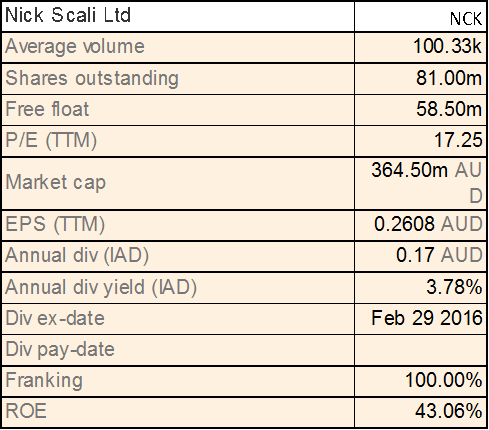

Nick Scali Ltd

NCK Details

Simple business model: Nick Scali Limited (ASX: NCK) operates on simple business model wherein the group does not keep its middle- upper –market furniture at its store, but products are imported from Asia after customers have placed their order. Although falling Australian dollar remained a concern on the group’s performance, Nick Scali reported a splendid 32% rise in sales to $102.5 million while net profit increased 41% to $14.1 million for the first half of FY16. It declared an interim dividend of 9 cents against 7 cents in the corresponding period. Accordingly, the company has witnessed strong sales delivery and order book for June 2016 and based on that, the company guided net profit of $24 -$26 million as compared to its previous guidance of $22 -$24 millions for the FY16.

The group’s solid performance coupled with positive guidance drove the stock by 14.32% (as of May 24, 2016) in the last four weeks placing the stock at higher levels which is trading at high P/E. Hence, we believe this dividend yield stock is “Expensive” at the current market price of $4.54

NCK Daily Chart (Source: Thomson Reuters)

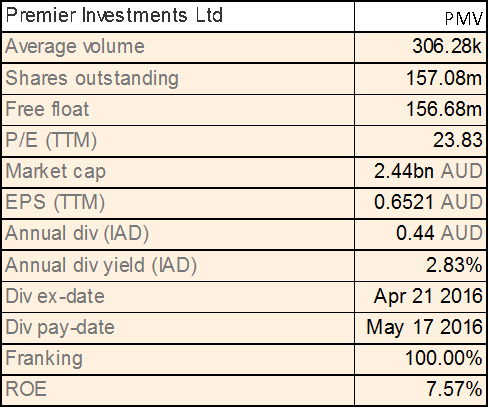

Premier Investments Limited

PMV Details

Overseas expansion: Premier Investments Limited (ASX: PMV) has delivered a strong growth for the previous year on the back of strong performance of its retail brands like Smiggle, Peter Alexander, Just Jeans and Dotti. Company’s UK expansion has seen a strong growth delivery on the back of Smiggle’s performance resulting into 26% rise in sales during the first half of 2016. The company is planning to expand its UK business by increasing its stores three times in next few years. Similarly, its nightwear brand Peter Alexander has also witnessed 22.5% growth on a year over year basis during the period. The Company has cash of $288.4 million and debt of $83 million as on January 2016, putting company in strong position to expand its popular retail brand locally and internationally. In UK, the company had opened 18 new Smiggle’s stores in first half and now planning 100 Smiggle stores in UK by December 2016. It plans one store each in Malaysia and Honk Kong in FY16.

On the other hand, PMV already rallied by 16.67% (as of May 24, 2016) driven by the positive drivers placing the stock at a high P/E. We give an “Expensive” recommendation to the stock at the current market price of $15.47

PMV Daily Chart (Source: Thomson Reuters)

