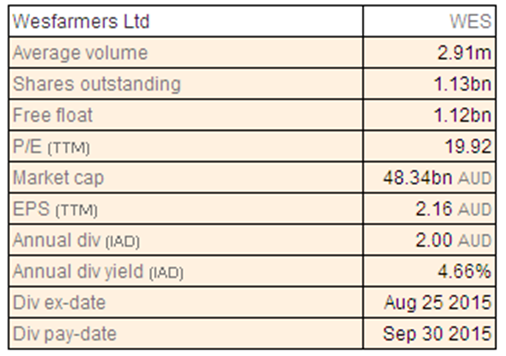

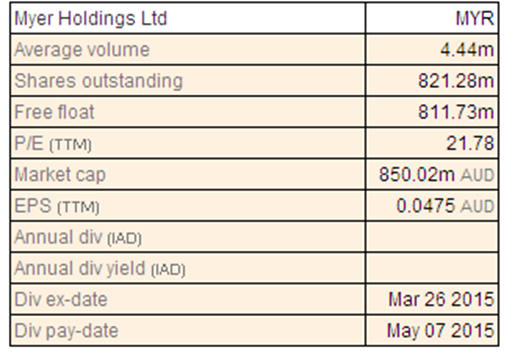

Wesfarmers Limited

WES Dividend Details

Acquisition of Homebase to leverage the potentialUK home improvement market: Wesfarmers Ltd (ASX: WES) recently announced that they would be acquiring Homebase, a UK retailer from Home Retail Group for £340 million. With this move, WES is targeting a potential market size of £38 billion in the UK market and intends to foray its Bunnings brand in the UK market. By combining the best of both Homebase and Bunnings business, WES believes that they would be able to position themselves in the UK market given their solid expertise in Australia. Consequently, the shares of WES have rallied over 11.70% in the last three months (as of February 08, 2016).

Homebase network (Source: Company Reports)

On the other hand, we believe that the recent rally has placed WES at higher levels. The group’s Curragh mine Coal production fell by 25.5% to 2,467,000 tonnes during December 2015 quarter as compared to the earlier quarter while metallurgical coal production fell by 31.7% in the same period due to mine site shutdown. The group’s share of Bengalla mine coal production fell by 2.9% to 3,326,000 tonnes during 2015 year. We believe that the stock is still “Expensive” at the current price of $42.85

WES Daily Chart (Source: Thomson Reuters)

Woolworths Limited

.png)

WOW Dividend Details

Focusing on core business: Woolworths Limited (ASX: WOW) reported that they would exercise their call option of their 33.3% interest in Hydrox Holdings (which operates Masters Home Improvement and Home Timber & Hardware) held by Lowe’s Companies subsidiary, WDR Delaware. Management reported that after conducting an operating review, they would need several years to turn its Home Improvement joint venture into profits. Hence, given the current challenging market conditions, the group had decided to sell the business. Meanwhile, the shares of Woolworths have been under pressure and fell by over 14.69% (as of February 08, 2016) in the last six months due to rising competitive pressures from its peers coupled with subdued consumer’s sentiment on the back of tough market conditions. Moreover, the group estimates a 28% to 35% lower Net Profit after Tax in the range of $900 million to $1 billion in the first half of 2016 against prior corresponding period as the group is incurring heavy investments to enhance its price and service. On the other hand, WOW is pursuing every opportunity to get back on growth track and recently ventured into China via its products launch in Tmall Global, an overseas platform of Alibaba Group’s B2C Tmall business in China, to leverage the massive potential opportunity and demand for high quality Australian products in China.

WOW also infused over $300 million in prices, as of November 26, 2015, to cut its prices further to regain its competitive position and accordingly delivered a Food and Liquor sales segment increase by 0.4% yoy during first quarter of 2016 to $11.1 billion. WOW has also announced for its strategic partnership with Hills Limited for an exclusive license to use Hills heritage brand. The correction in the stock also placed WOW at attractive valuations which is trading at a reasonable P/E. We remain bullish on WOW and reiterate our “BUY” recommendation on this dividend yield stock at the current price of $23.10

WOW Daily Chart (Source: Thomson Reuters)

Metcash Limited

.png)

MTS Details

Improving bottom line to offset top line pressure: Metcash Limited (ASX: MTS) stock surged over 48.31% (as of February 08, 2016) in the last six months as the group was able to deliver an outstanding reported profit after tax increase of 20% yoy to $122 million in first half of 2016 even though its revenues plunged 22.9% yoy to $6,606 million. Moreover, the group also enhanced its capital position by decreasing its net debt by 34.8% to $435.3 million during 1H16 against FY15.

