Power of Attorney

Updated on 2023-08-29T12:00:42.185762Z

What is meant by power of attorney?

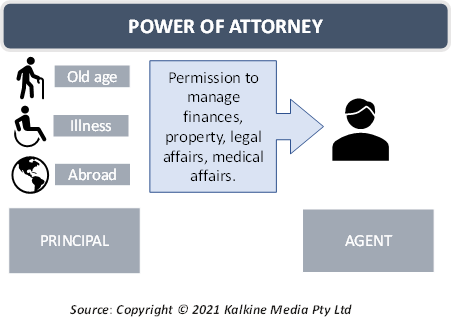

Power of attorney is a legal document that allows an individual to appoint someone to manage their property, finances, and medical affairs. This is usually done for those individuals that become unable to take care of their financial matters alone or are incapable of doing so.

Every power of attorney agreement can be customized to suit the concerned individuals. In this sense, the power vested in the agreement changes with each agreement. However, all power of attorney agreements come to an end upon the death of the principal. This means that the agent cannot act on behalf of a deceased client unless it has been explicitly stated so.

Power of attorneys can be easily created. However, it should be ensured that the process is done in the presence of a knowledgeable attorney. POA agreements are becoming increasingly popular as people often find it difficult to manage their finances on their own in the fast-paced world.

Summary

- Power of attorney is a legal document which comes to an end on the death of the principal, unless specified.

- POA are created for people unable to be physically present to manage their finances.

- Principal Agreement defines the power and role of the agent in detail.

Frequently Asked Questions (FAQ’s)

Who needs a power of attorney?

The power of attorney agreement includes a principal and an attorney. The principal is also known as the donor or the grantor and is the one who appoints the power of attorney to act on his behalf. The attorney or the agent is the one tasked with taking care of the donor’s financial matters.

Power of attorneys are created by individuals who are often unable to take care of their financial affairs. This can happen due to various reasons which do not allow the individual to be physically present to handle these matters.

Some of the common reasons why individuals would be unable to manage their finances and assets include: being abroad for some work or family related event, old age, health problems, being bedridden and other reasons that make the principal absent from the place of the transaction.

What is the role of an agent?

The principal’s agreement determines the role of the agent and how much power is granted to him. Such an agreement can take place immediately, as soon as it is proven that the principal is unable to manage the financial affairs.

There are multiple decisions that the power of attorney must take. These include not just financial decisions but also making gifts of money, making healthcare decisions, and recommending a guardian.

The relationship of the agent with the donor is that of a fiduciary. This means that the agent must always act in the best interest of the donor, even when the agent is not there to overlook. The agent must keep the principal’s property separate from his own and must maintain proper records.

In case of violation of any of the agreements, the agent would be subjected to liability for his actions. After the death of the principal, the agent must hand over the deceased’s property to the appropriate representative.

Sometimes, donors may grant the power of attorney to someone in the family. In such cases, the authority given to the family members is crucial and must protect the principal’s wealth. (SOURCE:)

What different types of power of attorney are there?

There are 4 types of power of attorney, depending on their purpose. These are:

- General power of attorney: This type of agreement allows the agent to perform almost all the acts done by the principal. The set of powers with the agent are broad and wide-ranging. Some of the decisions that can be taken by general power of attorney include buying life insurance, operating business interests, making gifts, settling claims, and implementing professional help.

This is an effective tool if the principal is a frequent flier to foreign countries or is incapacitated in some way.

- Durable power of attorney: This type of arrangement has a durable clause which states that the power of attorney comes into action once the principal becomes incapacitated. The agreement formed under durable POA can be a general POA agreement too. However, the durability clause allows it to apply to the time when the principal goes through some illness that makes him unable to take decisions.

For such an agreement, the doctor must first sign a certificate stating that the principal has become mentally incompetent and needs assistance. The doctor can be decided by the principal himself. A springing durable POA allows the principle to grant access to the agent only when a specified event occurs.

- Special or limited power of attorney: This type of agreement limits the powers held by the agent to specific areas. These special areas may be limited to real estate affairs, collecting debts, or handling certain aspects of a business. This type of an agreement is useful if the principal is unable to handle one’s business or is facing health concern or is busy due to other commitments.

- Healthcare power of attorney: This type of attorney comes into action when the principal becomes unconscious or mentally incompetent. This is different from a will and can be combined with a will to provide advanced healthcare services.

What aspects should be considered before a power of attorney is chosen?

Often individuals would assign their family members as POAs because a sense of trust is associated with them. Handing over financial matters to a foreign agent may not always be the easiest task. However, thorough investigation should be done and only those agencies that have a reputable name should be considered.

Many people assign their children as their power of attorney. However, it should be ensured that the children possess enough ability and knowledge to conduct financial operations successfully on behalf of the principal. In case children are not capable enough to be appointed as POA, the principal must make an outsider for the role.

Additionally, principals may choose more than one agent to take care of multiple matters. This can be done with multiple family members as well, in case one family member cannot take all financial decisions alone.