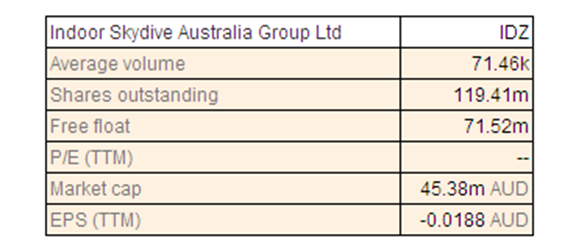

Indoor Skydive Australia Group Ltd

IDZ Dividend Details

Expanding international penetration: Indoor Skydive Australia Group Limited (ASX: IDZ) recently entered into a $6.15 million debt facility with Westpac Banking Corporation to fund its construction projects. Indoor Skydive Australia total revenues surged to $6.59 million in fiscal year of 2015, as compared to $1.32 million in fiscal year of 2014, with solid tunnel based revenue and occupancy. IDZ achieved solid unearned revenue (pre-sales) of $1.3 million during the period. Indoor Skydive Australia was able to decrease its net loss for the year to $1.75 million in FY15 from a net loss of $2.71 million in FY14, despite $1.4 million impact of performance based share expenses. Meanwhile, IDZ is enhancing its technology capabilities and efficiency to maintain competitive edge. The group intends to expand to more than 80 Vertical Wind Tunnels across the world and planned to open more than 40 by the end of 2016. Accordingly, IDZ estimates a global growth of 50% during fiscal year of 2016.

.png)

Performance metrics analysis (Source: Company Reports)

On the other hand, the shares of Indoor Skydive Australia delivered a negative year to date returns of 23.40% (as at November 19, 2015) impacted by the current slowdown and tough market conditions. But, we believe this correction placed the stock at attractive valuation. We believe the positive momentum in the stock would continue in the coming months and accordingly place a “BUY” recommendation on the stock at the current price of $0.36

IDZ Daily Chart (Source: Thomson Reuters)

RXP Services Ltd

.png)

RXP Dividend Details

Positive Outlook: RXP Services Ltd (ASX: RXP) delivered a revenue increase of 41.5% yoy to $78.9 million during fiscal year of 2015 and reported a profit before tax increase of 12.4% yoy to $10.4 million. Second half of the year’s performance was better than the first half and was able to generate a 26% revenue and profit growth as most of the group’s deferred projects started during the period. Meanwhile, the group is focusing on specialization (Practices) as a part of its OneRXP strategy and continues to build new clients as well as partner relationships. Accordingly, RXP Services also estimates a solid pipeline across its specialist practices. The group issued a positive outlook and estimates a revenue of more than $108 million while expects its profit before tax margin to be in the range of 13% to 14% for the fiscal year of 2016.

.png)

Fiscal year of 2015 Performance (Source: Company Reports)

The shares of RXP Services generated a solid performance delivering a year to date returns of 51.43% (as of November 20, 2015), and surged over 41.33% in the last six months alone. Still the stock is trading at very attractive valuations with a relatively cheaper P/E of about 10%. Based on the foregoing, we give a “BUY” recommendation on this 2.3% dividend yield stock at the current price of $0.53

RXP Daily Chart (Source: Thomson Reuters)

Ainsworth Game Technology Ltd

AGI Dividend Details

Targeting Growth via launching new products and enhancing penetration: Ainsworth Game Technology Limited (ASX: AGI) reported a revenue decrease by 1% yoy to 240.6 million in the fiscal year of 2015. On the other hand, AGI delivered a solid 14% rise in audited profit after tax of $70.4 million driven by foreign currency gains of $25.6 million ($17.9 million after tax) partly on the back of falling Australian dollar. Ainsworth Game Technology international business performed well with revenues rising 46% yoy to $147.6 million, leading to better segment’s share in overall revenues to 61% in FY15 from 41% in FY14. North America’s growing market share coupled with new markets contribution led to 42% yoy revenue rise to $82.8 million during FY15. Management reported that its A560SL™ release with game brands like Sweet Zone and Whopper Reels performed better than expected. Meanwhile, AGI recently acquired entire stake in Nova Technologies for US$38 million to boost its North American market opportunity. Moreover, the group’s new facility opening in 2016 at Las Vegas would also boost the regions performance. AGI estimates that its August release A600™ would drive its domestic business during FY16.

