SEEK Limited

Ongoing Market Leadership, delivered decent FY15 results: SEEK Limited (ASX: SEK) SEK continues to maintain its market leadership position in Australia, with 32% of placements and a lead of 10x higher as compared to its nearest competitor. The total visits in Australia witnessed a CAGR increase of 22% to 35+million in FY15, from FY12. Mobile visits performed even better showing a CAGR of 47% during FY12 to FY15. The group’s fiscal year of 2015 revenues rose 20% year on year (yoy) to $858.4 million. SEEK Limited’simproved Australia and New Zealand online employment businesses, Premium Talent Search promotion, and integration of JobsDB and JobStreet to Zhaopin in China have contributed to the overall revenue increase. The group owns market leaders in Brazil and Mexico that are achieving robust financial results whilst evolving their product and service offerings. SEEK increased its dividends by 20% yoy to 36 cents per share for the fiscal year 2015.

.png)

SEEK’s international presence (Source: Company Reports)

Attractive valuation: SEEK’s conservative FY16 guidance have disappointed the investors, due to which the stock fell over 15.2% in last four weeks. The group expects a revenue growth in 15% to 18% range while EBITDA is estimated to grow in the range of 5% to 8%. Moreover, the group fell over 27.4% in last three months due to tough market conditions. Therefore, the group is trading at a relatively cheaper valuation P/E of 20.35x as compared to its peers opening an attractive buying opportunity for investors seeking for high value stocks. We therefore put a BUY recommendation for the stock at the current price of $11.75.

.png)

Flight Centre Travel Group Ltd

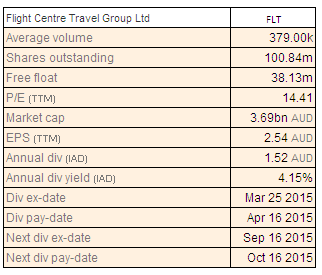

Delivered Outstanding TTV Growth: Flight Centre Travel Group Ltd (ASX: FLT) revenues improved by 6.8% yoy to $2.4 billion for the fiscal year of 2015, driven by significant total transaction value improvement by 9.7% yoy to $17.6 billion. Australia’s TTV surged to $9.6 billion in FY15, from $9.1 billion in the corresponding period of last year. Moreover, the group achieved a new TTV milestone across all of its 10 countries and regions. UK and Ireland, USA, South Africa and Singapore achieved record earnings before interest and tax during the period leading to >$100million overseas EBIT for the first time. FLT’s UK and Ireland TTV was GBP 1 billion for the first time, while USA TTV surged 18% yoy and contributed >$AUD2.5billion to the group’s top-line. InduAsia (which comprises India, Dubai (UAE), Greater China and Singapore) business delivered $870 million of TTV, with Singapore growing rapidly by TTV. Greater China business is also aggressively expanding through new brands, shops and websites plus landmark domestic ticketing licenses. Accordingly, the group’s statutory PBT rose 13.1% yoy to $254.8 million while statutory PAT surged 24% yoy to $256.6 million during the period. Meanwhile, the group maintained its interim and final dividends at 55 cents and 97 cents respectively as compared to pcp.

.png)

Performance by Region (Source: Company Reports)

Stock Outlook: IATA has projected 4.1% compounding annual growth in passenger numbers globally through to 2034, while Airbus estimates that international traffic serving the Australia South Pacific region is estimated to grow annually at 4.5% to 2033. We believe FLT is well positioned to tap this potential market through its wide product ranges, omni-channel capabilities and brand diversity. On the short term perspective, leisure travel is picking up with increasing customer enquiries than expected. Gross margins in Flight Centre brand have also recovered and niche leisure brands performance is favorable. FLT intends to address the gaps in its online product range by adding Air Asia and Tiger fares to the flightcentre.com.au website, along with additional Jetstar inventory and ancillary products. The group has a solid balance sheet and is well positioned to leverage the rising demand. FLT is trading at relatively cheaper valuations, with a P/E of 14.4x, as compared to its peers like Webjet Limited (P/E of 17.8x). The group also has a strong dividend yield of 4.2%. Based on the foregoing, we give a “BUY” recommendation to the stock at the current price of $35.46

WAM Capital Limited

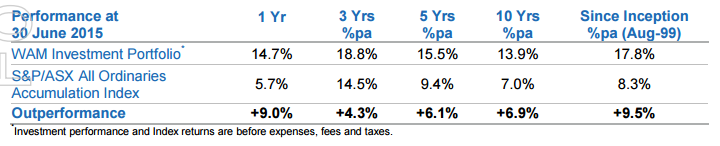

Investment portfolio performance continues to beat benchmark index: WAM Capital Limited (ASX: WAM) investment portfolio rose 14.7% during the fiscal year of 2015, beating the benchmark value of 9%. But the group’s operating profit before tax reduced to $71.2 million in FY15, from $90.5 million in FY14, as the capital base increased from 2014, while the value of the investment portfolio also changed. WAM delivered a 7.7% yoy better fully franked dividends to 14 cents during the year, against prior corresponding period. The group’s shareholder equity improved by 35.3% yoy to $806.5 million driven by investment performance and capital management efforts. WAM Capital share purchase plan and oversubscribed placement raised over $193.4 million.

Investment Performance during FY15 (Source: Company Reports)

Stock Performance: WAM Capital stock decreased only 2% during this year to date (as of Sep 11 close) even though the broader index S&P/ASX 200 fell by 6.3% during the period. But the stock had been stable from last three months, and even marginally rose by 1.5% despite tough market conditions as S&P/ASX 200 reduced by 8.6% in this period. WAM has an outstanding dividend yield of 7.1% and trading at an attractive P/E of 13.9x. We believe the stock has the potential to improve in the coming months, and accordingly recommend a “BUY” at the current price of $2.00

.png)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2015 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.

.