Investor relations

Updated on 2023-08-29T11:59:27.910746Z

What are Investor relations?

The term ‘investor relations’ is also known as financial relations or shareholders relations. The department is a division of Public Relations that helps to communicate data and insights of a company with the investment community. The financial relations department takes care that the accurate and factual information is going out to the public. The team caters to the investors, shareholders, and other parties, who are interested in the company’s financial stability. Based on which the individual investors or the investment firms make informed decisions related to the investments.

Source: Kalkine

Investor Relations (IR) does not only takes care of the financial aspect but is also closely integrated with the marketing department, legal department, and the executive management of the company to effectively manage the flow of information.

A public company must diligently provide financial details to its investors and stakeholders. As an essential aspect of the public relations for the public company, the financial relations team is also responsible primarily for developing relationships with the investors. It builds and maintains relationships with shareholders/stockholders, potential investors, financial analysts, the financial markets such as the stock markets and commodities exchanges.

A significant responsibility of the department is having smooth and meaningful communication with investment analysts who help in driving public opinion about the company as an investment opportunity. IR department priority work is to manage these expectations.

The department should generate accurate financial information for the media houses. These outside aspects play a major role in the success and growth of the company, hence maintaining a strong and transparent relationship with them is of utmost importance and priority for any public company.

Do they closely work with Wall Street?

Organisations top executives such as chief executive officer (CEO) and chief financial officer (CFO) have a handful of tasks in their daily corporate life. They have a business to run. Just like the public relations team is a bridge between the media and the company, the investor relations team is a bridge between Wall Street and the company. The CEO or the CFO is the face of the company, however, the IR department is usually in the middle connecting the company with investors, shareholders.

What are the roles and responsibilities of the IR team?

The move an organisation makes from a privately held company to a publicly traded company is a big step. It requires robust coordination to keep the company’s image while ensuring a smooth transition. The IR team seizes the interest of the investor’s community and maintains it.

IRO (investor relations officer) and PRO (public relations officer) both are in charge of the flow of information going out in the public domain. They build and maintain the brand image and manage crisis situations. Their teams however not only deals with the finance aspect of the company, but also communicate with the chief financial officer (CFO) or the Treasurer and are responsible for sharing the finances of the company to three main resources - financial analysts, media, and shareholders.

The success of the IR team is measured by the visibility of the company in the market, sell-side analyst coverage, and attractive higher liquidity into the company’s stock. The investor relations department is often engaged in identifying the market trends through analysing the company's stock. They also track historical deals to compare current situations.

It is important to effectively screen the institutional perspective of both the organisation and the market. They analyse the factors driving the industry, helping organisation to understand the market better and also the metrics used by investors to value a company.

In-depth analysis, ideas and data sets on industries, companies, credit, government, and litigation factors that impact decision making are also handled by the financial relations team.

Source: Kalkine

For any public company maintaining a timeline of upcoming activities is important. The public relations team focuses on media conferences, press releases, trade shows related part, whereas the investor relations team focuses on the financial calendar of the company.

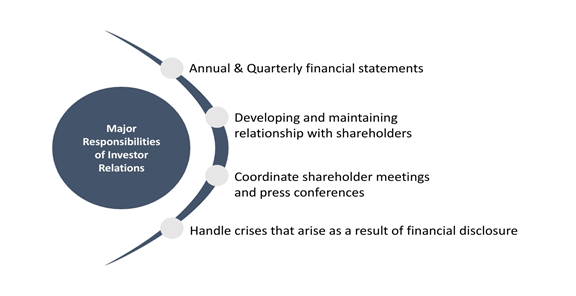

Their roles and responsibilities largely revolve around accumulating annual reports & quarterly financial statements, maintaining shareholder information, building and maintaining relations with them, addressing dividend & stock issues, coordinating shareholder meetings and press conferences and so on.

Before going public the company wants the team to institutionalised various important aspects for the company such as set up government alliances, internal financial audits and most importantly develop relationships with potential IPO investors.

Also read: What is Initial Public Offering? | IPO Explained

Why are they important?

In some organisations, investor relations are managed by the public relations team or by the corporate communications department. It may also be called financial public relations or financial communications. Investor relations department is considered a specialty of public relations by the U.S. Department of Labor. The department also engages with the Corporate Secretary on legal and regulatory aspects of the company. Through a financial relations team, an organisation can effectively communicate its financial strategy to the market.

Do Companies hire financial relations agencies?

Having a financial or investor relations team is a hallmark practice of good corporate governance. Apart from legal and accounting counsel, most of the public companies have investor relations, corporate communications or public relations teams, and strategic advisory counsel. Many companies have an internal individual or a group of employees responsible for IR, and they also hire an external agency specialised in investor relations, public relations. With this ever growing vigorously competitive market, companies find it hard to gain acceptance from the market. Having an IR team helps to get exposure in this complex market and act accordingly.