Diluted Earnings per Share

Updated on 2023-08-29T11:58:59.670479Z

What is Diluted Earnings per Share?

Diluted earnings per share (EPS) refers to the tool of profitability that is used to measure the quality of the earning per share of a company if all dilutive securities are realized. Diluted earnings per share shows the effect of convertible securities such as stock options, convertible preferred shares, bonds, warrants, and convertible debentures and the securities that can be converted into common shares on the basic EPS.

The simple or basic earnings per share (EPS) will always be higher than the diluted earnings per share, except in some condition when anti-dilutive securities are higher. In such a case, simple earning per share is reported in the financial statements.

Highlights

- Diluted earnings per share shows the effect of convertible securities such as stock options, convertible preferred shares, bond, warrants, and convertible debentures and the securities that can be convert into common shares on the basic EPS.

- Diluted earnings per share refer to the tool of profitability that is used to the measure the quality earning per share of a company if all dilutive securities are realized.

- Diluted Earnings per Share (Diluted EPS) play a vital role to evaluate financial health of a company.

© 2022 Kalkine Media®

Understanding Diluted Earnings per Share

The Diluted earnings per share is used to show the distribution of net earnings to the shareholders of a company by assuming that all the convertible securities include employee stock options, convertible bonds, warrants, convertible preferred shares, and other convertible securities have been exercised. Diluted earnings per share is a tool measured on the assumption that all the securities that can be converted into equity and common stock are already actually. The Diluted earnings per share (diluted EPS) include the securities which are not common stocks, but it can be converted over a period if the security holder chooses that option. The diluted earnings per share is treated as a more detailed gauge than the earnings per share as it shows the real value of shareholders based on the allocated earnings per share. The diluted earnings per share affect the price-to-earnings ratio of a company and other valuation measures.

© 2022 Kalkine Media®

Significance of Diluted Earnings per Share

Diluted Earnings per Share play a vital role to evaluate the financial health of a company. At the time of reporting financial results, revenue and earnings per share are two main evaluated metrics. Public companies have to report earnings per share on their income statement. The earnings report consists of both basic and diluted earnings per share, and the focus is on the main diluted earnings per share measure. It is not mandatory that every security holder can convert their shares into common stocks. The securities may include warrants, convertible debentures, options, convertible preferred shares, etc. Diluted earnings per share is important for shareholders because it allows the earnings that a shareholder would receive in the worst scenarios. If a public listed company has a huge variety of stocks in its capital structure, it provides information of both basic earnings per share and diluted earnings per share. The information must be visible on the income statement of the company, and it is for both existing operations and net income. Diluted Earnings per Share is considered a conventional metric as it shows a worst-case scenario with reference to earnings per share. A huge difference between earning per share and dilutive earning per share of a company shows the high potential of dilution for the shares of a company and it is an unlikeable attribute as per most of investors and analysts.

How to calculate Diluted Earnings per Share?

The Diluted Earnings per Share examines what would come if dilutive securities were realized. The common diluted securities are convertible preference shares, options, bonds, etc. that can be covert over a given period.

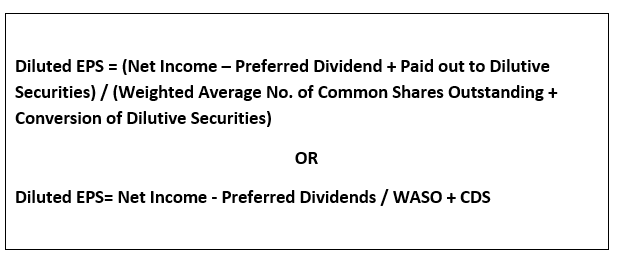

The Diluted Earnings per Share can be calculated by taking a company’s net income after deducting any preferred dividends from it, and then it should be divided with the sum of the weighted average number of outstanding share and dilutive shares including warrants, convertible preferred shares, options, and other convertible securities. Here, is the given formula can use for the calculation of the Diluted Earnings per Share (Diluted EPS).

Where, WASO stands for weighted average shares outstanding and CDS stands for Conversion of dilutive securities.

Where, WASO stands for weighted average shares outstanding and CDS stands for Conversion of dilutive securities.

What is the difference between Diluted Earnings per Share and Earnings per Share?

Both earning per share and diluted earnings per share is profitability gauge used for the fundamental analysis of companies. Earnings per share include common share of a company whereas diluted earnings per share include all the convertible securities of a company such as convertible preference share, convertible debentures, convertible bonds which can be convert into equity and common stocks anytime.

Earnings per share used to measure the proportion of profit of a company on the basis if per-share. On the other side, diluted earnings per share is used to measure the quality of a company’s earnings per share assuming all the diluted securities have been realized, it is used for the fundamental analysis of a company.

The diluted earnings per share (Diluted EPS) take all the convertible securities in account whereas earnings per share does not account for the effect of convertible securities.