National Australia Bank

.png)

Issued better outlook despite UK Pressure: National Australia Bank Ltd (ASX: NAB) stock fell over 19.4% in the last four weeks (as of 01 Oct 2015), as the group estimated an additional £500 million impact from its UK operations as well as increased the provision to the range of £290 million and £420 million, related to Clydesdale Bank for the 2015 full year results. However, the group already diverted over a £1.7 billion funds under its conduct mitigation package. NAB also delivered a revenue increase of 4% on a year over year basis during the third quarter of 2015. The group is focusing on its core business, enhancing its asset quality in Australian and New Zealand business and undertook initiatives to deal with its legacy issues. The bank invested on its home lending, SME and Specialized Business, to enhance its customer experience and also improved its business banking loan portfolio and wealth business. Market also speculates about NAB’s plans to spin off up to 80% of Clydesdale Bank to shareholders by year end and also have a sharemarket float.

.png)

National Australia Bank’s credit risk exposure (Source: company reports)

With the bank trading at trading at a cheaper P/E of 12.33x and a solid annual dividend yield of 6.58%, we give a “BUY” recommendation to National Australia Bank at the current stock price of $30.6.

.bmp)

NAB Daily Chart (Source: Thomson Reuters)

SEEK Limited

.png)

Maintaining market leadership, while delivering growth: SEEK Limited (ASX: SEK) in fiscal year of 2015 reported a solid revenue increase of 20% year on year (yoy) to $858.4 million, driven by better Australia and New Zealand online employment businesses, Premium Talent Search promotion, integration of JobsDB and JobStreet to Zhaopin in China. The group continues to maintain its market leadership Australia, generating over 32% of placements and a lead of 10x higher against the nearest competitor. The total visits in Australia reported a CAGR increase of 22% to 35+million in FY15, from FY12. Mobile visits performed even better showing a CAGR of 47% during FY12 to FY15. SEK is also developing its penetration in China through Zhaopin, post the integration of JobsDB and JobStreet. The group already owns market leaders in Brazil and Mexico. On the other hand, the group’s stock fell over 27.6% in the last four weeks, as the group issued a conservative outlook and anticipates a revenue growth of 15% to 18% range while EBITDA is estimated to grow in the range of 5% to 8%. But we view this correction as an opportunity given its solid penetration in the international markets and the dividend yield of about 3%, and accordingly recommend investors to “BUY” the stock at current price of $12.48.

.bmp)

SEK Daily Chart (Source: Thomson Reuters)

Greencross Limited

.png)

Expanding addressable market opportunity despite the management pressure: Greencross Limited (ASX: GXL) target pet sector market is forecasted to grow at around 4% per annum to reach $11 billion by 2020 from over $9 billion market now. Accordingly, Greencross customers spend 5x more at GXL stores which offers retail, vet and grooming services as compared to customers who shop only at its retail stores and 2x spend by customers who use only Greencross vet. Therefore, GXL is targeting these three major growth platforms, and intends to boost the market share from 8% (with 332 outlets) to 20%. The group is also delivering a 45% yoy revenue increase to $644 million for the fiscal year of 2015, boosted by the City Farmers acquisition, while its vet business and Retail business improved by 28% yoy and 52% yoy respectively during the year.

ANZ Pet Care Market Overview and Demographic Trends (Source: Company Reports)

The group already generated a revenue growth of 19% for the first five weeks of this 2016 fiscal year, and LFL sales improved by 6.2% with Veterinary rising 5.5. %, Australian retail by 5.0% as well as NZ retail growing by 9.3%. The group is on track to deliver organic growth in 2016 fiscal year by opening 20 new stores. The group rallied over 18% in the last four weeks partly driven by its solid FY15 performance, and we believe this momentum to continue and accordingly give a “BUY” recommendation at the current price of $6.62.

