simultaneously, leading to the majority of death occurring at the same time.

Copyright © 2021 Kalkine Media Pty Ltd.

Situations like pandemics increase the risk of the survival of the insurance sector as a whole. Under these underwriting services the underwriter tries to access the policy holder on the basis of its age, lifestyle, current health conditions, occupation, family medical conditions, hobbies, etc. All this evaluation helps in deciding whether insurance is to be granted or no and if yes then what’s the amount for the same.

Securities Underwriting

Underwriting in securities is done usually during the launch of an Initial Public Offering (IPO). The company who is bringing an IPO would avail the services of an underwriter. In a case where the IPO is not fully subscribed, the underwriter would purchase the remaining shares which are not subscribed, after charging some premium.

Copyright © 2021 Kalkine Media Pty Ltd.

At a later stage, the underwriting firm would sell the shares in open market or to the institutional buyers. If the shares during IPO are fully subscribed, the underwriters will still charge a fee for taking the risk incorporated during IPO.