Liability

Updated on 2023-08-29T11:56:14.338900Z

What is meant by liability?

Liability is an obligation towards something. In reference to business operations, it refers to the company's financial debts that need to be repaid. It can also be seen as a claim by creditors against an individual's or entity's assets as payment for a transaction. The bearer of the liability must make a settlement with a monetary value attached to it. So, it is a financial commitment for the bearer. Monetisation is essential to ensure recording in the books of accounts.

Summary

- A liability is a mandatory requirement for an organisation to pay back for an obligation created by a transaction between parties.

- Liabilities are recorded on the balance sheet or in the profit and loss account.

- Depending on the nature of the transaction, a liability may be long term or short term. The former has to be cleared off after a period of one year while the latte is payable within a year.

Frequently Asked Questions (FAQs)

What are the features of liability?

For liability to be created for a business, a transaction or event should take place. For instance, it may be a loan to buy a building or a credit purchase on which payment is due later. Unless forgiven, a liability is a mandatory requirement for an organisation to transfer assets, perform services, or otherwise utilise assets to meet an obligation it has taken on or has been imposed on it. An enterprise's liability remains an obligation until it is settled in another transaction that affects its books of accounts. While most liabilities are paid in cash, some may be satisfied by the company transferring assets or delivering services to other companies.

The Liability Section in The Company Balance Sheet © Johnkwan | Megapixl.com

What are the types of liabilities?

The liabilities are listed on the left side of the Balance Sheet. Liabilities can be classified on the basis of nature and time duration. The main types of liabilities are current assets, long term liabilities and contingent liabilities.

Current Liability

A current liability is an obligation due within a year. It also covers payments due in one operational business cycle of the company's business cycle is greater than a year. Accrued expenses, cash dividends due, short term bills payable, advance payments received, tax payable, bank overdrafts are all examples of current liabilities.

© Jirsak | Megapixl.com

Long term liabilities

Non-current liabilities, often called long-term liabilities, are debts or commitments due in more than a year. Long-term liabilities are a crucial component of a company's long-term financing strategy. It is required for purchase of capital assets or for new projects. Long-term liabilities play a critical role in determining a company's long-term viability. Companies will suffer a solvency problem if they cannot meet their long-term liabilities when they become due. For example, long-term component of bonds, debentures, capital lease, deferred revenue, long-term loans, long-term portion of deposits, deferred tax liabilities, and so on. The ability of the firms to meet long term obligations is a key factor in judging its credit worthiness in the market.

ID 209369298 © Rummess | Megapixl.com

Contingent Liabilities

Depending on the outcome of a specific occurrence, financial responsibilities may or may not occur in the future. According to General Accepted Accounting Standards (GAAP), a contingent liability is any prospective future expense that depends on a "triggering event" to be converted into an actual loss. A lawsuit is an example of contingent liabilities.

A probable contingency is defined as a financial obligation with a 50% chance of occurring in the future, and the loss resulting in a likely contingent liability. For example, winning or losing a legal case has a 50% chance each. However, even a 50% probability cannot be attached to the happening of an event- this is a potential contingency. It cannot be described in monetary terms and is recorded as foot notes only. In addition, there may be a remote contingency with even lower probability of occurrence and hence is not recorded in the books or mentioned in the footnotes.

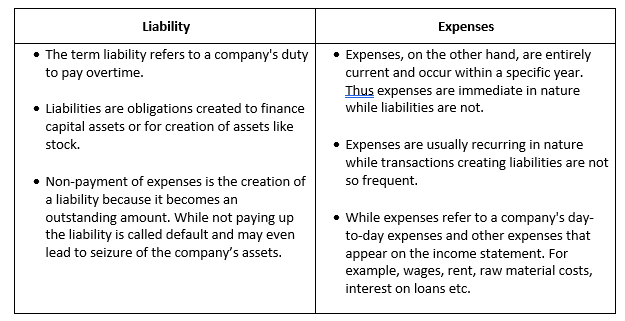

What is the difference between liabilities and expenses?

Image source: Copyright © 2021 Kalkine Media

How can we assess a company’s ability to repay liabilities?

A company’s ability to pay off debt whether long term or short term are important factors for creditors and investors while judging the performance of a company. Debt ratios are used to determine a company's ability to repay long-term debt. It's a financial ratio that shows how much of a company's assets are financed with debt. It's the proportion of overall debt to total asset. The higher the ratio, the bigger the risk associated with the company's operations. Furthermore, a high debt-to-asset ratio may suggest a company's limited borrowing capability, reducing its financial flexibility.

The current ratio assesses the firm’s ability to pay off its short term obligation. It is the ratio of a firm's current assets to its current liabilities. It may be noted that current assets are comprised of cash, accounts receivables and inventory of the firm. Current ratio less than one implies that the short term liabilities are more than the assets that it can turn to cash- this indicates liquidity risk; a value of one means just enough cash to pay off short term debts. It is ideal for maintaining a ratio of two or more to minimise liquidity risk.