.png)

Performance (Source: Company Reports)

Ainsworth stock delivered a year to date returns of around 13.58% this year (as of November 20, 2015) and is trading at attractive valuation with a relatively cheaper P/E of about 13x. We remain bullish on this 3.5% dividend yield stock and accordingly give “BUY” recommendation on AGI at the current stock price of $2.76

AGI Daily Chart (Source: Thomson Reuters)

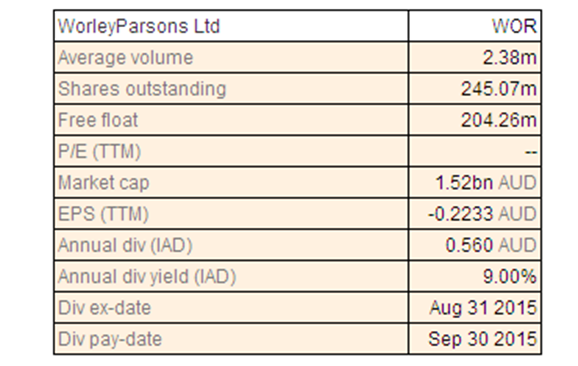

WorleyParsons Ltd

WOR Dividend Details

Repositioning to sustain market pressure and deliver growth: WorleyParsons Limited (ASX: WOR) reported underlying revenue decline of 1.8% yoy to $7,227.5 million impacted by falling commodity prices coupled with the oil prices pressure, as the group’s customers decreased their capital as well as operating expenditure. On the other hand, WOR has built a diversified revenue base and delivered better performance in selective markets which had partially offset the group’s overall revenue pressure (Improved business in Canada and Services business in North America and Australia). The group realigned its strategy in May 2015 and accordingly further developed its front end capability and several project delivery capabilities across execution project phases as well as enhanced its integrated offerings to become a full asset management services provider. Accordingly, the group is first targeting Advisian, its world class consulting business which is now the group’s standalone business line (since July 2015) and comprises over 3,000 consultants spread across 19 countries having technical as well as management consulting capabilities. Worleyparsons is also placing itself to be a major Project Management Contract provider of choice and accordingly increasing its proficiency of its Improve business to offer better integrated service in specific market. Accordingly, the firm finished the acquisition of a management consulting firm, MTG during the period which specializes in the oil and gas, petrochemicals and chemicals sectors. The group also acquired a Canadian based consulting business Atlantic Nuclear, which focuses in nuclear technology. The recent appointment of Tom Honan for the position of Group Managing Director Finance/CFO may also add value.

.png)

Performance by segment (Source: Company Reports)

Outstanding dividend yield: The shares of WOR plunged over 38.75% (as of November 20, 2015) in the last six months due to falling commodity prices and reducing investments by its clients across the sectors. On the other hand, the group is making all efforts to position itself for future growth and has accordingly made acquisitions, initiated cost optimization efforts, realigned strategy and is maintaining diversified revenues. WorleyParsonsCord recently won a contract from Cutbank Ridge to offer cutback with pipe fabrication, module assembly and field construction services for its Partnership Program’s 03-07 Tower Sweet Gas Plant Project. WorleyParsonsCord estimates a revenue of over CAD164 million from this contract. WOR also has outstanding dividend yield of about 9%. We believe that the stock has the potential to deliver further growth in the coming months, and accordingly place a “BUY” recommendation on the stock at the current price of $6.18

WOR Daily Chart (Source: Thomson Reuters)

