Fairfax Media Limited

.png)

FXJDetails

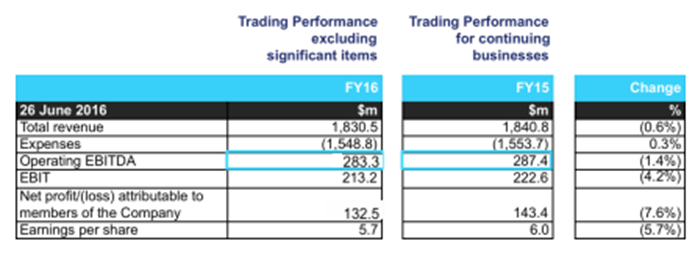

Decline in FY 16 Earnings: Fairfax Media Limited’s (ASX: FXJ) Fairfax New Zealand Ltd and NZME Ltd received and agreed to request from New Zealand Commerce Commission to extend the date of decision on the proposed merger. Meanwhile, for FY 16, FXJ reported a decline of 0.6% in revenue for continuing businesses. The group’s trading in the first five weeks of FY17 was weak wherein the revenues were 8% to 9% below last year. On the other hand, publishing trends were consistent in second half.

Group Trading Performance for FY 16 (Source: Company Reports)

The Domain business is delivering strong audience growth and yield improvements, with digital revenue growth of 10% in the first five weeks of FY17. But, the July 2016 new listings volumes were impacted by the longest Federal election campaign wherein new listings volumes were down 25% in Sydney and fell 11% in Melbourne.

However, FXJ is implementing cost savings measures to maintain earnings stability. The group is paying dividend on 06 September 2016. FXJ stock has generated over 31.5% in the last six months (as of September 01, 2016). We give a “Buy” recommendation on the stock at the current price of $0.985.

FXJ Daily Chart (Source: Thomson Reuters)

Australian Finance Group Ltd

AFG Details

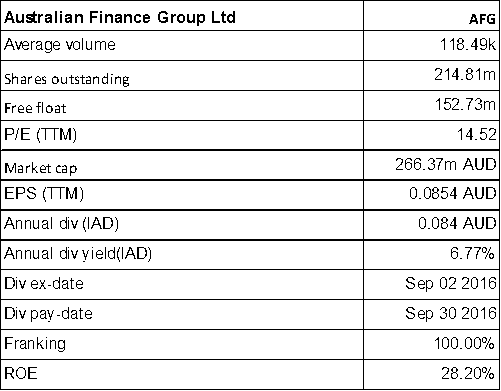

Exceeded NPAT guidance: Australian Finance Group Ltd (ASX: AFG) delivered FY16 results with NPAT of $22.6 million slightly above the earlier disclosed upgraded range of $22 million to $22.5 million. FY16 residential settlements of $33.8 billion were up 8.3% over FY15 despite numerous headwinds. On the other hand, commercial settlements were up 15% on FY15.

FY16 Performance (Source: Company Reports)

AFG had earlier announced about the strong trading across both segments of the business, in particular within AFG’s Home Loans division. AFG stock has risen 17.3% in the last four weeks (as of September 01, 2016), and we still believe there is more momentum in the stock. Based on the foregoing, we give a “Speculative Buy” recommendation on this dividend yield stock at the current price of $1.20

AFG Daily Chart (Source: Thomson Reuters)

Myer Holdings Ltd

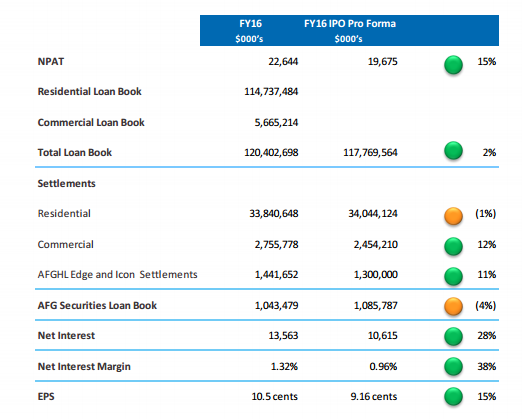

MYR Details

Unfavorable weather conditions affecting sales: Myer Holdings Ltd (ASX: MYR) is exiting its stores located at Wollongong in October 2016 and Orange in New South Wales in January 2017 as a part of New Myer strategy, which is designed to return Myer to profitable growth. But, MYR is accelerating the rollout of New Myer initiatives leading to increased costs and capex that includes the major refurbishment at Warringah, which is due to reopen before Christmas 2016. However, MYR says that the unseasonably warm weather has contributed to subdued sales of winter product, while the timing of 2016 Federal election campaign would impact the consumer sentiments. The group would incur an implementation costs of $20-$30 million associated with New Myer initiatives for FY16.

