Suncorp Group Ltd

.png)

SUN Dividend Details

Targeting growth based on resilient business model: Suncorp Group Ltd (ASX: SUN) has delivered a strong performance in 2015, registering a growth of 55.2% in Group net profit after tax (NPAT) of $1,133 million, despite the fact that Suncorp group’s NPAT main business of General Insurance suffered a decline of 25.1% owing to high number of natural calamities this year. The performance nonetheless indicated a successful resilient and diversified business model of the group. The group is also focusing on optimizing its business operations and has set a target of saving nearly $170 million by 2018. The savings coupled with potential growth opportunities in new segments as well as new geographies are expected to drive the group’s bottom line further. For the year 2015, the group has committed to maintain the dividend payout ratio of 60% to 80% and to return any surplus capital to the shareholders. Meanwhile, the stock plunged over 11.52% in the last four weeks (as of December 31, 2015) on the back of the group’s announcement of a profit downgrade for the year 2016 due to impact from weather events in 2015.

.png)

Strong growth opportunities based on diversified business model (Source: Company reports)

However, we believe that the stock is currently trading at discounted value and the profit downgrade impact is already factored in. SUN is trading at a reasonable P/E and has a good dividend yield. Given the group’s solid growth plan, and its track record of managing downside risks via diversified business portfolio to enhance its earnings, we give a “BUY” recommendation on SUN at the current price of $12.06

SUN Daily Chart (Source: Thomson Reuters)

CIMIC Group Ltd

.png)

CIM Dividend Details

Decent business performance but expensive: CIMIC Group Ltd (ASX: CIM) announced a better-than-expected half yearly result in June, 2015 which resulted in rise in its stock prices. Even though its revenue of $7.2bn was lesser than the previous year by 14.1%, its NPAT grew to $258.2m. This was primarily attributed to the group’s effort towards reducing its operational cost by 16.2% (which it set as a strategic goal for 2015). Based on these figures, the group is likely to achieve its revenue projections of $450-$520m for the year 2015. Observing the last six months trend, CIM’s stock prices have seen significant fluctuations with lowest and highest values of about $21.25 and $27.91 respectively. However a series of recent announcements resulted in a steady increase in the stock prices. Recently, the group has made an off-market bid to acquire Devine Ltd., Queensland based residential property dealers. In addition, the group’s global mining contractor arm, Thiess, was awarded a contract worth $115 million from Dawson Coal mine based in Central Queensland.

CIM also plans to buy back up to 10% of its own shares over the next year. On the other hand, we believe the current trading prices for CIM are slightly expensive and the stock might correct in the near future. The stock has already fallen about 4.74% in the last one month (as at December 31, 2015). Accordingly, we give an “Expensive” recommendation on the stock at the current price of $23.41

CIM Daily Chart (Source: Thomson Reuters)

Santos Ltd

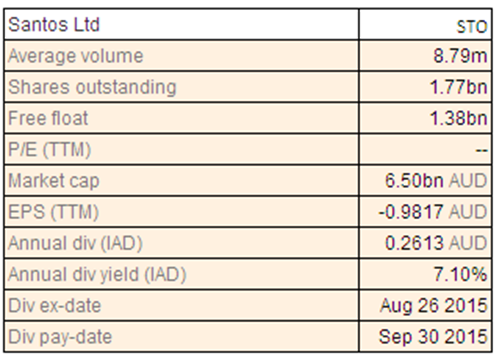

STO Dividend Details

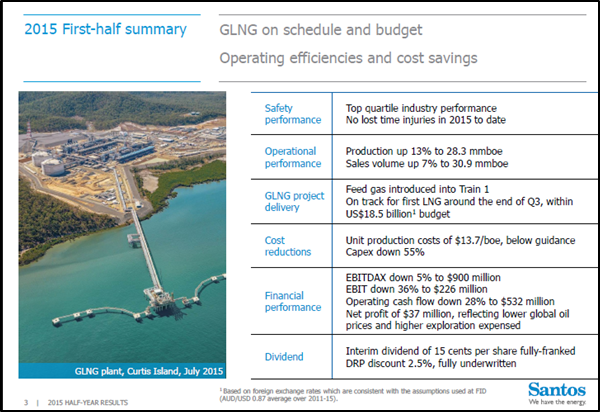

Weak current performance but bright future prospects: Santos Limited (ASX: STO) announced weak results in the first half of 2015. Even as the group’s production and sales volumes increased by 13% and 7% respectively, the half yearly NPAT declined by 82% to $37 million. This was primarily due to significantly lower crude oil prices. The weak results had driven down the company’s stock values by 47.44% over the past six months (as at December 31, 2015). However, the company has taken significant steps to improve its performance. STO has worked actively towards reducing its operational cost, particularly in the Eastern Australian business. In addition, company has been putting efforts in view of its plan to raise $3.5 billion from various asset offsetting initiatives to reduce its debt burden. The company has also made leadership changes with the hiring of new CEO, Kevin Gallagher from engineering services group, Clough Limited. The promising aspect of Santos upcoming projects is the GLNG project (Santos having 30% interest therein). As reported, the project progress is on schedule and on budget. Expected to commence operations by third-quarter of 2015, this project is likely to make a positive contribution to Santos’ revenues.

Growth and operational efficiency plans on-track (Source: Company reports)

Recently, GLNG project made an eleven years agreement with AGL Energy for 254 petajoules of gas for supply to GLNG project. The group’s Western wet gas joint venture with Drillsearch also started production. Given the company’s strong efforts towards operational efficiency and growth prospects based on growing LNG demand driven by Chinese market, the stock can be leveraged at the current low prices. Hence, we give a “BUY” recommendation on this high dividend yield stock at the current price of $3.83

STO Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.