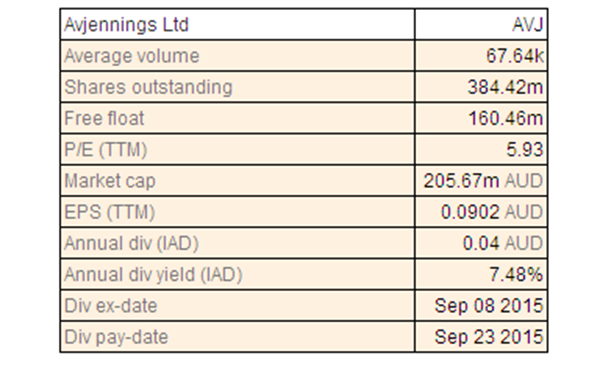

Avjennings Ltd

AVJ Dividend Details

Solid projects pipeline and outstanding dividend yield: Avjennings Ltd (ASX: AVJ) reported that its profit before tax surged by 78.3% yoy to $48.2 million in fiscal year of 2015, from $27.0 million in pcp, driven by better production, revenues and margins. Revenues rose by 26.9% yoy to $317.9 million in fiscal year of 2015, driven by increasing contributions from New South Wales, Queensland and New Zealand. On the other hand, AVJ stock plunged over 22.30% (as of November 20, 2015) in the last six months impacted by the challenging market conditions and adverse weather conditions in NSW and Queensland. But, AVJ’s lots under control improved by 10.6% yoy to 10,198 lots and it also reported a contract signing guidance in the range of 1,800 to 2,100 lots for fiscal year of 2016. Moreover, the group expects that the extreme weather impact in FY15 would benefit FY16 leading to better performance.

.png)

Projects Pipeline (Source: Company Reports)

Meanwhile, AVJ stock correction placed it at very cheaper valuations with the stock currently trading a P/E of just 5.9x. Avjennings also has an outstanding dividend yield of 7.4%. We maintain our positive stance on AVJ and accordingly give a “BUY” recommendation on the stock at the current price of $0.54

AVJ Daily Chart (Source: Thomson Reuters)

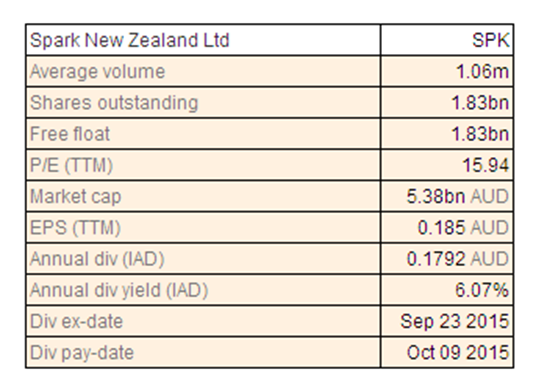

Spark New Zealand Ltd

SPK Dividend Details

Shifting to a digital services retailer: Spark New Zealand Ltd (ASX: SPK) operating revenues declined by 2.9% yoy to $3,531 million in fiscal year of 2015 impacted by continuous fall in calling and access revenues despite solid mobile and IT services revenue growth. On the other hand, the group’s net earnings after tax from continuing operations rose 16.1% yoy to $375 million driven by its cost control efforts and gain from AAPT sale. Meanwhile, Mobile connections increased by 172,000 during the period as the group’s efforts to target Auckland region and younger demographics (below 35 years) paid off. Accordingly, SPK’s mobile revenue share surged 40% yoy boosted by solid consumer growth.

.png)

FY15 performance (Source: Company Reports)

The group enhanced its cash flow by $169 million by divesting its non-core assets including Telecom Cook Islands, Telecom Rentals and the international voice business. SPK is shifting to a digital services retailer from traditional infrastructure based firm, and accordingly, it enhanced its focus on data, mobile and ICT platform services. As a result, SPK launched several products like Revera, Skinny, Bigpip, Lightbox, Qrious big data analytics, Putti apps, and Morepork. Lightbox exceeded the subscriber targets by June 2015 and is witnessing solid growth driven by the rise in average fixed broadband data usage per New Zealand household by 58% during FY15. SPK invested in fibre and 4G mobile and is focusing on digital?based customer services. Recently, Spark Finance Limited reported that it might make an offer of up to $100 million unsecured, unsubordinated fixed rate bonds (Bonds) for institutional as well as New Zealand retail investors, with the ability to accept up to $50,000,000 oversubscriptions. The Bonds are forecasted to have over seven years term and mature by March 2023. The company has lately lodged a product disclosure statement for the offer of NZ$100,000,000 unsecured, unsubordinated fixed rate bonds. We give a “BUY” recommendation on the stock at the current price of $3.03

SPK Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.