The AES Corporation

AES Details

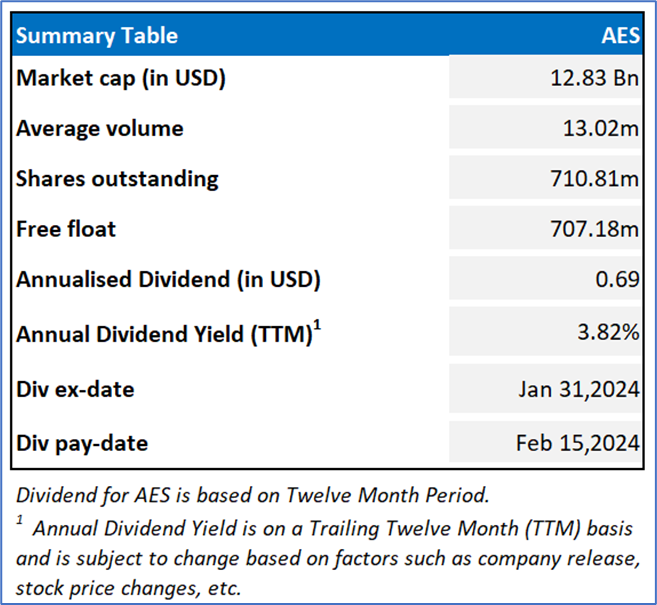

The AES Corporation (NYSE: AES) is the global power company operating throughout 14 countries and 4 continents.

Financial Results for FY 2023

- The company has released financial results for the year ended December 31, 2023. Overall, 2023 was the company’s best year ever in terms of execution as well as financial performance.

- AES exceeded almost all of the strategic objectives, including increasing renewables construction by 100% to 3.5 GW as well as signing 5.6 GW of new PPAs.

- The company’s backlog of signed PPAs now stands at 12.3 GW. It continues to witness robust and growing demand from the corporate customers, including data center companies.

Outlook

The company has initiated 2024 guidance for Adjusted EBITDA of $2,600 - $2,900 million. It has reaffirmed annualized growth target for adjusted EPS of 7% - 9% through 2025, from the base of 2020.

Key Risks

The changes in availability of the generation facilities or distribution systems because of increases in scheduled as well as unscheduled plant outages, equipment failure, failure of transmission systems, etc.

Fundamental Valuation

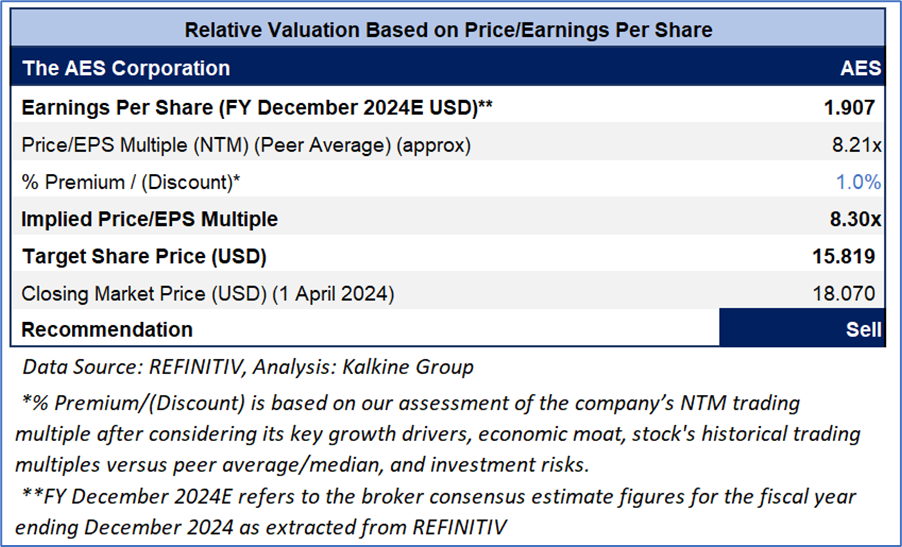

P/EPS Based Relative Valuation

Stock Recommendation

Over the last three months, the stock has given a return of -6.12%. The stock has made a 52-week low and high of USD 11.43 and USD 25.735, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Its FY 2023 net income (Loss) was ($182) Mn, which includes $1.1 Bn of impairments in 2023 mainly associated with the company’s continued exit from coal-fired generation.

The destabilization of markets as well as decline in business activity could negatively impact the company’s customer growth in service territories at its utilities. Apart from this, any sort of further delays to the construction projects, including at the renewables projects, could also impact the business momentum.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of $18.07 per share, up by 0.78% as on 1st April 2024.

Technical Overview:

Daily Price Chart

AES Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on April 1, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.