Santos Ltd

-

Improving production and reducing costs to offset falling prices: Santos Ltd (ASX: STO) revenues fell 15% yoy to $1.6 billion (includes $263 million from third party product sales) in the first half of 2015 financial year, on the back of falling oil prices. Realized oil prices plunged to USD 60 per barrel in first half of 2015 against USD 115 per barrel in the corresponding period of last year. But Santos have been improving its production to offset the oil price pressure, and accordingly, developed its overall production by 13% yoy to 28.3 mmboe driven by better than expected production from PNG LNG and Darwin LNG as well as Cooper gas. LNG production rose 131% yoy in the first half of 2015, while the GLNG first LNG is estimated to be delivered by the third quarter of the fiscal year.

.png) Santos Daily Chart (Source - Thomson Reuters)

Santos Daily Chart (Source - Thomson Reuters)

-

Santos LNG sales revenue generated outstanding growth of 150% yoy to $448 million in the first half of 2015, driven by PNG LNG and Darwin LNG production performance. The group also improved its production efficiency and was able to decrease its production costs per barrel of oil equivalent by 11% on a year over year basis. Meanwhile, Santos EBITDAX reduced only by 5% yoy to $900 million in the first half, driven by better production costs as well as strong volumes. Asia Pacific EBITDAX witnessed a major increase due to PNG LNG half-year of production. On the other hand, the group’s net profit after tax fell 82% yoy to $37 million in first half of 2015 financial year, against $206 million in the corresponding period of last year, affected by rising net finance costs, effective tax rate and lower capitalized interest.

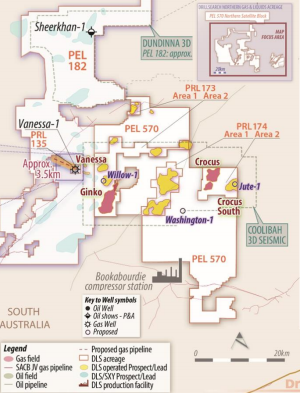

Exploration Wells (Source: Company Reports)

-

Stock Outlook:Santos shares plunged over 47% in the last three months (as of sep 11) due to falling oil prices. The stock fell 31% in just last four weeks (as of sep 11) partly impacted by rumors of a possible equity raising by the company (which STO later clarified that it has no plans of equity raising), weak first half of 2015 performance and resignation by CEO. But the group’s Chairman, Peter Coates is assuming the role of Executive Chairman and is even conducting strategic review on the firm. Recently, Washington-1 exploration well was spudded targeting the Permian source rocks in the Toolachee, Epsilon and patchawarra formations with a target depth of 3,686 meters. We believe that Santos is in heavily oversold zone, trading near its multi-year low prices. STO has a solid dividend yield of 6.7% and is making efforts to offset the impact of oil prices by improving production and operational efficiencies. We view Santos as a bargain opportunity, and based on the foregoing, we suggest a “BUY” recommendation on the stock for investors at the current price of $4.51

AWE LIMITED

-

Below the guidance performance: AWE Limited (ASX: AWE) sales revenues plunged 14% yoy to $284 million during the fiscal year of 2015, which is 2% below the guidance, impacted by the oil prices pressure. The group’s Average realized oil & condensate price was cut by 28% yoy to $79 per barrel. Field EBITDAX reduced 31% yoy to 143 million and consequently Underlying net loss after tax fell to $52 million on the back of lower production base due to planned downtime associated with development activity during the period. AWE also issued a conservative FY16 guidance, and forecasts an Oil and gas production in the range of 5.1 to 5.6 mmboe and a sales revenue of $225 - $250 million, assuming the Brent Oil price of US$50 per barrel and AUD/USD of 75 cents.

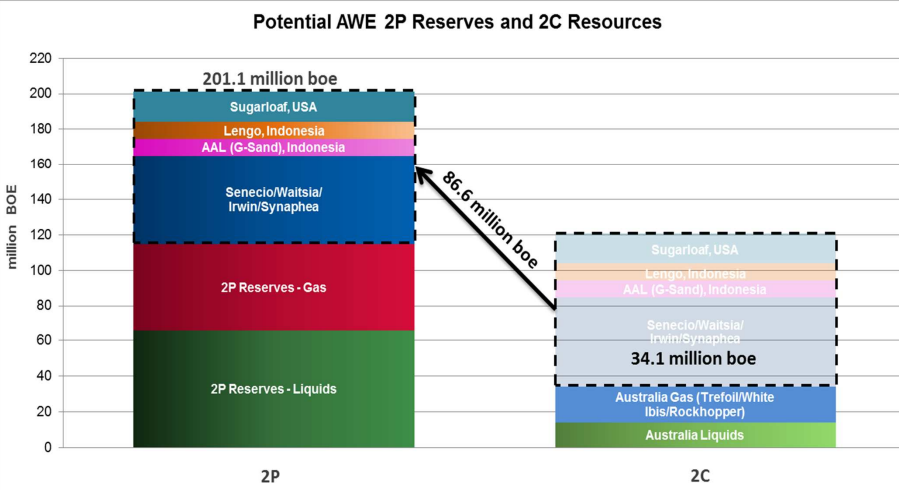

Potential AWE 2P Reserves and 2C Resources (Source: Company Reports)

-

Solid resource potential: AWEstock plunged around 43% in just last four weeks (as of sep 11 close), and fell over 52% in last three months, impacted by oil prices volatility as well as a weak FY15 performance and guidance. On the other hand, the group has a solid resource potential with Net 2P Reserves improving by 25% yoy to 114 mmboe driven by the positive appraisal at Perth Basin and Sugarloaf during the period. The group has a solid reserves to production ratio of 22 years. Net 2C Contingent Resources improved by 57 yoy to 121 mmboe while net 2P plus 2C increased by 40% yoy to 235 mmboe. Recently, the Yolla-5 development well has been tied-in to export facilities on the Yolla platform, while the production from the well also started. The combined production rate from the BassGas facilities has improved by around 64 TJ/day with the addition of the Yolla-5 and Yolla-6 wells. AWE also intends to focus on its development feasibility studies for the nearby Trefoil gas/condensate resource to take advantage of ullage in the system after 2020. Having a solid resource potential, we view that the recent correction in the stock offers an attractive investment opportunity in the stock, and accordingly recommend a “BUY” at the current stock price of $0.605.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.