On 3 July 2015, the company announced that it proposed to make a takeover bid for all the ordinary shares in Affinity Education Group Ltd (ASX: AFI) that it does not already own. The company proposes to offer 1 fully paid share in G8 Education for every 4.61 fully paid shares in Affinity Education for a total value of $ 162 million ($ 0.70 for every Affinity share based on the closing price on the day immediately preceding this announcement). This represented a premium of 29.6% to the closing price of Affinity on 2 July 2015, the last day prior to the announcement, at $ 0.54 and a 9.4% premium to the 10 day weighted average price at $ 0.64 on 10 trading days prior to the announcement.

GEM Brands (Source - Company Reports)

GEM Brands (Source - Company Reports)

On 2 July 2015, G8 Education acquired 38,001,946 fully paid shares in Affinity representing approximately 16.41% of the shares on issue. The company's offer is subject to certain defeating conditions including the acquisition of a 50% minimum shareholding and subject to the necessary authorisations and clearances being obtained from the Australian Competition and Consumer Commission and the Australian Competition Tribunal. G8 Education Chairperson Jenny Hutson said that the offer represents compelling value to Affinity shareholders.

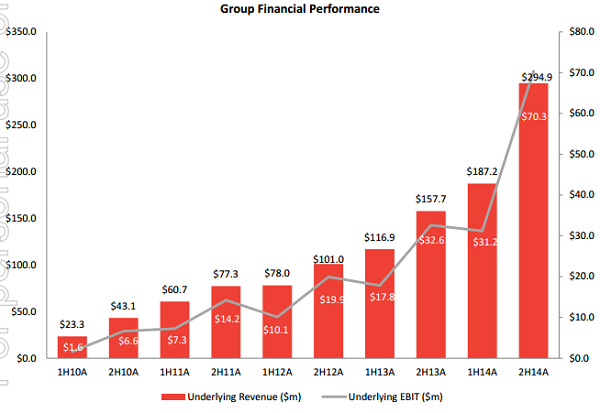

Group Financial Performance (Source - Company Reports)

Affinity immediately responded by recommending that shareholders take no action with regard to the offer. Their board of directors said that they considered this unsolicited approach to be "highly opportunistic "and the proposal to be "highly conditional". They therefore advised that until they provided further guidance, shareholders were strongly advised to take no action. On 6 July 2015, Affinity announced that they had not yet received a formal takeover offer and that upon receipt of such an offer, it would undertake a detailed analysis with the help of expert advisors and provide a recommendation to shareholders as to what further action they should take. During the coming weeks, shareholders should expect to receive a formal Bidders Statement from G8 Education and a formal Target' s Statement prepared by the Affinity Board and that no action should be taken until this information had been received and considered.

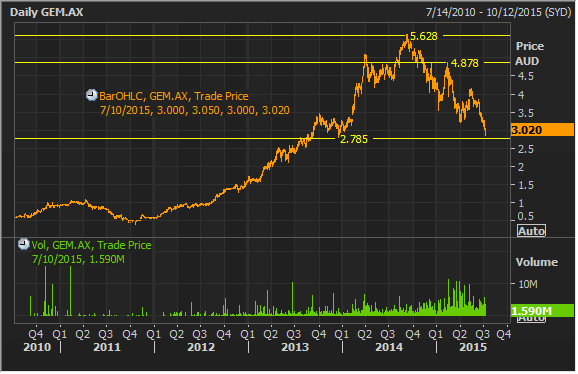

G8 Daily Chart (Source - Thomson Reuters)

G8 Daily Chart (Source - Thomson Reuters)

G8 Education respond to the 6 July from Affinity to clarify some of the confusion that had been caused. They confirmed that their proposal was in line with what they had disclosed on 3 July and that the Affinity reference to a previous proposal from them was not a formal takeover proposal in discussions between the two companies. Confidential nonbinding discussions were held on 24 April 2015 and 20 June 2015. Following these discussions, on 25 June 2015, (a week before the earnings guidance statement of 2 July 2015), the chair of Affinity advised the chair of G8 Education that the Affinity Board could not see a way forward to a no premium merger. Affinity agreed to keep these earlier discussions confidential but have now disclosed some details to the market so it is important that shareholders be aware that G8 Education was very recently prepared to offer a higher value for Affinity shares. On the day before the earnings guidance announcement, Affinity shares closed at $ 0.82 falling more than 34% to $ 0.54 on relatively high trading volumes on the next trading day. G8 Education considers it important for affinity shareholders to be aware that this material earnings announcement was made following the preliminary discussions.

From the sequence of events, it would appear that following the earnings downgrade and the more than 34% drop in the share prices of Affinity, G8 Education announced a full takeover at the exchange ratio and price announced having earlier acquired a 16% stake at $ 0.70 per share. The rejection by the Affinity Board came later on the same day. However, a couple of days after the rejection on 3 July 2015, the Affinity Board has released an announcement on 6 July 2015 is announcing the hiring of independent advisers to assist the board in the assessment of the proposed offer. It does seem that Affinity will now try to obtain a valuation of the company to assess the fairness of the takeover offer. G8 Education has now boosted 16% stake to 19.89% becoming the largest single shareholder in the process and looks determined to go through with the offer. However, the fact that they were so recently prepared to pay a higher price means that Affinity shareholders may try and hold out for a higher price. However G8 Education would probably be unwilling to consider a higher price because the Affinity centres are only of average quality with occupancy below 80%.

For the year 2014, G8 Education reported 455 owned child care centres (up 81%), acquired 203 centres during calendar year 2013 (up from 86 centres in the previous year), 32,782 licensed places per day and 9705 employees. Disciplined consolidation in high demand areas continues to be the focus and, as at 31 December 2014 , the group owned 437 centres in Australia and 18 centres in Singapore. Revenues were up 79% to $ 491.3 million, EBIT by 117% to $ 107.2 million and NPAT by 70% to $ 52.7 million. Dividends were increased to $ .24 per share per annum fully franked and paid quarterly.

The market potential in a highly fragmented industry is around 6500 daycare centres in Australia of which this company represents approximately 9% of total revenues. There are approximately 4000 centres in the addressable market. There is strong demand for early education services because of changes in attitudes, increasing numbers of women in the workforce and undersupply in many key areas. The group has a strong pipeline of further acquisition activities based on good relationships with brokers and vendors, strong reputation and disciplined processes for due diligence. The group also has a credible track record in showing results from previous acquisitions.

The affinity acquisition will bring in an additional 161 daycare centres and we believe that this expansion should go a long way towards accelerating growth. The acquisition is being made at what we consider to be reasonable prices and there should be no strain on liquidity given the all share nature of the transaction. We believe that the investment is well worth making and recommend a Buy on the share at the current price of $3.02.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.