Penny Stock

Updated on 2023-08-29T11:58:40.801605Z

Penny stocks are the stocks traded at a low price, issued by companies having lower market capitalization than others. These stocks are listed on smaller exchanges and are issued by companies that possess fewer assets and have small business operations or have been in business for a significantly less amount of time.

Different countries may give different price points below which stocks are considered penny stocks. The specification to define a penny stock may not be the same across countries. For instance, in the US stocks priced under US$5 are counted as penny stocks while for the UK, the stocks traded for less than £1 are counted as penny stocks.

Penny stocks may also be associated with companies that had earlier been well-functioning firms. A majority of penny stocks are traded over-the-counter (OTC) with a few being traded on the prominent stock exchanges.

What are the characteristics of penny stocks?

A company’s market capitalisation is determined by multiplying the net asset value of the shares and the number of outstanding stocks. Based on this, companies are ranked, and since penny stocks belong to low market cap companies, they usually lie on the lower rung of stock exchanges.

Since penny stocks are associated with small companies, they might experience a lack of buyers in the marketplace. Thus, penny stocks may be less liquid than other types of stocks as there are less individuals willing to purchase them.

Their low pricing is what sets them apart from other stocks in the exchanges. This low pricing allows for greater number of shares to be purchased at a single time.

Stock exchanges put these stocks under “trade-to-trade” basket as they are highly risky investments. Under this basket no intra-day trading is allowed and transactions must be completed on gross basis. This means that shares must be delivered on the same day by the seller and received by the buyer.

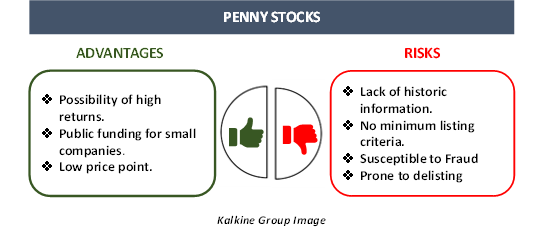

Why are the advantages of penny stocks?

Penny stocks may seem like risky investments, however, there is a reason why they are listed on exchanges. It is possible to gain huge returns by investing carefully in penny stocks. Here are incentives offered by penny stocks:

- Possibility of high returns: Some penny stocks may include new companies or start ups that have the potential to blow up over time. The penny stocks that have the potential to double, triple or quadruple one’s investment are called multibaggers. These stocks can be purchased in high volumes at a low rate and could bring significant profits when prices increase. Thus, certain penny stocks may hold the potential to outperform mid-cap and large-cap stocks.

- Benefits to Small companies: Penny stocks are issue by small companies, thus making them available for public funding, an access that would not have been available to them otherwise.

- Low price point: Since these stocks are inexpensive, it can allow traders who do not hold substantial amount of cash to invest in them. However, it is important to note that penny stocks may prove to be quite risky as they are highly volatile.

What are the risks associated with penny stocks?

Penny stocks are high risk stocks that must be invested in with careful prior judgement. There are various reasons why these are prone to price fluctuations, these include:

- Lack of historic information: Since many of the penny stocks are new or low cap companies, there may be a lack of information about these companies and the trend followed by their share prices. This makes investing in these companies a risky venture.

- No minimum listing criteria: Those penny stocks are the traded OTC may not be required to surpass any minimum listing requirement for the same.

- Susceptible to Fraud: These stocks are highly susceptible to frauds and scams. Since these are less liquid, investors can get the change to rig the market and manipulate the prices. This does not give an actual representation of the value of the company’s shares.

- Sudden delisting: Another aspect that makes penny stocks highly volatile is that they may be delisted anytime without prior information as they belong to companies that are not performing very well. Thus, investors might end up losing their money.