Caltex Australia Ltd

.png)

CTX Details

Investment in low risk business opportunity:Caltex Australia (ASX: CTX) stock corrected over 12.58% in the last three months (as of May 04, 2016) on the back of its pressure in Caltex refiner margins. The company reported that its net profit dropped to AUD 114 million in three months through March with an inventory loss of AUD37 million over a year-ago profit of AUD174 million and an inventory gain of AUD12 million. There was also 6.8% drop in operating profit on a replacement cost of sales basis at AUD151 million. On the other hand, the group successfully completed its $270 million off market share buy back at 29.39 per security, reflecting buyback discount of 14%.

.png)

Q1 unaudited net profit after tax (Source: Company Reports)

Moreover, to accelerate the business growth, the Group is investing in supply chain including retail network and infrastructure, and even exploring low-risk adjacent business opportunity. We maintain our “Hold” recommendation on this dividend yield stock at the current price of $33.08

.PNG)

CTX Daily Chart (Source: Thomson Reuters)

Aurizon Holdings Ltd

.png)

AZJ Details

Steady coal volume for March quarter: Aurizon Holdings Ltd. (ASX: AZJ) recently reported that the Queensland Competition Authority (QCA) Final Decision has specified an overall maximum revenue of $3.925 billion over the period of the undertaking, against QCA’s Consolidated Draft Decision of $3.927 billion. Weighted Average Cost of Capital (WACC) is maintained at 7.17%, on track with the Consolidated Draft Decision. Meanwhile, AZJ reported steady coal volumes last quarter, although the shipments of iron ore and freight were slightly lower than previous year.

.png)

QCA Final Decision highlights (Source: Company Reports)

The group hauled 49.4 million metric tons of coal in the three months through March 2016 and expects annual volumes of 204 million to 209 million tons in the year through June. Aurizon’s iron-ore volumes fell 3% year-on-year to 6.0 million tons. Nonetheless, the same have been reported to be on track to meet an earlier projection of steady annual volumes against 23.9 million tons of last year. With a good dividend yield and fundamentals, we believe the stock is a “Buy” at the current market price of $4.41

AZJ Daily Chart (Source: Thomson Reuters)

Spark New Zealand

.png)

SPK Details

Strategic initiatives:Spark New Zealand (ASX: SPK) has taken various strategic initiatives to drive future growth and among all, the group has announced changes to its leadership team to sheer company through next phase of transformation. The group has also acquired Radio Spectrum management rights from Craig Wireless Systems for NZ$ 9 million to expand its business in New Zealand.

Moreover, the management has guided to pay annual dividend of 22 cents and special dividend of 3 cents for FY16; and expecting the performance to ride on high growth, intends to pay special dividend in FY17. We believe the favorable government measures for telecom industry coupled with its acquisition benefits would drive the stock higher in the coming months. Hence, we recommend to “Hold” this dividend yield stock at the current market price of $3.41

SPK Daily Chart (Source: Thomson Reuters)

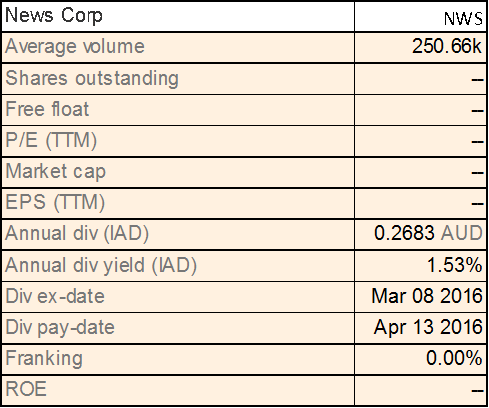

News Corp

NWS Details

Focus on diversifying revenues: News Corp (ASX: NWS) is seeking to diversify its revenues and accordingly launched Heat Street, another entrant in the U.S political commentary landscape, a center-right publication that aims to champion free speech. It has also been in news that News Corp has invested in a startup that aims to make augmented reality. NWS also clarified investors that it is not involved in wrongdoings and settled the class action law suit involving the News America marketing division. On the other hand, despite the Group being in transitional phase focusing on diversifying revenues stream, the ongoing foreign currency headwinds coupled with soft advertisement revenues would continue to pressurize the group’s growth. We believe the stock is “Expensive” at the current price of $16.51

NWS Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2016 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.