.bmp)

GXL Daily Chart (Source: Thomson Reuters)

Freelancer

.png)

Ongoing gross payment volume growth: Freelancer Ltd (ASX:FLN) generated a net revenue increase of 41% yoy to $16.8 million in FY15 while its gross payment volume improved by 30% yoy to $64.1 million, driven by the growing user, project & contest acquisition, and better market-place efficiency and conversion rate optimization. The group is also improving its products, value-added services and optimizing memberships. Conversely, the group continued to witness a net loss after tax of $0.8 million, while the operating EBITDA is $(1.0) million. But, FLN raised over $10 million of new shares at $1.40 to global and domestic institutional investors and is using the proceeds to boost the free float to 23%, enhancing trading liquidity. FLN also acquired Escrow.com, a secure online payments provider with a gross payment volume of US$265 million in 2014 and a net revenue and EBITDA of US$5 million and US$1.2 million respectively. FLN launched jobs across 100 categories of location specific work, to magnify its overall addressable market from $122 billion in GPV to some hundred billion dollars per annum. Meanwhile, FLN delivered over 112.3% year to date returns and we believe this rally would continue further, given its potential to improve revenue and registered users along with rise in posted projects. Based on the foregoing, we give a “BUY” recommendation to the stock at the current price of $1.36.

.bmp)

FLN Daily Chart (Source: Thomson Reuters)

Woolworths

.png)

Reorganizing business to address the performance pressure: Woolworths Limited (ASX: WOW) continued to witness pressure on sales, which declined by 0.2% yoy to of $60.7 billion due to impact from its Australian Food, liquor and petrol as well as General Merchandise segments. WOW’s net profit after tax plunged by 12.5% yoy to $2.15 billion during the year. But, the group is making efforts to recover its business across all the segments, given the intense market competition and accordingly launched an Australian Supermarket Customer first Strategy, through which it estimates an expansion in sales over the next three years. WOW invested over $200 million on price during the second half of FY15, and estimates to do the same in the first half of FY16. As a result, over 9,000 items from WOW were cheaper as compared to its major competitor Coles during fourth quarter of 2015, based on the Nielsen Homescan reports. The latest winning example of price battle comes with regards to the lower cost of same items for WOW then Coles. Further, collaboration with eBay seems to pay off well. Woolworths is also focusing on team hours during FY15 and FY16 to enhance the customer service and availability as well as improve fruit and vegetable offers, leading to a better Net Promoter Score. The group’s transition to Lean Retail Model helped them to achieve significant costs savings of >$500 million, ahead of their targets. On the other hand, WOW shares fell by 16.8% (as of 01 Oct 2015) during this year to date, partly attributed to intense competition from peers like Coles, Costco and Lidl, credit rating decline from Moody’s and poor FY15 performance.

.PNG)

Result Overview (Source: Company reports)

But, WOW has a strong dividend yield of 5.45% and is trading at cheaper valuation with P/E of 13.34x, as compared to its peers. We believe that the group’s strategies would pay off in the coming periods and therefore reiterate our “BUY” recommendation on WOW at current price of $25.88.

.bmp)

WOW Daily Chart (Source: Thomson Reuters)

Australia and New Zealand Banking Group

.png)

