This report is an updated version of the report published on the 20 May 2024 at 3:55 PM AEST.

Champion Iron Limited (ASX: CIA)

CIA is an ASX listed iron ore exploration and development entity with major projects in the Southern Labrador Trough, Canda’s largest source of iron ore.

Recommendation Rationale – SELL at AUD 7.665

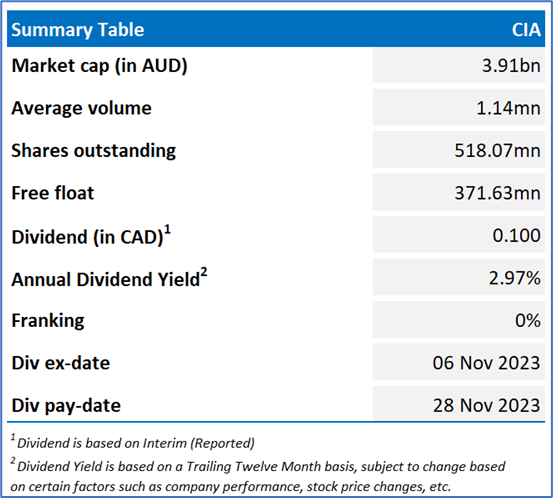

- Financial Performance: The company’s other current assets declined by nearly 42% to CAD 47.44mn as on 31 December 2023 vs CAD 81.28mn as on 31 March 2023. For the three-month period ending 31 March 2024, the company produced 3.3 million wet metric tons (3.2 million dry metric tons) of high-grade iron concentrate with 66.1% iron, representing a 19% decrease from the previous quarter.

- Outlook: The company projected that its Kami Project would produce 9mn wet metric tons (wmt) of Direct Reduction (DR) grade pellet feed iron ore each year. The Direct Reduction Pellet Feed (DRPF) is expected to be ready by 2HFY25. Additionally, Hydro-Québec plans to increase the power capacity in Québec by 8000 to 9000 MW by 2035.

- Emerging Risks: Materials companies could encompass potential losses due to adverse market conditions, such as currency fluctuation, geopolitical events, technology changes, and macroeconomics changes, among others.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/Sales, EV/EBITDA, Price/Earning, Price/Book, and Price/Cash Flow) are higher than the median of Basic Materials Industry.

CIA Daily Chart

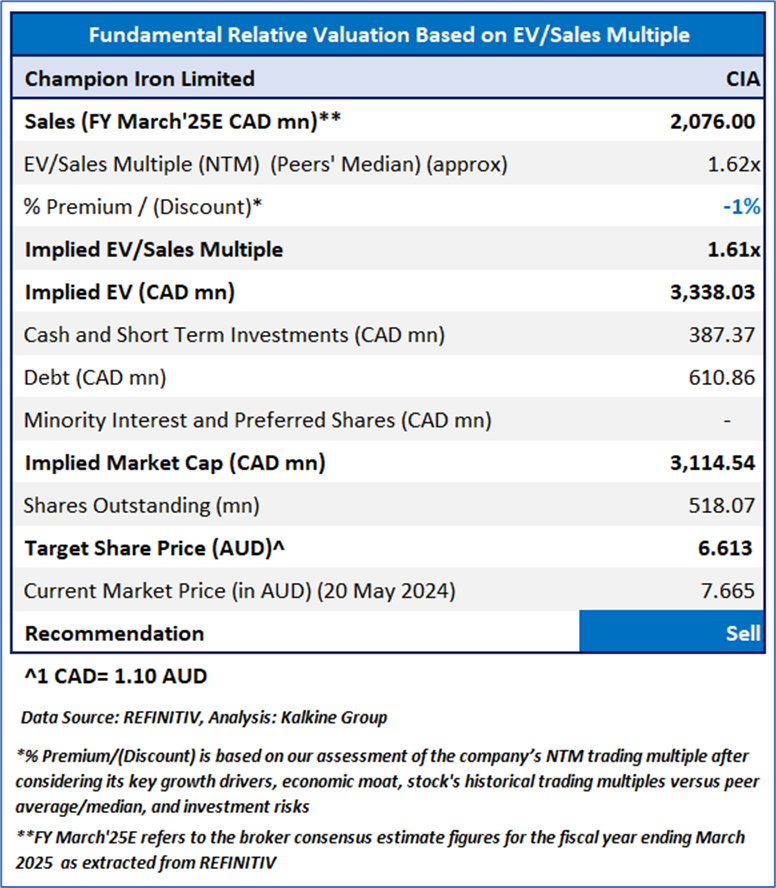

Valuation Methodology: EV/Sales Approach (FY March’25E) (Illustrative)

Considering the commodity price fluctuation, reduction in high-grade iron concentrate production, intense competition in market, and regulatory barriers, the company might trade at a slight discount to its peers. For valuation, few peers such as Iluka Resources Ltd (ASX: ILU), South32 Ltd (ASX: S32), BlueScope Steel Ltd (ASX: BSL), and others have been considered. Given its current trading levels, recent rally in the share price, and risks associated, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of AUD 7.665, at 12:10 PM AEST, as of 20 May 2024.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 20 May 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.