Metcash Limited

.png)

MTS Details

Received ACCC’s bidding approval for WOW’s Home Timber and Hardware: Metcash Limited (ASX: MTS) got the approval from Australian Competition and Consumer Commission (ACCC) for bidding for Woolworths Home Timber and Hardware business. Accordingly, the stock surged over 7% in the last four weeks (as of August 02, 2016), while the rumors over the group’s bid drove the stock by 20.90% in the last three months.

Transformation initiatives: Metcash reported a revenue rise of just 1.3% year on year (yoy) to $13.5 billion in fiscal year of 2016 while the underlying profit after tax rose only 2.7% yoy to $178.3 million. Food & Grocery segment delivered a revenue rise of just 0.5% yoy to $9.3 billion during the period while Supermarkets revenue rose 0.5% to $7.7 billion. On the other hand, the group’s Food & Grocery EBIT fell 17.0% to $179.9 million as the group is making incremental price investment. Moreover, the group’s Convenience business surged only by 0.4% to $1.6 billion on the back of challenging environment due to decline in the Campbells reseller business (particularly in tobacco). The segment’s margins were also under pressure from major Convenience Store Distribution contracts. As a result, MTS undertook transformation initiatives like Competitive Pricing, Network Investment and Core Ranging especially for food and grocery to fight against deflation and peer pressure. The group’s Price Match program is now rolled out in over 960 stores, and the Diamond Store rollout is now in over 150 stores. Diamond Stores have continued to deliver about 16% improvement in retail sales post investment. The group’s Working Smarter program is forecasted to deliver a savings of over $100m across all businesses in the coming three years, with gross savings of over $35 million in FY17.

.png)

MTS retail presence (Source: Company Reports)

Challenging outlook ahead: Despite the group’s initiatives to revamp its business, we believe that the group’s competition is intensifying from major players like Woolworth, Wesfarmers and Aldi.

Moreover, MTS Food & Grocery segment is facing huge pressure in South Australian and Western Australian markets while the segment continues to be prone to deflation and a rising cost base. Even though MTS is aiming to expand its business via Home Timber and Hardware business acquisition, they might face huge threat from Bunnings. Hence, we recommend investors to leverage the rise in the stock as an exit opportunity. We give a “Sell” recommendation on MTS at the current price of $2.12

MTS Daily Chart (Source: Thomson Reuters)

TPG Telecom Ltd

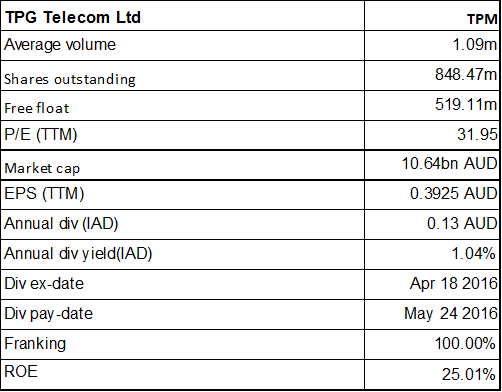

TPM Details

Debt Scenario: TPG Telecom Ltd (ASX: TPM) has a high net debt to EBITDA leverage ratio of over 2.1x (based on annualized 1H16 underlying EBITDA and including IRU debt within net debt) as at 31

st Jan 16. Moreover, the group’s debt balance was $1460 million. The group reported an underlying EBITDA of $368.8 million in the first half of 2016 while the capital expenditure was $133.4 million. Moreover, TPM is expecting the underlying EBITDA to be in the range of $770-775 million and the capex to be in the range of $280-310 million for FY 16.

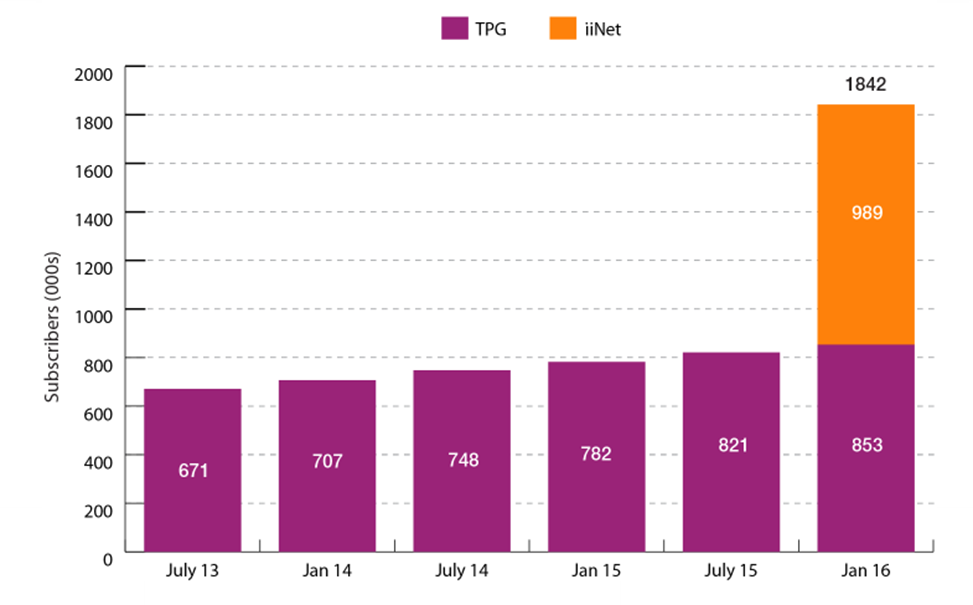

iiNet acquisition impact on subscriber’s base (Source: Company Reports)

Impact on subscriber base: TPM’s organic growth plus the addition of iiNet drove the Group’s broadband subscribers to 1.84 million at end of first half of 2016. During the financial year TPM has completed the purchase of iiNet and has announced plans to buy $85 million worth of spectrum for mobile phone and broadband, to be paid over two financial years. On the other hand, TPM’s mobile subscribers are falling and the subscriber base is migrating to Vodafone network. With regard to the Vodafone fibre network construction, capital expenditure over rollout period would be $300-400 million with the majority of which would be over next 3 years and the minimum contracted revenue over the term would be greater than $900 million. There have been rumors swirling on TPM’s possible takeover bid with regard to the entire mobile network of Vodafone Australia and New Zealand. TPM had announced few months back that they had agreed for a $1 billion deal with Vodafone Australia to migrate its mobile customers to the Vodafone network, while Vodafone would gain use of TPM’s extensive fibre optic physical cable network.

The main problem to this deal is with respect to the huge costs that are involved as TPM Telecom is already suffering with a high debt. Recently, ACCC has released its first report on NBN wholesale market stating that TPM was acquiring the most higher speed NBN wholesale access services. We recommend investors to leverage the current decent levels of TPM stock which rose over 23.91% in the last six months (as of August 02, 2016) and is trading close to its 52-week high price, as an exit opportunity. Moreover, the stock has a low dividend yield and is trading at a high P/E. We give a “Sell” recommendation on the stock at the current price of $12.68

TPM Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.