TCL is a road manager/toll operator company with headquarters in Melbourne, Australia. The company looks good with its earnings growth, healthy dividend yield, investor confidence and strong pipeline. A few months back, Citi analysts have stated that the company is a cash cow for the investors as it pays more to the investors out of every dollar compared to the investment made. In the last five years, dividend per share for TCL has increased by 10.1% per annum while for the next two years, it is expected to jump by 12.2% per annum.

For the fourth-quarter ended June 2015, TCL’s toll road revenue increased by 70.8% totaling to $400. According to TCL, proportional toll revenue, which is the most precise indicator of the portfolio’s performance surged 43.4% from the previous corresponding period (pcp), to $411 million. After, deducting the contribution from these acquisitions on a statutory basis, toll revenue for the quarter spiked 22.4% to $286 million compared to the pcp. Proportional toll revenue for the quarter increased by 17.0% totaling to $335 million.

CityLink in Melbourne, Hills M2 in Sydney and the 50% owned Westlink M7 in Sydney contribute 75% to the revenues of TCL. Growth in the company depends on an increase in the population of Melbourne and Sydney. Melbourne is expected to grow at a rate of 4% over the next 20 years while Sydney is expected at 1.7% over the next 20 years. This means that even though the company will be able to add to its revenue in the upcoming years, there would be only limited upside eventually.

In the United States, TCL could not perform in line with the expectations losing its first US investment, Pocahontas Parkway due to weak traffic numbers and over debt. Another investment on the shortly opened 495 Express Lanes was also low on performance until Transurban raised new equity. The company funds its negative cash flows through raising equity capital and additional debt, and the same continues until next year. TCL is entering another “high capital investment phase,” and requires equity through a dividend reinvestment plan or raising.

TCL Daily Chart(

Source: Thomson Reuters)

Even though TCL is growing by leaps and bounds, and revenue has increased 13% in the year ending June 2014, shares are expensive at whopping 31.3 times the earnings. The price to book value of the company is 3.3x and Return on Equity is standing at -3.90%, which suggests the stock to be overvalued. TCL shares have been up almost 27% in the last 12-months, outperforming S&P/ASX 200 up just 2% over the same period. TCL is paying healthy dividends to the investors and in turn the income investors are inflating the price of the share out of proportion.

Over the past few trading sessions, the stock has briefly stayed above its 50 days SMA, but could not sustain for long. Since then it is forming inverted hammer patterns and seeing further downside. The price behavior of the stock suggests that there is further downside from the current price point until the share price closes above the 20 days SMA. TCL has a 52-week high of $10.59 and 52-week low of $7.54 indicating that the stock currently is more close to its 52 weeks high. Share price are range bound between $9.52 and $9.82, which indicates that the traders should wait for movement towards specific direction and until then avoid any risky trade.

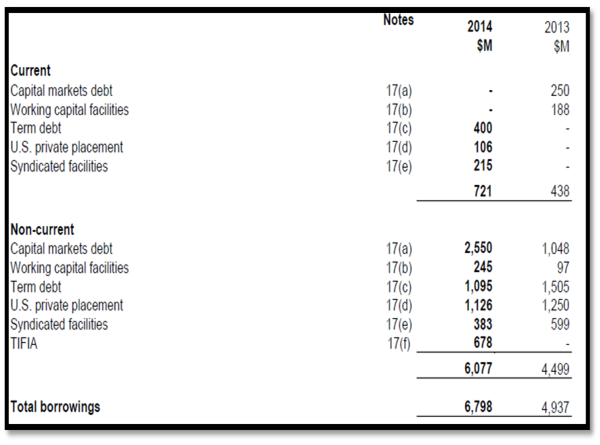

TCL has announced $125 million in corporate working capital in its half yearly 2015 report. Additionally, TCL also mentioned about $2500 million drawn debt and $400 million undrawn debt raised for Queensland Motorways acquisition. Total amount of $450 million of the drawn debt subsequently has been refinanced into debt capital markets. Additionally, $1270 million were raised to refinance Westlink M7’s debt facilities. Further, TCL mentioned that Corporate Euro issuance swapped into $833 million and used to repay corporate maturities.

Debt Facilities

Debt Facilities (

Source: Company Report)

As of now, all the growth projects of TCL are far from paying off in the near future as success of these projects largely depends upon the growth in the population, and in turn more job creation, which is not going to happen all of a sudden. Further, there are potential risks related to the recent M&A activities, when associated with the existing assets and TCL’s system in entirety.

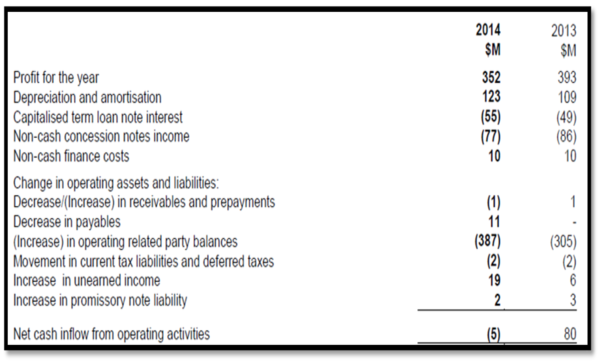

Cash inflow from operating activities (Source: Company Report)

Cash inflow from operating activities (Source: Company Report)

Taking everything into consideration, it is safe to consider that the stock is expensive at this price point, and could undergo correction in the coming days. Thus, offering a better opportunities for the investors to accumulate at low price.On the basis of above reasoning, we recommend TCL as EXPENSIVE at current price of $9.96.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.