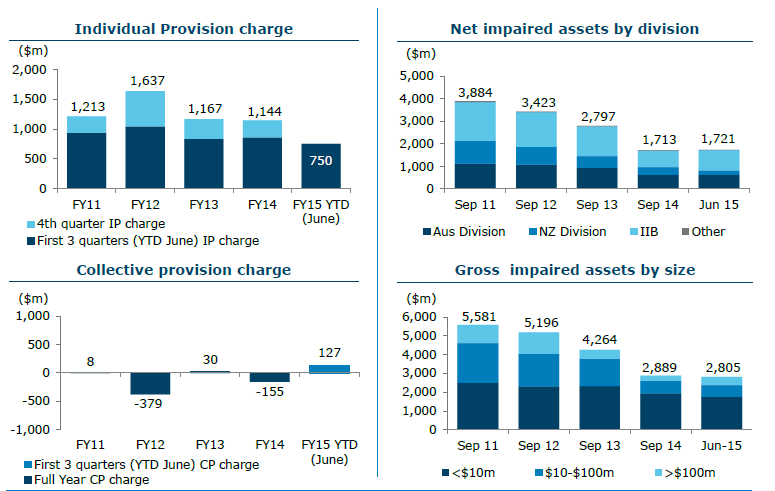

Focusing on super regional strategy: Australia and New Zealand Banking Group (ASX: ANZ) cash profit rose by 4.3% yoy to $5.4 billion in the nine months ended on June 30 of fiscal year of 2015 while statutory profit improved by 11% yoy to $5.6 billion, driven by better customer franchises across Australia, New Zealand and Asia Pacific. Global markets business income rose 6% yoy to $1.8 billion during the nine months ended on June 30 of fiscal year of 2015, while the customers for International and Institutional Banking improved 9% yoy, boosted by Asian business. ANZ is heavily focusing on its Asian business growth and launched a “super-regional strategy” program to build a solid presence in Asia as compared to its Australian peers. Meanwhile, Shayne Elliott would be replacing Mike Smith as ANZ CEO. ANZ also recently finished a $720 million share purchase plan offer. On the other hand, ANZ shares fell over 25.4% in last six months (as of 01 Oct 2015 close) partly due to CET-1 ratio requirement impact and tough market conditions in China (which would impact the bank’s Asian business). But management clarified that its China assets have a stronger average credit rating than the bank’s Institutional assets in Australia and New Zealand. China’s Exposure at default comprised only 3% of the bank’s EAD, while its total Institutional Asia Exposure constituted 12% of the group’s EAD.

Year to date as at June 2015 performance (Source: company reports)

The market believes that the bank has a risk profile and therefore needs to regulate capital allocation in order to have better returns. ANZ has attractive valuation with P/E of 9.95x, and annual dividend yield of 6.72%. We maintain our bullish stance on the stock at the current price of $27.39.

.bmp)

ANZ Daily Chart (Source: Thomson Reuters)

Nearmap

.png)

Domestic and US market coupled with new patents to underpin future growth: Nearmap Ltd’s (ASX: NEA) US segment contributed to the revenues for the first time during the FY15 and issued a revenue forecast in the range of $30 million to $50 million in the US by December 2017. Total contracts signed in the US surpassed over $100k, and NEA had already built a solid pipeline while the trial subscriptions are rising daily. Meanwhile, NEA’s total revenue improved by 32% yoy to $23.6 million boosted by subscription revenues and higher renewals during FY15. The group is expanding its growth opportunities in AU and US market driven by increasing awareness, rising penetration and new products. NEA also won two patent approvals for its new multi-directional oblique views, high-resolution digital elevation models - HyperCamera and HyperCamera 2. The group integrated MapBrowser with ESRI ArcGIS platform ESRI software, which is used by >350k organizations worldwide. Meanwhile, NEA stock corrected over 33.3% year to date (as of 01 Oct 2015 close), partly due to earnings pressure, heavy US setup costs and tough market conditions. But, group’s efforts in the US would be paid off in the coming years, and accordingly drive the stock performance. The company is also well funded for growth. We reiterate our positive stance on NEA and give a “BUY” recommendation to the stock at the current levels of $0.435.

.bmp)

NEA Daily Chart (Source: Thomson Reuters)

Dick Smith Holdings

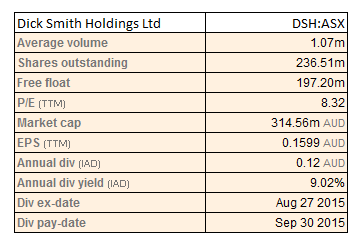

Online coupled with new stores to drive growth: The shares of Dick Smith Holdings Ltd (ASX: DSH) fell over 36.7% in the last three months owing to its poor fiscal year of 2015 performance. Although the group reported a sales growth of 7.5% yoy to $1,319.7 million in FY15, DSH’s New Zealand business revenue growth fell by 7% yoy to $166.6 million. However, DSH doubled its online sales driven by its comprehensive customer omni-channel experience.

.png)

Largest store network (Source: Company Reports)

The group estimates to open over 15-20 new stores during fiscal year of 2016. DSH also improved its Private label range by 40% on a year over year basis. The stock is trading at an extremely attractive P/E of 8.3x and has outstanding dividend yield of 9%. We give a “BUY” recommendation to the stock at the current levels of $1.355.

DSH Daily Chart (Source: Thomson Reuters)

DSH Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2015 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.