Annuity

Updated on 2023-08-29T11:56:50.270684Z

- What is Annuity & its fundamentals?

Annuity, a contract meant for long term duration, is issued & sold by a life insurance company. The insurance company makes the payment in a fixed stream to retirees upon annuitization, which is generally an income to the latter. The annuities are designed to underpin the growth of retirement income and are funded by individuals.

In case of a deferred annuity, where payments begin after a certain duration, there is an accumulation phase which is the time period when an annuity is being accumulated before the fund payouts to the individuals begin. When the payments start, the contract is said to have entered an annuitization phase.

In case of an immediate annuity, payments begin immediately in the annuitization phase, and there is no accumulation phase.

The life insurance company after accumulating funds from individuals generally invests in mutual funds to get profit from their investments.

- What is the Purpose of Buying Annuities?

As a part of retirement income planning, the annuities are relied upon to get a regular income through a steady cash flow in the retirement phase.

The investors can take the payments either as a lump-sum amount or get paid periodically. The payment to the annuitant is done either for a fixed period or for the annuitant's remaining lifetime.

On the other hand, making the corpus of fund for retirement is not easy, as one has to find out how much an individual needs to save to retire. This is where the real financial planning begins. There are a number of retirement savings options available to an individual, tailored to specific needs. For example, investment can be made through the employer in the form of an annuity or super funds or pension plan.

Meanwhile, some market players in favor of income strategy also consider exposure to dividend stocks for beefing retirement investment portfolio.

- What is the difference between Annuities and Pension?

While both annuities and pension are common sources of retirement income, it is important to understand the difference between the two.

Though annuities are purchased from insurance companies via the signing of the contract, the pension is generally a kind of retirement account offered by companies to their employees.

Individuals buy an annuity scheme from life insurance companies to get a guaranteed regular/lump sum income after retirement, whereas people save from the amount earned to make a pension pot throughout the life when they are earning.

While pension benefits are availed post the retirement, financial benefits of annuities do not necessarily require the person to retire.

ALSO READ: Retire from Work, Not From Life: Superannuation And Age Pension

- What is the difference between Annuities and Insurance?

While both annuities and insurance plans are essential components of long-term financial planning, some differences between the two deserve closer attention. Notably, annuities can be purchased without a medical need, unlike insurance.

Looking a payment flows, annuities dole out funds to the owner when the annuitization period begins as per the contract. While, insurance schemes provide income streams to dependent in case of the owner’s death, unless the policy is surrendered.

- What are the different types of Annuities?

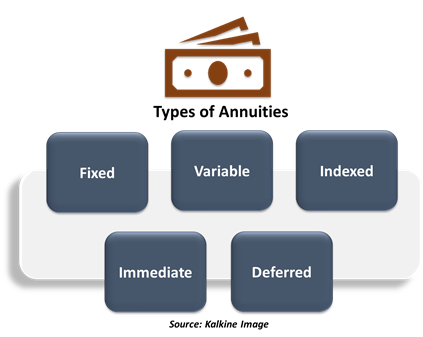

There are various types of annuities, and the exact payment structure of each individual will depend upon the terms that the individual had agreed with the insurance company.

Annuities can be structured into different kinds of instruments, that includes fixed, variable & indexed with the options of immediate or deferred income, that gives the investors flexibility to get their payments as annuities in different forms.

Fixed annuity provides the guarantee of a minimum rate of interest on the money invested by an individual and also offers a fixed number of payments that will be received from the insurance company.

Variable annuity gives the individuals an option to invest the money in different types of securities as the mutual funds do. The payments an individual will receive in the form of annuities will depend on the performance of the funds.

Indexed annuity combines the benefits of both fixed and variable products. The returns on investment an individual will get from an indexed annuity are not dependent on individual’s investment decision but will depend on the performance of stock market indices like the S&P 500, where the fund manager invests in the stocks of the index in the same weightage.

An investor in all the three annuity types, has an option of choosing an immediate annuity or a deferred annuity. In an immediate annuity, the individuals deposit the insurance company with a lump sum and can immediately start receiving the annuities.

In a deferred annuity, the individuals pay a lump sum or a series of payments but will not start getting payouts as annuities until a specified period. This gives the individual’s money an opportunity to perform and either earn interest or appreciate, as for a variable annuity.

- What are the Benefits vs Risks of Investing in Annuities?

An annuity is considered to be a good option as it offers regular payments, tax benefits and a potential death benefit. The most basic feature of an annuity is the individual gets an opportunity to tap regular payments in the form of supplemental income from an insurance company during the retirement. This will help the individuals that have not saved enough to cover their normal expenses.

Further, the money that individuals contribute to an annuity is tax-deferred, which means the individuals do not need to pay taxes on the money until the individual starts receiving the payments.

Annuities somewhat guarantee returns in terms of safeguarding retirement related financial requirements.

Meanwhile, there is a certain level of risk involved when individuals invest their money. The individuals get fixed annuities guarantee on a certain percentage of the individual’s principal (original) investment, which is generally quite low.

Moreover, variable annuities carry more risks because of the probability for an individual to actually lose the money, depending on the fund’s performance. However, variable annuities offer an extra benefit, which is a death benefit.

Besides, the annuities have illiquid nature. Once the individual has contributed the money to fund an annuity, he cannot get it back or even pass it on to a beneficiary. It could only be possible if the individual has opted for another annuity plan, however, this could involve fees attached to it. Further, the benefits will disappear when an individual die.

Besides, annuities generally involve high fees like administrative fees, mortality and expense fees associated with annuities, which makes the annuity products among the most expensive investment products available in the market. Insurance companies charge these fees, in order to cover the costs and risks of insuring the individual’s money.

- What do we understand by Death Benefit Associated with Variable Annuities?

A death benefit is a payment made by the insurance company to a beneficiary when an individual who invests principally dies. The death benefit for a basic variable annuity is generally equal to the amount that the individual had contributed to the annuity. It will not depend upon the performance of the securities of the annuity’s fund.

There are also variable annuities with enhanced death benefits, in which the insurance company records the value of the individual annuity’s investments each year on the annuity’s start date. In the case an individual dies, then the insurance company pays a death benefit equivalent to the highest recorded value of the annuity.

For example, suppose an individual has entered into an annuity contract of total value $50,000 and on the anniversary of the annuity’s start date, the individual’s investments have increased to $75,000. The individual’s death benefit would then be of total value of $75,000, even if the value of the investments has fallen for the rest of your life.

- What are the different terms associated with Annuities?

The annuity contracts have surrender charges which apply to both variable and fixed annuities. Surrender fees are generally high and require to be given for an extended period of time.

A surrender charge is incurred when an individual goes for more withdrawals than actually allotted. The insurance company has the power to limit withdrawals primarily during the early years of the contract.

Some annuities also have additional riders attached that are availed by giving an extra fee. A rider provides a guarantee which is optional. For instance, adding death benefits to an individual’s contract requires a death benefit rider. Rider fees will vary across individuals, but they can be of higher costs (up to 50% of the value of the in account).

Moreover, the deposits into annuity contracts are generally locked up for a certain duration, which is known as the surrender period. The annuitant would incur a penalty if all or part of that money within this period gets touched.

These surrender periods can be of a time period of two to more than 10 years, which will depend on the particular product. Surrender fees can be of 10% or even more and the penalty generally falls annually over the surrender period.