Loan

Updated on 2023-08-29T11:56:16.910774Z

What is meant by a loan?

A loan is the amount of money that is borrowed by businesses or households to gain some monetary leverage. Loans are taken to plan more expensive purchases, the ones which may not be financed through regular incomes. These purchases include cars, property, houses, and other investments.

Loans are a liability; thus, the loaned amount needs to be returned along with interest within a given period. The conditions and repayments of a loan are agreed upon before the loan is given. Businesses or individuals may approach banks or financial institutions for a loan.

Most institutional lenders ask for collateral against which the loan is to be given. However, many financial institutions offer loans without any mortgage or collateral. The loaned amount may be given as a lumpsum amount or it can be released in portions spread over time.

How do loans work?

Secured loans are offered against a collateral, which acts as a security in case the borrower were to default in the future. All loans involve a rate of interest, which is an additional amount to be paid to the lender that is a percentage of the loaned amount.

Interest rates form a crucial part of taking loan. Interest payments may differ depending on the credit rating of the borrower. Most loans taken by businesses or households have a fixed rate of interest. This does not change even if the market interest rates do change. Some loans do offer variable rates, but they are not as popular. Repayments must be made monthly or can be made in a lumpsum manner.

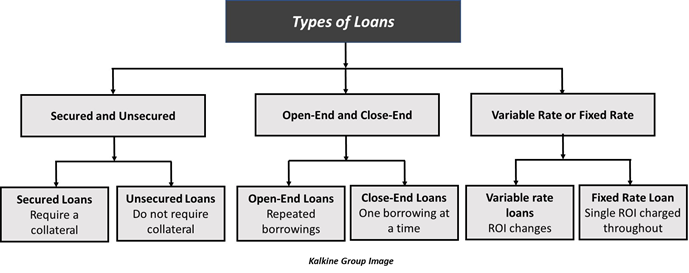

What types of loans are there?

Loans can be of various types, some of these include:

- Secured and Unsecured Loans: Secured loans refer to the loans which are offered against a collateral. Collateral acts as an insurance. Alternatively, unsecured loans refer to the loans that are offered without any collateral. For instance, personal loans are offered against income receipts and do not require a collateral. However, mortgage loans and car loans require a collateral as a security.

- Open-End and Close-End Loans: An open-ended loan allows the borrower to borrow again even if the previous loan repayment has not finished yet. An example of this can be credit cards, however, they also have a limit. A credit limit refers to the end limit to the sum of money that can be borrowed by an anyone at a point. Conversely, close-end loans refer to those loans that can only be borrowed again if the previously loan has been repaid completely. These include are mortgage, auto loans, and student loans.

- Variable Rate or Fixed Rate Loans: Variable rate loans refer to those loans that charge a variable rate of interest from the borrower, whereas the fixed rate loans refer to those loans that charge a fixed rate from the borrower throughout the period of repayment.

- Credit Cards: Purchases from credit cards are not loans in the strict sense of the term. However, they function like a loan with a high rate of interest. Each transaction made on credit comes with a future repayment along with an interest. The interest charged on credit cards is much higher than the interest on other loans.

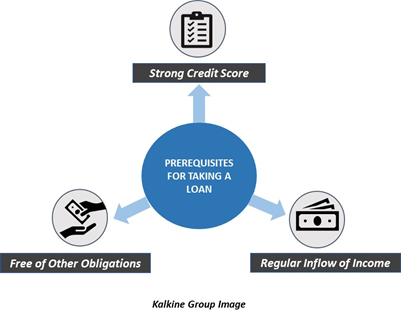

What aspects are considered by financial institutions before giving out a loan?

There are 3 factors that may affect the creditworthiness of an individual or of a business. All these factors are crucial to lenders as it helps them avoid the scenario of a default on the loans they give out. These factors are:

- Credit History: Credit score gives a number to the creditworthiness of an individual. It is based upon the credit history of an individual. Credit history refers to the account of previous borrowings taken by an individual. If the individual has a history of defaulting on loans, then he/she would have a low credit score. Similarly, if the individual did not make previous loan repayments in the specified time then too, he/she would have a low credit score. Thus, a credit score reflects the past loan repayments made by an individual and helps institutions avoid default risk.

- Income: Banks often ask for payslips from borrowers. This is done to ensure that a borrower has a fixed stream of income that would enable him/her to make the loan repayment in the future. If an employee is self-employed then he/she must provide the tax returns as a proof of income and invoices too.

- Other Obligations: An individual who has other obligations in a month might not be left with enough income to repay a loan. Thus, banks as well as institutions must ensure that monthly obligations of an individual do not render him incapable of repaying a loan in the future.

What are the pros and cons of taking a loan?

Loans offer various advantages, the primary one being profit retention. Loans need not be shared with equity holders, unlike the funds received through equity. Investors must be repaid with profits in the future leading to a reduction in future profits. Loans allow an individual or a business to utilise the loaned amount themselves without having to share the profits.

However, loans have a disadvantage as well. Secured loans which offer a lower interest rates are often harder to procure. They come with a strict set of requirements, which many individuals might not be able to fulfil. Small business and individuals without any credit score might find it hard to meet the bank requirements.

Why are loans important for businesses?

Loans are accounted as a liability on the balance sheet of businesses. However, for the lender, a loan is an asset as it promises a future set of income for him. Moratoriums may be offered on loans under dire circumstances. However, certain banks and financial institutions may not be as accommodating.

When a loan remains unpaid for over one year then it becomes a long-term debt for the borrower. This could severely affect the credit score of a business, which could affect their loan eligibility in the future. If a business depends highly on loans for its functioning, then it would increase their liabilities.