This report is an updated version of the report published on December 12, 2023 at 4:30 PM AEDT.

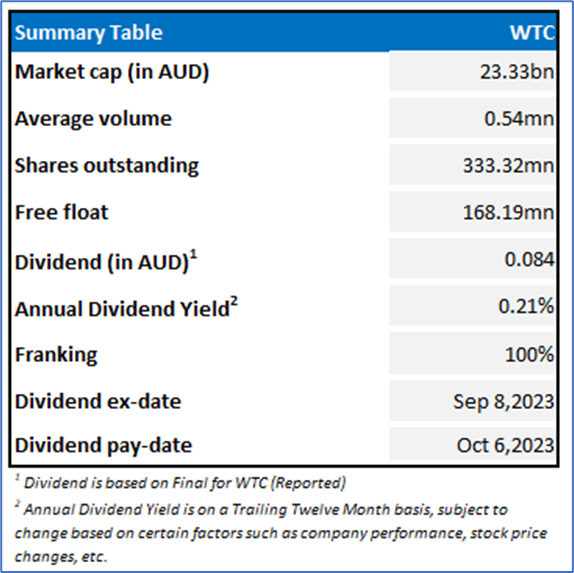

Source: REFINITIV

WiseTech Global Limited (ASX: WTC)

WTC caters to the global logistics execution industry with software solutions. Its client list includes more than 17,000 of the world’s logistics companies across 174 countries.

Recommendation Rationale – SELL at AUD 70.00

- Financial Performance: In FY23, WTC's group revenue increased by 29% annually to AUD 816.8 million, and EBITDA surged by 21% to AUD 385.7 million. Its recurring revenue increased from 89% of total revenue in FY22 to 96% in FY23. However, its EBITDA margin declined from 50% in FY22 to 47% in FY23. The company reported an underlying NPAT of AUD 247.6mn, up 30% annually.

- Outlook: WTC expects FY24 revenue to be in the range of AUD 1,040-1,095mn, representing annual revenue growth of 27%–34%, and EBITDA of AUD 455-490mn, representing YoY growth of 18%–27%.

- Emerging Risks: The company is exposed to changes in supply chain volumes and market conditions, which are subject to volatility. Also, an increase in borrowing costs could impact on the company's profitability. WTC has also highlighted that its EBITDA margin could be diluted further in FY24 because of the acquisitions of Shipamax, Envase & Blume.

- Overvalued Multiple: On a forward 12-month basis, WTC shares are trading at a P/E multiple of 75.1x compared to the industry (Software & IT Services) multiple of 16.3x, hence looking overvalued.

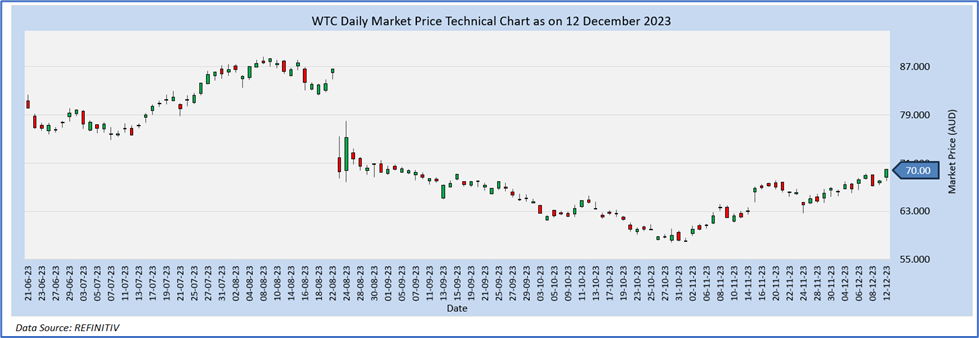

WTC Daily Chart

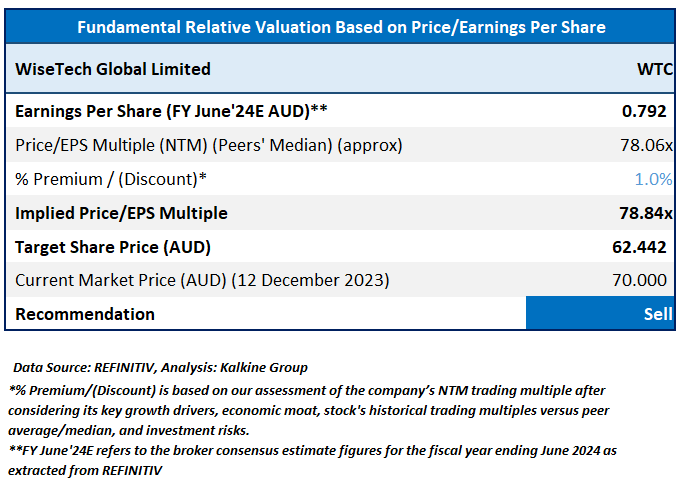

Valuation Methodology: Price/Earnings Approach (FY24E) (Illustrative)

Considering the current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 70.00, as of December 12, 2023, at 3:55 PM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 12 December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.