Flight Centre Travel Group Ltd

.PNG)

FLT Details

Expanding Indian presence via acquisition: Flight Centre Travel Group Ltd (ASX: FLT) has agreed to acquire the business assets of the Bengaluru Travel Tours Group (TTG), which is a leading local travel group with interests in foreign exchange, the MICE sector and in leisure, corporate and wholesale travel. This will strengthen their position in India. Moreover, FLT would further strengthen Europe operations and has secured a presence in five key countries, Sweden, Denmark, Norway, Finland and Germany through the agreement to acquire corporate businesses owned by European online travel agency eDreams ODIGEO. Additionally, FLT has acquired a minority interest (49%) in the Gold Coast-based Ignite Travel Group. The group will hold its AGM on November 09, 2016. Meanwhile, FLT stock fell 12.71% in six months (as of October 31, 2016). We give a “Hold” recommendation on the stock at the current price of – $ 33.69

.png)

FLT Daily Chart (Source: Thomson Reuters)

Skydive Beach Group Ltd

.PNG)

SKB Details

Boosting capital position: Skydive Beach Group Ltd (ASX: SKB) has completed the acquisition of Raging Thunder Adventures with a consideration of AUD 15.45 million. SKB also acquired the Performance Aviation, which is an aircraft and helicopter maintenance business based in Wanaka for NZ$500,000. Moreover, SKB has raised about $19 million via Institutional Entitlement Offer and the fund would be used to acquire Raging Thunder Pty Limited (RT), trading as Raging Thunder Adventures, North Queensland’s leading multi-faceted adventure tourism business. On the other side, SKB reported a growth of 126.3% in FY 16 in the total Tandems due to the increased number of drop zones operated by the group. The revenues and EBITDA were up 122.2% and 123.4%, respectively, led by growth in key sites in Australia such as Wollongong and Byron Bay. The ongoing growth in other Australian regions like Victoria and Far North Queensland, coupled with growth in the newly acquired NZone Skydive sites in Queenstown New Zealand also contributed to the growth.

FY 16 Financial Performance (Source: Company Reports)

Additionally, SKB expects strong business momentum to continue into FY17. Meanwhile, SKB stock rose 49.58% in the last six months (as of October 31, 2016) while we give a “Hold” recommendation on the stock at the current price of – $ 0.61

.png)

SKB Daily Chart (Source: Thomson Reuters)

Qantas Airways Limited

.PNG)

QAN Details

QAN Transformation program: Qantas Airways Limited (ASX: QAN) has reported for weaker than anticipated 1Q FY17 revenue at the back of rising international competition. The revenue slipped by 3% driven by lower international air fares. On the other side, the group intends to report Underlying Profit Before Tax of $800 million to $850 million for first six months of FY17. QAN has extended its debt maturity profile after the issuance of the unsecured fixed rate notes. Moreover, QAN has reported a 57% increase in the underlying profit before tax to $1.53 billion in FY 16 and a 24% increase in the statutory earnings per share to 49.4 cents. Additionally, QAN Transformation program has to unlock the total cost and revenue benefits of a further $450 million in FY 17 to reach the QAN’s increased target of $2.1billion by June 30, 2017. On the other hand, concerns over the rising competition coupled with fares pricing pressure might continue to impact the stock performance and accordingly we give an “Expensive” recommendation on the stock at the current price of – $ 2.99

QAN Daily Chart (Source: Thomson Reuters)

Corporate Travel Management Ltd

.PNG)

CTD Details

FY 16 EBITDA is above the upgraded guidance: Corporate Travel Management Ltd (ASX: CTD) has in FY 16 reported 41% growth in the underlying EBITDA to $69.0m and statutory EBITDA of $70.1m which is above the upgraded guidance of $68m. CTD’s Over 80% of profit growth is organic in which CTM global network and SMART technology are the key contributors to the organic growth/client wins.

.png)

FY 16 Financial Performance (Source: Company Reports)

Meanwhile CTD stock rose 34.66% in the last six months (as of October 31, 2016) while, we give a “Hold” recommendation on the stock at the current price of – $ 18.93

CTD Daily Chart (Source: Thomson Reuters)

Indoor Skydive Australia Group Ltd

.PNG)

IDZ Details

Corporate debt facility increased: Indoor Skydive Australia Group Ltd (ASX: IDZ) has executed documentation to increase the existing corporate debt facility with Westpac Banking Corporation to support the current and future projects. Moreover, IDZ continues to grow into FY17 and the third facility is on track to be operational by Christmas. Overall, the facility utilization is strong at 67% based on 12hrs/day, 364 days/year. The group at its AGM informed that the third facility, iFLY Perth will be opening up by end of calendar year. We give a “Buy” recommendation on the stock at the current price of – $ 0.46

.png)

IDZ Daily Chart (Source: Thomson Reuters)

Topbetta Holdings Ltd

TBH Details

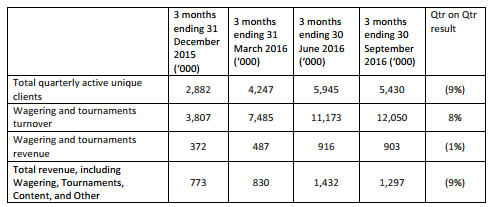

September Quarter subdued than the previous quarter: Topbetta Holdings Ltd (ASX: TBH) will hold its AGM on November 22, 2016. For the quarter ending September 30, 2016, the group updated that the Global Tote is set to be launched. There has been a switch from increase in Players’ Funds in previous quarter to a modest reduction in the current quarter. Cash flow for product manufacturing costs have also gone up in Q1. For the September quarter, TBH had reported a turnover of around $12M and revenues of approximately $1.2M. Moreover, over 1,650 tournaments were held in the quarter and over $1.5 million of prize money was paid.

Quarter on Quarter Performance (Source: Company Reports)

Additionally, Alderney Gambling Control Commission granted the Business2Business eGambling license and Northern Territory Racing Commission granted the Sports Bookmaker license. Meanwhile, TBH stock surged 15.6% in the last six months (as of October 31, 2016) and we give an “Expensive” recommendation on the stock at the current price of – $ 0.18

TBH Daily Chart (Source: Thomson Reuters)

Virgin Australia Holdings Ltd

.PNG)

VAH Details

Successfully priced Senior Notes: Virgin Australia Holdings Ltd (ASX: VAH) will hold its AGM on November 16, 2016. The group has successfully priced US$350 million aggregate principal amount of Senior Notes due 2021. Moreover, VAH has welcomed the ACCC’s draft determination approving the reauthorization of its alliance with Singapore Airlines for five years. In addition, VAH has reported a statutory loss after tax of $224.7 million for the FY16 which is the fourth consecutive annual loss. Accordingly, VAH stock fell 32.86% in the last six months (as of October 31, 2016) and accordingly, we give an “Expensive” recommendation on the stock at the current price of – $ 0.24

.png)

VAH Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.