RCG Corp Ltd

.png)

RCG Dividend Details

Progressing well considering the lift in earnings: Including the effect of the acquisition of Accent Group (for five weeks from 27 May 2015 to 28 June 2015), the financial highlights by RCG Corp Ltd (ASX: RCG) for FY 2015 included an increase of 27.6% in underlying consolidated EBITDA of $ 21.8 million; underlying Net Profit after Tax of $ 13.7 million, a rise of 16% on the previous year; and underlying EPS of 4.71 cents per share indicating an increase of 2.8% over the previous year. The underlying EBITDA of the existing businesses, excluding Accent Group, was $ 18.5 million which is an increase of 8.5% over the previous year. A fully franked final dividend of 2.5 cents per share was declared resulting in a total of 4.5 cents per share for the full financial year which was the same as the previous year.

.png)

Accent Group’s Performance (Source: Company Reports)

The completion of the acquisition of Accent Group has resulted in the creation of a regional leader in the retail and distribution of branded footwear with more than 300 stores and exclusive distribution rights to 12 major international brands. Accent is the owner of Platypus Shoes and distributes seven international brands including Vans, Skechers, Dr Martens and Timberland. The purchase price of $ 203 million was arrived at on the basis of six times normalised maintainable EBITDA. The earnings accretion was immediate and sustainable and the two businesses are naturally aligned. The company’s forecasts for FY 2016 is consolidated EBITDA of $ 55 million-$ 57 million which will result in an increase in the underlying EPS of 25% to 30%. The stock has delivered 144% this year to date (as at December 01, 2015) and is currently trading at just about its 52-week high price while the P/E ratio is quite high at 43x.

However, on the basis of these growth prospects, we believe the share is expensive at the current price levels and do not recommend a buy.

RCG Daily Chart (Source: Thomson Reuters)

Lynas Corp Ltd

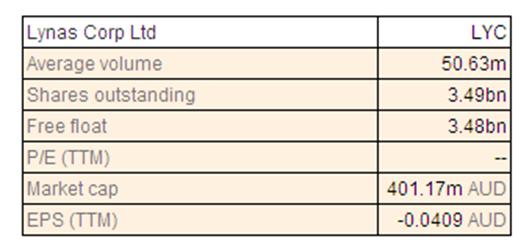

LYC Details

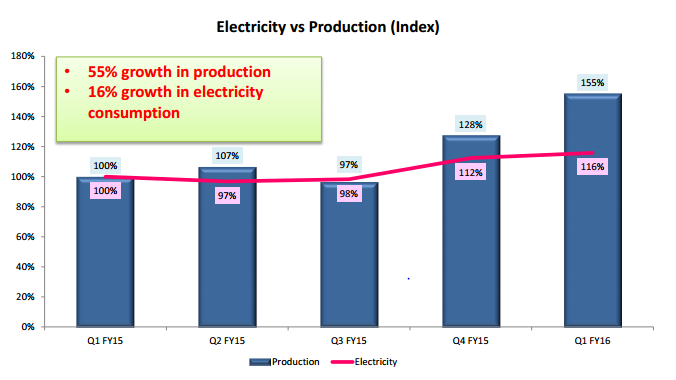

Growing production and improvement in cash flow: For FY 2015, Lynas Corp Ltd (ASX: LYC) reported growing production on target with rare earth oxides production of 8799 t for FY 2015 and 3171 t for the first quarter of FY 2016. Sales are growing by value and volume with FY 2015 registering 7883 t with a value of $ 155.7 million and the first quarter of FY 2016 reporting 2691 t with a value of $ 55.9 million. There has been a 25% reduction in unit operating costs/kilogram (excluding depreciation) and a 40% reduction in overheads. The workforce is now considered to be at the right size delivering improved efficiency. The production has been planned to optimise the use of equipment and energy and a 55% growth in production has been achieved with only a 16% growth in energy consumption.

Electricity vs Production (Source: Company Reports)

Similarly, 115% growth in oxides production has been achieved with only 16% growth in gas consumption. The cash flow has improved with net operating cash flow of $ -31.9 million in FY 2015 and $ 4.5 million in the first quarter of FY 2016. The investing cash flow was $ -9.6 million in FY 2015 and $ -3.2 million in the first quarter of FY 2016. The combined total was $ -41.6 million and $ 1.3 million, for FY15 and 1QFY16, respectively. Rare earth market estimates show increasing growth rates especially for magnets. Approximately one third of the supply is processed in China and consumed in China, one third processed in China and consumed in the rest of the world, and one third is processed in rest of the world and consumed in the rest of the world. The company differentiates itself as a supplier on the basis of quality, environmental assurance and performance as well as catering to customers looking for independent and reliable supplies for which the company is the only non-Chinese miner and processor of rare earths.

We see that the company has certain strengths but these do not justify the present share prices which we consider expensive and as such the stock is trading close to its 52-week high price at the moment.

