Revenue

Updated on 2023-08-29T11:59:27.078252Z

What is Revenue?

Proceeds generated by a company from its core operations, such as sales of goods or delivery of services is called revenue. Thus, revenue for a grocery seller would be generated from the sale of its grocery products. Meanwhile, bank’s revenue comes from the interest on the loans that it provides.

The sale of goods or services (Retail store), interest (banks), rent (leasing company) are familiar sources of revenue.

What is the Difference between Income and Revenue?

Revenue takes into account the discounts provided to the buyers or deduction on the return of the goods. Significantly, revenue is different from income. While revenue called as ‘top line’ parameter represents gross sales, the income primarily denotes ‘net income’ or ‘net earnings’ after subtracting all the expenses. Income Is referred to as bottom line parameter for the company.

What is the Significance of Looking at Revenue?

The revenue remains one of the critical focus of a company backing the survivability and sustainability of their business. In order to gauge the performance of a particular company or business, the analysts evaluate the revenue generated, the trends in revenue growth and comparison with other players in similar businesses.

The current or potential revenue should justify the fixed and variable expenses incurred by the company. Thus, if a firm’s total costs are consistently exceeding the current or prospective revenue, then there are chances that it would face survivability issues in the future.

The revenue can be generated via different streams that relate to catering to the diverse needs of the customers by the provision of services or sale of goods. One-time projects, the recurring revenue models or the single-time delivery of goods or services are some of the revenue generation routes.

What are the Types of Revenue?

The operative revenue is generated from primary activities of the company. It typically gives insight on the effectiveness of business operations and thus can be used for analysing the company’s performance across different periods. In general terms, it is the operating revenue that is commonly referred to as revenue for the company.

Significantly, operating revenue bears strong significance when evaluating the company’s financial performance. Besides, revenue figures released by the company can impact its stock performance. Analyzing revenue trends primarily sheds light on company’s future sustainability and growth.

Besides, inclusion of financial proceeds as operating revenue depends on nature and type of business.

For example, for a pet shop, the operating revenue would come from the sales of pet along with pet-related supplies and accessories. The pet show may also raise funds through donations. However, grants are not primary business activities, and thus it would not be referred as operating revenue.

The non-operating revenue, on the other hand, is derived from activities which do not come under the core operations of the company. Generally, such kind of revenue does not have a consistent trend and can be infrequent. Owing to inconsistency in their generation and their unusual nature, such cannot be solely used to gauge a company’s performance.

Nevertheless, they are used in combination with the Operating revenue to get a bigger picture of the company’s operations as well as other strategic undertakings during the period. When evaluating business performance, one should, however, be cautious that a large amount of non-operating revenue does not obscure the operating performance of the company.

The donations in the above pet shop example represent the non-operating revenue. However, for a non-profit organization, the donations would be an operating revenue. Thus, depending on the nature of the business, operating revenue differs.

What Do We Mean by Revenue Recognition?

Revenue recognition is an element of accrual accounting, meaning that they are recognised when they occur and the risk is transferred and not when the cash is received. The different nature of industry often creates variation in timing and method of accounting the cash inflow for business.

For example, a subscription-based company would charge first before delivering the service, while many B2B suppliers would sell the goods on credit. Furthermore, the charging method would also differ, such as payment based on percentage of completion, a lump sum at one go or regular period charges. Due to such discrepancies and to promote transparency, Generally Acceptable Accounting Principles (GAAP) use revenue recognition.

The criteria for revenue recognition include:

- Identification of contract with the customers

- Identification of promises or performance obligations for transfer distinct customer goods or services

- Determining the amount of consideration (transaction price) which will be provided to the business for the exchange of goods or services

- Ensure measurability of the performance obligation through relative stand-alone selling prices of each specific product.

- Recognition of revenue on the satisfaction of performance obligations when the promised goods or services is transferred to the customers

The discrepancy in the revenue recognition guidance of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) led to an issue of the new standard on May 28, 2014. The Financial Accounting and Standards Board (FASB) and the International Accounting Standards Board (IASB) released the new guidance, which removes discrepancies and provides a more robust framework.

What is the Relevance of Analyzing Revenue in Income Statement?

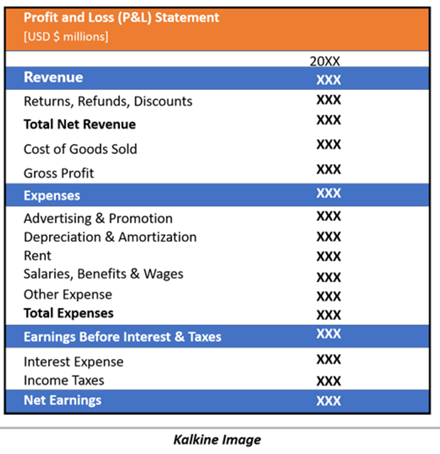

Under the income statement of financial statements, revenue is recorded under the heads of Operating Revenue, Non-Operating Revenue and Other Income (Gains). It is important to understand the difference between revenue and profit, such that Gross Profit is the result of subtracting Cost of Goods Sold from Revenue. Subsequently, after taking into consideration, Expenses comes into picture Net Profit. Notable, Net Profit is the bottom line, while revenue is considered as a top-line financial indicator.

Analysing revenue components with a breakup of business and non-businesses related aspects, along with expenses, provides a holistic picture of efficiencies/scope of improvement in each department.

The revenue components are essential parameters in determining profit/loss over a specific accounting period so that business strategies and initiatives can be channelised in the dedicated areas accordingly. It is all about determining the economic viability of the business in the competitive market scenario.

Product-specific and geography wise top line analysis will better place the organisation in understanding relative strengths and undertaking judicious decisions for pushing the areas with a scope of improvement.

Besides, revenue analysis helps in making trend analysis and projections for the future, so that planning on different parameters in terms of asset requirement, product diversification, geographic expansion, along with expected costs can be undertaken accordingly.

Based on top line growth analysis, a business can make important decisions in terms of less revenue-generating business segments and whether they require some investments, marketing or other action plan or whether it is beneficial to shut the business from an earnings standpoint.

Besides, it is important to understand that top line analysis should be accompanied by bottom-line analysis. While revenue growth analysis indicates the effectiveness of the business in generating income, bottom line analysis in more wholistic, taking into consideration operating efficiencies.

Moreover, top line growth analysis aids financial managers in undertaking decisions to promote growth via an increasing number of customers, frequency of customer trade and average value of each transaction. Here, marketing plays an important role.