VWAP

Updated on 2023-08-29T11:56:53.350271Z

What is VWAP (Volume Weighted Average Price)?

The Volume Weighted Average Price is a technical analysis tool that is the ratio between the asset price and total trade volume. VWAP is a trading benchmark used by the trader and used to obtain the average price at which the security traded throughout the trading session in terms of volume and price. VWAP is vital as traders get an understanding of trend as well as the value of the security.

Source: Shutterstock

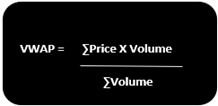

The Formula of VWAP

VWAP can be calculated by adding the traded stock’s price for each transaction and then dividing it by the number of shares traded on that day.

What are the Steps to Calculate VWAP?

- In the first step, we find the average price of the traded stock (for the first 5-min duration in the day) by taking the average of its high price, low price and closing price. Once you get the average value, you multiply the volume of shares traded during these intervals.

- In the next step, we find the volume of shares traded during the period and add them.

- Then we divide the total sum of value that we obtained by multiplying the price of shares are each interval and the corresponding volume of shares traded by the summation of the volume of shares traded during the day.

Why do traders consider VWAP as an Essential Tool?

- VWAP helps in identifying where the market is bearish or bullish. If the market is bullish, it means that the price at which the shares are trading is below the VWAP. On the other hand, a market is bearish, when the market price is above its VWAP. When the market is bullish, there would be an increase in the buying price, and we would notice that the trend line on the chart is moving in an upward direction. On the other side, in case of a bearish market, market participants are seen selling their stock, or simply we can say that there is selling pressure in the market, which results in the downward trend on the chart.

- Another advantage of VWAP is that you can understand the time to buy or sell the stock. Any market participant who buys a stock at a price below the VWAP can buy a stock at a lower price and make better profits when selling the stock.

- Retail and professional traders use VWAP for determining the intraday trade.

Application of VWAP strategy

VWAP strategy is used when we trade in short-term timeframes and is very simple and effective. A common approach for a bullish trader is that they wait for a clear VWAP that cross above. When this happens then, the trader takes a long position. When VWAP cross above, it indicates that more and more buyer would enter into the picture. Thus, there would be a possible upward movement in the stock price.

On the other hand, if the trader is bearish on the stock, then he/she short the stock when they see VWAP cross below. This indicates that the buyer would step out and would aim at gaining profit. We can also say that at this stage, the seller enters the picture.

Advantages and Disadvantages of Volume Weighted Average Price

After having a fair idea about the VWAP strategy, let us understand its advantages and disadvantages.

Advantages of VWAP strategy

- The most significant advantage of using the VWAP strategy that it is easy to calculate and understand.

- It is beneficial to calculate small trades.

Disadvantages of VWAP strategy

- One of the major disadvantages of VWAP is that it does account for any opportunity cost.

- It can manipulate trading by positioning the trades only at the time when market prices are at a level that is favourable with the Volume Weighed Average Price.

- There is a scope that the results could be inaccurate and misleading for big orders. A wrong decision could take considerable time to recover.