Growth Investing

Updated on 2023-08-29T11:56:55.583516Z

Making one’s money grow is the fundamental investment objective. Growth investing might seem to be a complex subject, often closely coupled with fundamental analysis, technical analysis, and market research- but is it?

Let us take a comprehensive look at one of the most popular stock market investing styles- Growth investing. dd

What Is Growth Investing?

Growth investing is an investment style and strategy focused on increasing an investor's capital. Having said so, the primary focus of growth investing is on companies (or even entire markets) that are expected to grow at an above-average rate, relative to their industry peers. For instance, a typical growth investing opportunity could be in a new industry where the demand for the new technologies/products and services are on a higher side.

As investors seek to maximize their capital gains, growth investing is often referred to as capital growth or capital appreciation strategy.

Interesting note: Most growth-stock companies reinvest their earnings back into the business, rather than pay a dividend to shareholders.

What Are the Benefits Of Growth Investing?

2 major advantages of investing in growth stocks-

- LARGE STOCK PRICE APPRECIATION- Growth stocks offer the largest price increases. However, after a growth stock has made a huge increase in price, it can also fall back in price just as much, or more. For instance, the 1990s case of the high-technology stocks Sun Microsystems and Cisco Systems, that made huge moves, but came back down in price.

Interestingly, growth stocks show well-defined topping patterns that can be detected by the experienced investor, but it is easier said than done.

- WEALTH COMPONDING- This second key advantage of growth investing is also the fastest way to grow wealth. The stock market consists of alternating bull and bear markets. The big winners of one bull market rarely lead the next bull market cycle, which shows new growth stock winners. For instance, even when Sun Microsystems was a big winner of the bull market of the late 1990s, it did not lead the bull market of 2003.

Many high-quality long-term growth stocks have delivered stupendous returns to their investors. Growth stocks with competitive advantages tend to compound wealth over many years as the business gains in strength as they grow in size.

Growth Investing Vs Value Investing

Investing pioneer Warren Buffett has said- “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

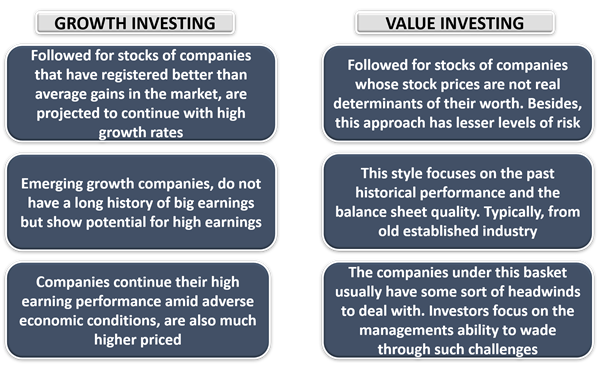

On this note, let us understand the differences between growth and value investing.

While growth and value investing are two different styles of investing, both seek to fulfil the common goal of maximising the value of investment for the investors-

Kalkine Group Image

Growth Stocks- An Overview

Growth stocks are usually found in upcoming industries where companies prefer to reinvest back into the business as a means to stay fresh, current, and stand out from the competition for continued rapid growth. They can be looked upon as an incentive for a company to continue advancing itself into the future while offering shareholders with benefits in the form of price appreciation.

Investment in growth stocks can ensure wealth accumulation via large scale capital gains. Besides, returns on growth stocks is larger than the prevailing inflation rate in an economy, which provides a window for investors to generate real income on total investments.

However, buying growth stocks are said to be ideal for those who are risk prone. If the company hits a pitfall and is unable to meet the investor expectations, the shares are likely to get out of favor and crash or time correct.

Interesting note: Growth shares usually have higher valuations as compared to value shares. The later have a lower price to earnings and price to book ratio, and thus providing better margin of safety.

Does Growth Investing Come With Any Drawbacks?

Growth stocks are considered as a risky investment venture. These stocks are highly susceptible in nature and heavily influenced by any market fluctuations. The companies that are considered to be growth stocks intend to generate profits by gaining significant market advantage via aggressive business strategies.

Consequently, these companies tend to forgo on dividend payments for reinvestment for expansion purposes- a major disadvantage to investors. Besides, if the business churns out losses, investors stand to lose out on total investment undertaken, as no dividend payments are realised during the lock-in period.

ALSO READ: Growth Investors must exercise prudence in 2020

What Does A Growth Investor Look At?

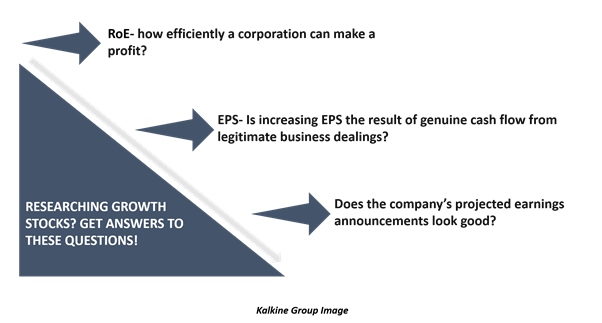

Growth investors look at a number of key factors when selecting companies that may provide capital appreciation-

- Strong historical earnings growth- If the company has displayed good growth in the recent past, it’s likely to continue doing so moving forward

- Strong forward earnings growth- It is these estimates that growth investors pay attention to as they try to determine which companies are likely to grow at above-average rates compared to the industry.

- Strong profit margins- This is an important metric to consider because a company can have great growth in sales with poor gains in earnings, which shows that the management is not controlling costs and revenues.

- Strong return on equity- Stable or increasing ROE indicates that management is doing a good job generating returns from shareholders’ investments and operating the business efficiently.

It was a popular belief in the market that value stocks outperform growth stocks over the long run. However, growth investing has proved to work even in the long run, especially during the times of low interest rates. What matters to investors is not the relative returns of the past. The investors relative returns over his/her time horizon matters. Having said so, predicting a winner is impossible- perhaps a blend of value and growth may be the best option!

MUST READ: Which Parameters Should Be Looked at While Selecting Stocks?