LYC Daily Chart (Source: Thomson Reuters)

UXC Ltd

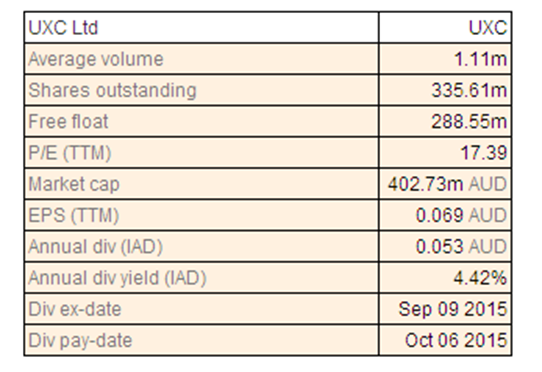

UXC Dividend Details

Computer Sciences Corp set to acquire UXC: UXC Ltd (ASX: UXC) has announced that it has entered into a Scheme Implementation Deed with Computer Sciences Corporation (CSC) under which it is proposed that a fully owned subsidiary of CSC will acquire 100% of the issued share capital of the company for cash consideration of $ 1.22 per share for all the 345 million outstanding shares of UXC while UXC will pay a franked dividend of $ 0.02 cash per share for the half-year ending 31 December 2015. The acquisition will proceed by way of a Scheme of Arrangement between the company and its shareholders. This is actually a revised proposal and the adjustment to the offer consideration downwards is an acknowledgement from both sides that the synergies may take longer to achieve as well as a higher working capital position than originally envisaged. However, the CSC-UXC combined entity is predicted to emerge as one of the top IT service companies in the region. UXC’s board has recommended that shareholders vote in favour of the scheme in the absence of a better proposal and subject to the opinion of an independent expert that the proposal is in the best interests of shareholders. The board points out that the total cash payments of $ 1.24 per share represents an attractive premium of 8% to the closing price, or 14% premium to the 60 day volume weighted average price and a premium of 29% to the 120 day volume weighted average price. The company has appointed KPMG Financial Advisory Services (Australia) Pty Ltd as an independent expert to deliver the opinion on whether the scheme is in the best interests of shareholders. Based on the outstanding shares of the company, the total value of the transaction will be approximately $ 427.6 million and the transaction is expected to close by February 2016.

The offered price is close to the current price at which UXC is trading at the moment. In view of the above, we do not recommend a buy for the stock at the current price.

UXC Daily Chart (Source: Thomson Reuters)

Goodman Group Pty Ltd

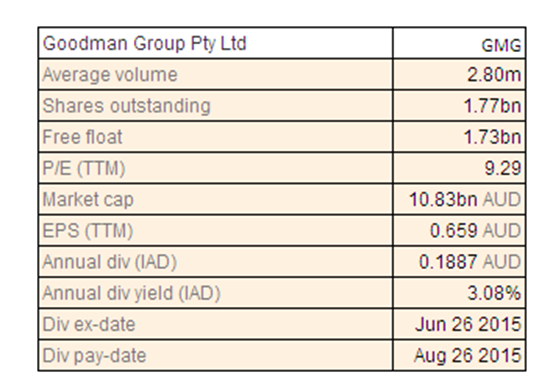

GMG Dividend Details

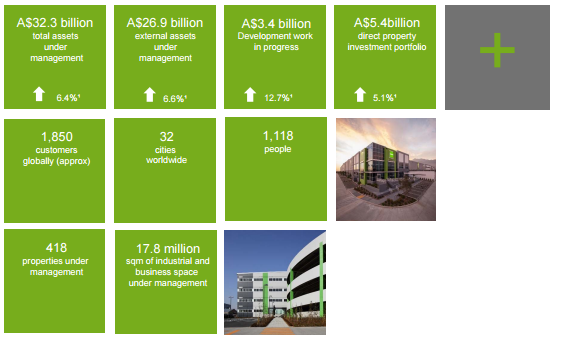

FY2016 forecast reaffirmed: Goodman Group Pty Ltd (ASX: GMG) has risen 8.62% this year to date (as at December 01, 2015). The company has recently announced an operational update for the first quarter ended 30 September 2015 which shows sustained momentum across the global development and management activities driving strong operational performance in the first half of FY 2016. The group is executing its strategy to deliver sustainable growth by focusing on quality assets, partnerships and capital management supported by the disciplined risk management. Total assets under management increased by $ 2 billion to $ 32.3 billion reflecting development completions, currency movements and strong revaluation. Over the quarter, 0.7 million sqm of space was leased over the group and the partnerships for the quarter representing $ 83 million worth of annual rental income.

Performance Snapshot (Source: Company Reports)

Occupancy was maintained at 96% over the group and the partnerships with an average lease expiry of five years. Development work in progress total is $ 3.4 billion spread over 78 projects with a forecast yield on cost of 8.7%. Asset quality is improving across the group and the partnerships and asset protection yielded $ 0.6 billion excluding urban renewal for reinvestment in the development pipeline. A disciplined approach to development activities resulted in pre-sale 69% of all development completions with the capital being recycled into new projects. The urban renewal strategy is proceeding in line with expectations with sites worth $ 1.7 billion conditional contract in Sydney and $ 110 million completed during the quarter. External assets under management for the quarter were up 6.6% to $26.9 billion.

The company has reaffirmed the forecast for FY 2016 full-year operating earnings per security of 39.4 cents up 6% over the previous year. We are impressed by the performance and the results but consider that the current stock price makes the stock expensive and do not therefore recommend an investment at the moment.

GMG Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

Copyright

Copyright © 2014 Kalkine Pty Ltd ABN 34 154 808 312. No part of this website, or its content, may be reproduced in any form without the prior consent of Kalkine Pty Ltd.

Kalkine is a trading name of Kalkine Pty Ltd ABN 34 154 808 312, which holds Australian Financial Services Licence No. 425376.