Stocks that met the guidance/ outperformed

Flight Centre Travel Group Ltd

.png)

FLT Dividend Details

Positive financials: Flight Centre Travel Group Ltd (ASX: FLT) reported its first half financial results with revenue increase of 15.1% to $1.3 billion thereby driving income margin of 13.8%. Profit before tax increased 11.2% to $156.9 million, while net profit after tax was up 16.3% to $116.7 million. Cash and investment portfolio totalled $1.15 billion as of December 31, 2015, including $429.8 million in company cash, compared to $1.10 billion in year ago period. Interim dividend of $0.60 was higher by 9.1% from previous year. FLT reconfirmed its full year guidance of profit before tax between $380 million and $395 million.

Rea Group Ltd

.png)

REA Dividend Details

Premium listings driving revenue: REA Group Ltd (ASX: REA) recorded a 20% increase in revenue for its first half financial year 2016 results to $314.8 million compared to the year ago period, meeting the consensus result. EBITDA was up 29% to $185.9 million while net profit rose 28% to $121 million.

.png)

Revenue growth drivers (Source: Company reports)

The company's declared interim dividend was up 22% to 36 cents per share. The company's Australian sites record an average of more than 42 million visits per month.

Whitehaven Coal

.png)

WHC Details

Record results and production: Whitehaven Coal Ltd(ASX: WHC) recorded a gain of 34.15% in the past one month stock performance with first half financial results (as of February 26, 2016). Net profit after tax stood at $7.8 million compared to net loss of $77.9 million in the year ago period. Sales revenue was up 54.5% to $574.3 million. Operating EBITDA rose 104% to $106.4 million led by a 40% increase in operating margin. Operating cash flow increased 421% to $118.3 million. Meanwhile, net debt was lower at $924.9 million with gearing down slightly to 24%. WHC has raised its FY16 coal production guidance by 0.6Mt based on the first half results.

JB Hi-Fi Ltd

.png)

JBH Dividend Details

New stores driving financials:JB Hi-Fi Ltd (ASX: JBH), trading at a high dividend yield, reported its first half financial results with sales up 7.7% to $2.12 with comparable sales recording a 5.2% increase driven by the opening of seven new stores in the first half. Net profit after tax was up 7.5% to $95.2 million. Meanwhile, the company provided a January 2016 trading update with total consolidated sales growth of 10.2% compared to 8.9% in same month year ago.

.png)

Store growth and estimates (Source: Company reports)

Interim dividend was up 4 cents to 63 cents per share from prior year. For FY16, JBH expects total sales to be around $3.9 billion while net profit after tax to be in the range of $143 million to $147 million, which is as per the market consensus.

Stockland Corporation Ltd

.png)

SGP Dividend Details

Strong financials and FFO: Stockland Corporation Ltd (ASX: SGP), recorded 3.68% increase in the past one month stock performance, and reported its first half financial results with distribution per security increase to 1.6% to 12.2 cents from year ago period. Statutory profit stood at $696 million, up 50.6%. Funds from operations per security increased 9.9% to 14.5 cents. The results were quite close to the consensus expectations.

.png)

Segment wise financial highlights (Source: Company reports)

Looking ahead, the company squeezed its FY16 guidance for EPS growth to 6.5% - 7.5% above prior year and FFO per security growth to 9% - 10%, assuming no material decline in market conditions. Dividend per share is targeted at 24.5 cents per security.

Stocks that missed the guidance/ underperformed

Downer EDI Ltd

.png)

DOW Dividend Details

Slump in Profit: Downer EDI Ltd(ASX: DOW) recorded first half 2016 net profit after tax at $72.1 million, decline of 23.9% from the prior year period. Total revenue stood at $3.5 billion, down 1.2%. Earnings before interest and tax was down 20.1% to $113.2 million.

.png)

Financial performance (Source: Company reports)

Operating cash flow stood at $178.1 million representing a cash conversion of 64% of earnings before interest, tax, depreciation and amortisation. However, declaring an interim dividend of 12 cents per share, the company is trading at a good dividend yield. Looking ahead to FY16, DOW is estimating an NPAT of about $180 million.

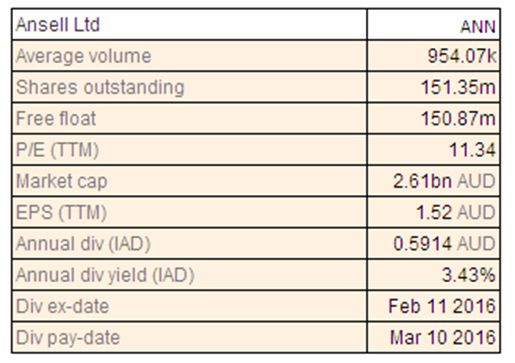

Ansell Ltd

ANN Dividend Details

Weaker financials & lowered estimates: Ansell Ltd (ASX: ANN) reported its half yearly financial results and in the past one month the company's stock price dipped 12.32% (as at February 26, 2016). Trading at a decent dividend yield, the company declared an interim dividend of 20 cents per share. However, for the first half of 2016, reported sales were down 7% to $784.8 million with organic growth trend improving through the first half. EBIT dipped 16% to $99.3 million while profit attributable declined 10% to $69.6 million. Looking ahead, EPS guidance was reduced to $0.95 to $1.10 from $1.05 to $1.20.

Rio Tinto Ltd

.png)

RIO Dividend Details

Weaker sales and profits: Rio Tinto Ltd (ASX: RIO) reported its full year 2015 results with consolidated sales revenues standing at $34.8 billion, $12.8 billion lower than the previous year. Underlying earnings were $4.8 billion lower than 2014 levels to $4.5 billion while EBITDA margin was down to 34% from 39% earlier.

.png)

Stable costs & Capex (Source: Company reports)

The net loss attributable to the owners of Rio Tinto in 2015 totalled $866 million compared to 2014 profit of $6,527 million. Rio maintained its full year dividend of 215 cents per share but stayed away from the progressive dividend policy.

Medibank Private Ltd

.png)

MPL Dividend Details

Health insurance segment driving growth: Medibank Private Ltd (ASX: MPL) reported its first half 2016 financial results with revenue rising 3.4% to $3.38 billion from year ago period. Group net profit after tax increased to $227.6 million from $143.8 million a year ago, driven by health insurance profit surging 58.8% to $271.7 million. Trading at a dividend yield of 4.1%, the company declared an interim dividend of 5 cents per share. However, this equates to a payout ratio of 64% which is below guidance of 70% to 75%.However, the company still targets to achieve this as the full year payout ratio (70-75%). Looking ahead to full year 2016, health insurance premium revenue growth is expected between 4.5% and 5% while operating profit is seen above $470 million.

Santos Ltd

.png)

STO Dividend Details

Falling oil price denting revenues: Trading at a good dividend yield, Santos Ltd (ASX: STO) reported its full year financial results with full year production up 7% to 57.7 mmboe and unit production cost per barrel down 10% to $14.40 per boe. Sales revenue was down 20% to $3.3 billion as average realized oil price dipped 48% to $54 per barrel. Reflecting after tax impairments of $2.8 billion and lower oil prices, net loss expanded to $2.7 billion compared to $935 million in year ago. Underlying net profit after tax was $50 million, 91% lower than the previous year and below the market’s expectation.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.