Deficit

Updated on 2023-08-29T11:57:03.447736Z

What do you mean by Deficit?

In monetary terms, a deficit happens when costs surpass incomes, imports exceed fares, or liabilities surpass resources. A deficit is inseparable from a loss or misfortune and is something contrary to an excess. A shortage can happen when an administration, organization, or individual spends more than it gets in a given period, usually a year.

Copyright © 2021 Kalkine Media

Understanding Deficit

A deficit implies a sum by which an aggregate misses the mark concerning some reference sum. A shortfall is a sum by which one asset, particularly cash, misses the mark regarding what is required. A deficit exists on the off chance that consumptions surpass pay, imports surpass fares, or liabilities exceed resources. An insufficiency or misfortune is inseparable from a shortage, and it is something contrary to an excess.

Since a deficit infers a lack of assets or an overabundance of money surges over inflows, it does not present an ideal circumstance for an entity. Such deficiencies consistently require the expansion of obligation to conquer them, making an organisation obligated to external lenders. It is the reason specialists believe deficits to be profoundly impractical and hindering long-term economic strength.

Well-known British financial expert John Maynard Keynes, who had introduced the theory - Keynesian Economics, believed that fiscal deficits permit governments to buy labour and products that can help animate their economy; making deficiencies a valuable instrument for delivering countries once again from downturns. Defenders of import/export imbalances say they allow nations to get a more significant number of products more than they produce — at any rate for a while — and can likewise spike their homegrown ventures to turn out to be more aggressive worldwide.

On the contrary, adversaries of import/export imbalances contend that they give occupations too far off nations instead of making them at home, harming the homegrown economy and its residents. Additionally, many argue that administrations ought to cause financial shortages regularly because the expense of adjusting the external loan goes through assets that the public authority may use in a more proper manner. For example, spending on public infrastructure, residential, or social programmes etc.

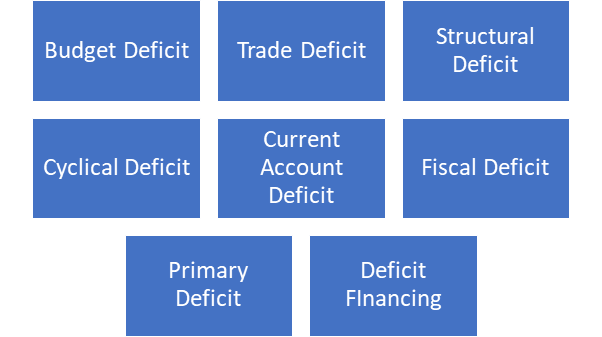

Types of Deficits

There are many types of deficits. Some of them are:

- Budget Deficit: A budget deficit happens when an administration spends more in a given year than it gathers in income. As a basic model, if an administration takes in £5 billion in revenue in a specific year, and its expenditures for that same year are £7 billion, it faces a deficit of £2 billion. This shortfall, added to those from earlier years, comprises the country's public obligation.

- Trade Deficit: An import/export imbalance exists when the worth of a country's imports surpasses its total exports. For instance, if a nation imports $3 billion in merchandise, however, exports goods worth $2 billion, at that point, it has an import/export imbalance of $1 billion for that year. In actuality, more cash is going out of the country than what is coming in, which can cause a gradual drop in the worth of its currency.

- Structural Deficit: This type of Deficit implies that the economy is operating at full employment.

- Cyclical Deficit: This Deficit occurs when the economy is impacted by business fluctuations/cycles.

- Current Account Deficit: The Deficit arises when a nation has a higher level of imports when compared to its exports.

- Fiscal Deficit: Fiscal Deficit is when the central government of a country spends more than the revenue they have generated, including external funding.

- Primary Deficit: The fiscal deficit for the current financial year subtracts the interest payments on prior borrowings.

- Deficit Financing: The different ways a government finances its budget deficit are deficit financing. Example: Bonds, Printing Money, and others.

Frequently Asked Questions

- What are the pros and cons of having a Deficit?

Organisations may purposely have a deficit to augment future profit openings, such as retaining workers during an economic downturn to guarantee a sufficient labor force on busier occasions. Additionally, a few governments run shortfalls to back huge public ventures or keep up spending for their residents. During a downturn, an organisation may run a deficiency deliberately by diminishing its avenues of income while keeping up or increasing expenditure. The hypothesis is that these actions will support the public's buying control and, ultimately, boost the economy.

At the point when governments borrow, they need to pay extra interest on such credits. Interest installments drive up government use in ensuing periods and increment the Deficit later on. Printing new cash prompts the inflow of an extra amount of money in the economy. On the off chance that individuals have more cash to spend, more individuals will attempt to buy merchandise that is accessible in limited amounts.

Since market request will surpass market supply, inflation can be a consequence, an ascent in the costs. Additionally, suppose the vast majority of the public authority's incomes are spent to settle past advances. In that case, there will be less cash to put resources into improvement and occupation creation, stalling economic growth.

- What is deficit spending?

Deficit spending is the point at which an administration's expenses surpass its incomes during a financial period, making it run a spending deficit. The public authority assumes obligation while utilizing its spending ability to provoke interest and invigorate the economy. Deficit spending is a method of expansionary monetary strategy.

Occupation creation gives more individuals cash to spend, which further lifts development. Tax breaks are also one of the methods used to lift the economy.

- What is deficit financing?

Deficit financing, a commonly used technique in which an organisation/government spends excess funds than it gets as income, the distinction being made up by collecting or stamping new assets. Although spending deficits may happen for various reasons, the term, for the most part, alludes to a conscious endeavour to animate the economy by bringing down borrowing rates or expanding government uses.

Deficit financing, in any case, may likewise result from government shortcoming, reflecting boundless tax avoidance or inefficient spending instead of the activity of an arranged countercyclical strategy.