Additionally, MYR stock is trading at a high P/E. Based on the foregoing, we give an “Expensive” recommendation on the stock at the current price of $1.31, ahead of its full year results due on September 15, 2016.

MYR Daily Chart (Source: Thomson Reuters)

Finbar Group Limited

.png)

FRI Details

Strong cash position: Finbar Group Limited (ASX: FRI) reported $21 million as FY16 operating profit while the net profit after tax and impairments has been $8 million. The profit was negatively impacted by the weak investment property rental market that affected the assets at Fairlanes, East Perth and Pelago.

FRI otherwise reported a cash position of $28 million to fund working capital and future growth. Despite the headwinds, pre-sales rose 11% over previous year while the company has a $2.2 billion project pipeline supporting growth. We give a “Buy” recommendation on the stock at the current price of $0.835

FRI Daily Chart (Source: Thomson Reuters)

ResMed Inc.

.png)

RMD Details

Patent Infringement allegations: ResMed Inc. (CHESS) (ASX: RMD) through its subsidiaries, designs, manufactures and markets equipment for the diagnosis and treatment of sleep-disordered breathing and other respiratory disorders, including obstructive sleep apnea. RMD had recently filed a complaint in the Southern District of California for F&P Simplus™and F&P Epson™range of masks while Fisher & Paykel Healthcare intends to defend the allegations. Earlier, Fisher & Paykel Healthcare filed patent infringement proceedings in the US District Court for the Central District of California seeking judgment that ResMed Inc’s AirSense 10 and AirCurve 10 range of flow generator products, ClimateLineAir heated air tubing for use with such flow generator products. Moreover, Swift LT and Swift FX masks are said to infringe patents held by Fisher & Paykel Healthcare. On the other hand, RMD in the fourth quarter of FY 16 has reported 14% increase in the revenue to $518.6 million, non-GAAP diluted earnings per share of $0.74 and the operating cash flow of $143.0 million. RMD has finished the $800 million acquisition of Brightree in the fourth quarter.

The group is paying dividend on 22nd September 2016. We believe that the stock is “Expensive” recommendation on the stock at the current price of $8.80

RMD Daily Chart (Source: Thomson Reuters)

Suncorp Group Ltd

.png)

SUN Details

Expects reasonable ROE: Suncorp Group Ltd (ASX: SUN) is in the provision of general insurance, banking, life insurance, superannuation products and related services to the retail, corporate and commercial sectors in Australia and New Zealand. SUN has recently reported an NPAT of $1,038 million in FY 16 against $1,133 million in prior corresponding period. This is due to the lower returns from investment markets and a reduction in reserve releases. The General Insurance underlying ITR is of 10.6% due to the increased cost of settling claims and lower investment returns while the total GWP enhanced 1.8% to over $9 billion. Suncorp Bank net profit after tax grew 11.0% due to continued home lending growth, improved net interest margins and ongoing improvement in credit quality.

.png)

Result Overview (Source: Company Reports)

Suncorp Life net profit after tax grew 13.6% while the underlying profit increased by 9.7% to $124 million. In addition, after accounting the dividend payment, the group is well capitalized with $346 million in CET1 capital held above its operating targets. Additionally, SUN expects to get a sustainable return on equity of at least 10% which means an underlying ITR of at least 12% and maintaining the dividend payout ratio of 60% to 80% of the cash earnings.

The stock has risen 9.10% in the last six months (as of August 31, 2016). We give a “Buy” recommendation on the stock at the current price of $12.70

SUN Daily Chart (Source: Thomson Reuters)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.