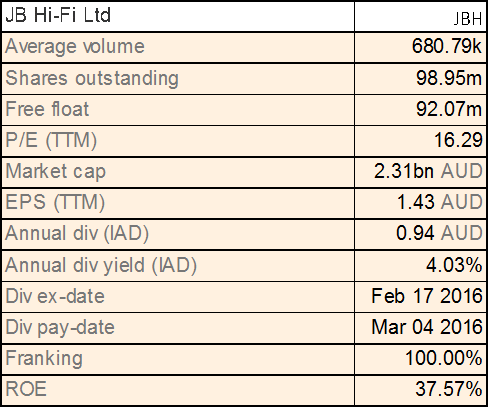

JB Hi-Fi Limited

JBH Details

Continued sales momentum: JB Hi-Fi Limited (ASX: JBH) reported 7.7% rise in sales for first half of FY16 and delivered an 8.6% rise in third quarter of 2016. The company has guided total sales of $3.9 billion and net profit of $143 - $147 million for FY16. The company plans to open nine new stores including five Home format taking home stores to 58 by FY16 and 75 by FY17. JBH has also targeted to introduce small appliances to existing JB Hi-Fi stores and take the count to 50 JB Hi Fi stores with small appliances by FY16. JB Hi Fi has signed a 6.5 year cooperation agreement with Heinemann Tax and Duty Free to be the exclusive technology partner at Sydney International Airport.

.png)

Financial performance (Source: Company reports)

Moreover, JB Hi Fi is also in news that the company is exploring a potential acquisition of The Good Guys. If this proposal materializes, the company would expand its Home stores to 100 by FY17 as against its own planned Home stores of 75.

The stock gained 23.02% over last six months (as of May 24, 2016) we give a “Hold” on this dividend yield stock at the current market price of $23.82

.PNG)

JBH Daily Chart (Source: Thomson Reuters)

Super Retail Group Ltd

.png)

SUL Details

Supply chain initiatives: Super Retail Group Ltd (ASX: SUL) reported a strong increase in like for like sales as of April 2016 compared to the same period last year. The group has reported total 6% rise in Auto retailing, 5.5% rise in leisure retailing and 9% rise in sports retailing for 44 weeks ended till April 30, 2016. To improve supply chain, the Group has selected the LLamasoft Supply Chain Guru and SupplyChainGuru.com supply chain modeling platform and the LLamasoft Data Guru visual data blending and analytics tool to model and optimize their complex supply chain operations.

.png)

Segment performance targets (Source: company reports)

Furthermore, the Group has increased its shareholding from 50% to 95% in Infinite Retail in November 2015. This improving performance has advanced the stock by 10.24% in last one month (as of May 24, 2016) and we believe the stock could generate more returns given the improving consumer sentiment coupled with pay off from group’s initiatives. We recommend a “Hold” on this dividend yield stock at the current market price of $9.17

SUL Daily Chart (Source: Thomson Reuters)

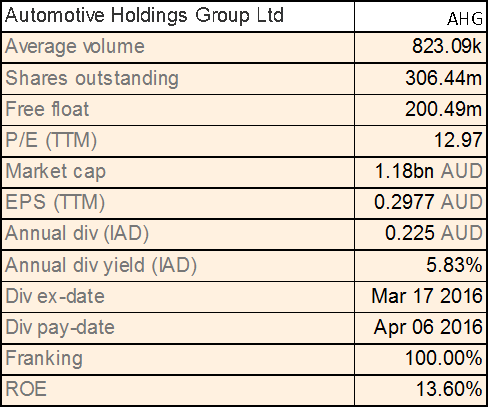

Automotive Holdings Group Ltd

AHG Details

Acquisition to lead growth: Automotive Holdings Group Ltd (ASX: AHG) has agreed to acquire Lance Dixon group of dealerships at Doncaster in Melbourne’s inner suburbs. It has also bagged a Hyundai dealership acquisition at Penrith. The group also acquired Knox Mitsubishi dealership located at Melbourne at a consideration of $5.4 million for goodwill and assets as well as to leverage further opportunity to grow the Group’s portfolio brands in Victoria. The acquisition would help Automotive Group to increase Mitsubishi presence in Melbourne. It further offers administrative synergies on account of its proximity to Group’s existing Ferntree Gully Toyota dealership and takes Automotive’s network to 179 franchises at 104-dealership location in Australia and New Zealand.

Furthermore, the Group has divested its Covs business to GPC Asia Pacific (GPC) and accordingly agreed the sale of all 21 stores in the Covs network and retains four stores in Albany, Esperance, Karratha and Port Hedland, which would be rebranded as Skipper Transport Parts in its AMCAP business. We rate this dividend yield stock a “Buy” at the current market price of $3.87

AHG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.