.png)

Metcash Limited first half of 2016 performance (Source: Company Reports)

We believe that the group’s stock has more potential momentum driven by the group’s efforts to generate further operational savings of over $100 million per annum by financial year 2019 via its Working Smarter program. Accordingly we give a “HOLD” on this dividend yield stock at the current price of $1.695

.PNG)

MTS Daily Chart (Source: Thomson Reuters)

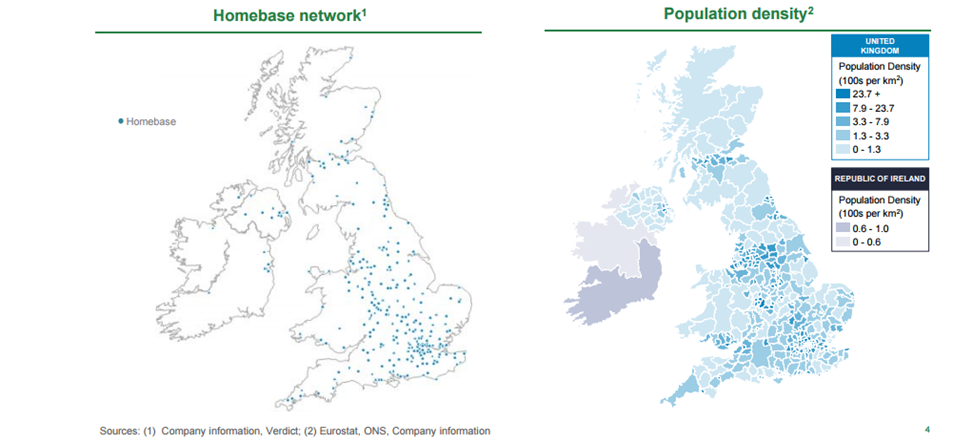

Myer Holdings Limited

MYR Details

Raising funds to decrease debt: Myer Holdings Limited (ASX: MYR) raised around $221 million via pro-rata non-renounceable entitlement to decrease its debt as well as to position itself to fund its ‘New Myer’ strategy, which is aimed at enhancing the group’s productivity and customer experience to revamp Myer’s growth. But, the stock fell over 4.44% (as of February 08, 2016) in the last four weeks on investors’ concerns over the group’s ability to deliver benefits via its New Myer’ strategy given the challenging market conditions.

New Myer Strategy highlights (Source: Company Reports)

Moreover, the group’s fiscal year of 2015 net profit after tax (excluding Individually Significant Items) fell by 21.3% yoy to $77.5 million, while the group estimates its NPAT to be even lower for FY2016, in the range of $64 million to $72 million (without the impact of implementation costs related to the New Myer strategy). Based on the foregoing, we give an “Expensive” recommendation on MYR at the current price of $1.025

.PNG)

MYR Daily Chart (Source: Thomson Reuters)

Retail Food Group Limited

.png)

RFG Dividend Details

Robust growth prospects: Retail Food Group Limited (ASX: RFG) management confirmed that they would be able to deliver over 20% rise of underlying NPAT for full year of fiscal year of 2016. Accordingly, the group was as able to deliver an organic growth (including Michel’s Patisserie, Brumby’s Bakery and Donut King) Same Store Sales (SSS) and Average Transaction Value (ATV) increase of 2.3% and 2.4%, respectively, during the year to date of fiscal year of 2016 against prior corresponding period. We believe that the group’s organic performance coupled with the contribution from its acquisition and increasing international penetration would drive the stock higher in the coming months. Hence, we maintain our “BUY” stance on this dividend yield stock at the current price of $4.33

.PNG)

RFG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.