Cash Receipt

Updated on 2023-08-29T12:00:55.577792Z

What is a cash receipt?

A cash receipt is a printed statement of the amount of money obtained in a transaction involving the transfer of money or money equivalents. The buyer receives the original copy of the cash receipt, while the vendor keeps the other copy for accounting purposes.

Cash receipts are essential items used in cash transactions as they serve as an evidence of ownership of the goods bought against them.

Summary

- A cash receipt is a printed document that shows the amount of money collected from a customer during a cash sale transaction.

- The cash receipts journal is used to document all incoming cash to keep track of all cash inflows in a company.

- Cash receipts serve as evidence of ownership for the item purchased.

Frequently Asked Questions (FAQs)

What does the term "cash receipt" mean, and how does it work?

When cash is paid for a particular service or product, cash receipts are printed documents provided as evidence of purchase.

When a seller receives cash or cash equivalent from an external source, such as an investor, a customer, or a bank, cash receipts are issued. It can also be thought of as a pool of funds that adds to a company's cash and cash equivalent balance.

There are various ways to run a company, some of which offer services and goods on credit and expect cash payment later, while others need the cash payment when a service or product is sold. The cash receipt is issued at the time when the customer gives the business cash or a cheque as payment for the product or service offered, regardless of when the sales transaction took place.

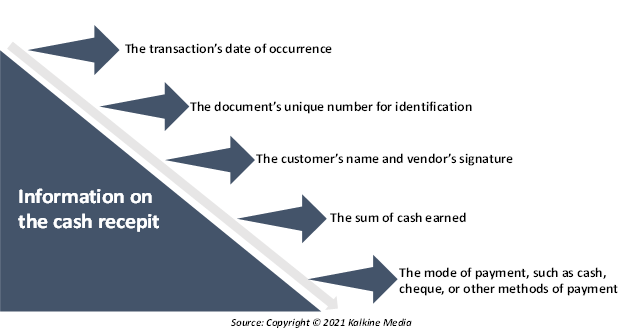

What information is included on the cash receipt?

A cash receipt usually includes the following information:

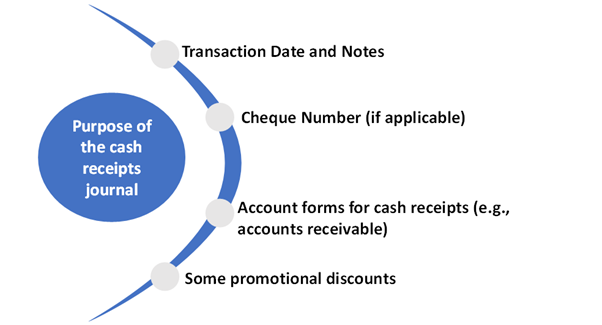

What purpose does the cash receipts journal serve?

The cash receipts journal is used to track all cash inflows in a company by recording all incoming cash. It usually involves both credit categories and cash sales. The following are some categories to register in the cash receipts journal.

Source: Copyright © 2021 Kalkine Media

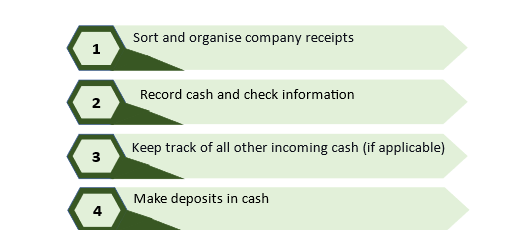

What are the steps involved in accounting for cash receipts?

The measures to properly account for cash receipts are outlined below.

It is necessary to make a cash sale and retain all sales receipts issued during the transaction before recording the corresponding cash receipts. The sales receipts include the date of sale, the customer's name, an itemisation of the goods or services offered, the total sale number, the price for each item, and the sales tax (if applicable). If the cheque is accepted, the cheque number must be included with the sales receipt.

- Keep track of cash receipt transaction:

Using sales receipts, a cash receipts journal can keep a chronological record of cash transactions.

It is necessary to report collected sales tax in the sales journal rather than in the cash receipts journal.

Cash sales should be credited in the sales journal and debited in the cash receipts journal. Customers who use a mix of payment methods (e.g., credit and part cash) or who give store credit will have different sales entries.

What are the processes for cash receipts?

The cash receipts method will ensure that transactions are appropriately recorded, accounting mistakes are avoided, and total cash receipts are organised.

The following items should be included in the cash receipts procedure:

Source: Copyright © 2021 Kalkine Media

Customers often pay in cash later; in these situations, a separate journal entry must document this information. The effect of these payments on store credit and customer invoices should be monitored.

When depositing cash payments, the sum on the deposit slip should match the amount in the cash receipts journal. In case of any inconsistencies, keep deposit receipts with other company receipts. The cash receipt procedure, on the other hand, differs from one company to the next.

What are the advantages of using cash receipts?

- Unlike debit or credit card receipts, cash receipts do not need any authorisation, such as the requirement of a PIN code.

- They are not affected by technological issues since they can function without the use of electricity.

- They provide accurate and timely information.

- They are easy to handle for freewheeling executives and do not leave much space for overspending.

- They act as proof of ownership for the purchased item.

- Customer-friendly in the event of a return or exchange of a purchased item.

- When a vendor must deal with consumer warranty disputes, this tool comes in handy.

- They have accounting documents that are accurate and justify the existence of tracking transactions.

- A cash receipt is also relevant since a lack of records to support the presence of a transaction is one of the most common reasons for an audit. As a result, having cash receipts and filing them correctly will reduce the chance of an audit. The accounting record is incomplete without a cash receipt, which can be dangerous in the long run.

What are the disadvantages of cash receipts?

- They are most successful for extended periods, up to six months, and businesses need more time to build budgets for shorter periods.

- They are highly vulnerable to harm or theft, and it would be challenging to classify company cash without a computerised record. Cash sales have become a target for robbers, and workers can even manipulate the records and steal.

- They might end up being a high labour cost, mainly if the amounts obtained are large. Counting and banking will take longer, and there will be an additional service charge for banking.

- There is a chance of getting fake money.