Turnover ratio

Updated on 2023-08-29T11:56:04.308840Z

What do you understand by Turnover Ratio?

The turnover ratio refers to the percentage change made in mutual funds or other portfolio holdings to generate revenue. Turnover ratio is also referred to as efficiency ratio or activity ratio. Usually, the turnover ratio differs, depending on I) Type of mutual fund ii) the portfolio manager's investing style iii) investment objective.

Under accounting, the turnover ratio tells us how efficient a company is in utilising its assets to generate revenue. The greater the turnover ratio, the better it is because it depicts that a company optimally utilises its assets as resources to earn revenues.

A higher turnover ratio would imply a higher return on investment. On the contrary, in accounts payable, a low liability turnover ratio is considered good because it shows a prolonged delay in payment by the company to its suppliers. This delay helps a company to hold back its cash for a longer duration.

Summary

- The turnover ratio refers to the percentage of mutual funds or other portfolio holdings that a company replaces to generate revenue through sales.

- Under accounting, the turnover ratio tells us how efficient a company is in utilising its assets to generate revenue.

- While deciding whether to invest in a mutual fund, one should always consider its turnover ratio.

Frequently Asked Questions (FAQs)

What does higher and lower turnover ratio indicate?

Turnover ratios do not have a permanent or inherent value. Thus, one cannot say that higher turnover ratios are bad or low turnover ratios are necessarily good. However, the investors should not ignore the consequences of turnover frequency. Usually, high turnover leads to an increase in the cost of funds, impacting the fund’s overall return. The high turnover and high cost of the funds are due to commissions and the payments arising from the difference between the bid price and ask price of a security or an asset. In addition, funds with a higher turnover ratio generate short-term capital gains and taxed as ordinary income rates.

Image Source: © Ipopba | Megapixl.com

While deciding whether to invest in a mutual fund, one should always consider its turnover ratio. It is always helpful to see how a particular fund's turnover ratio performs compared with others of the same type having a similar investment approach for investment purpose.

For example, suppose the average turnover ratio for managed mutual funds is 80–120%. In that case, an equity investor who has a conservative approach is likely to target those funds where the turnover ratio is below 60%. On the other hand, investors should become a little more cautious if a fund’s turnover ratio is entirely different or out of line with the comparable funds.

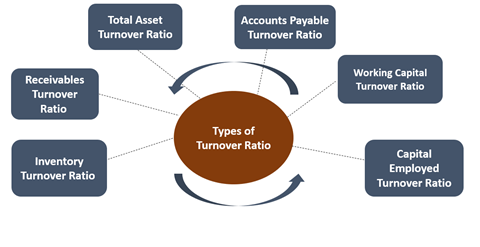

What are some common types of Turnover Ratios?

Source: Copyright © 2021 Kalkine Media

Inventory Turnover Ratio

The Inventory turnover is a financial ratio that indicates how many times a company's inventory has been sold and replaced in a given period. The days it takes to sell the inventory on hand may then be calculated by multiplying the number of days in the period by the inventory turnover formula.

Inventory turnover can assist firms in making better decision on pricing, production, marketing, and purchasing new inventory.

Image Source: © Rummess | Megapixl.com

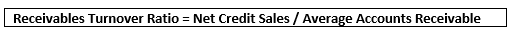

Receivables Turnover Ratio

The Receivables Turnover Ratio measures a company’s effectiveness in extending as well as collecting its debts.

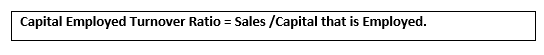

Capital Employed Turnover Ratio

The Capital Employed Turnover Ratio measures how well a company's capital is used to produce sales. This ratio aids investors or creditors in determining a firm's ability to generate revenue from the capital employed and serves as a crucial decision element for lending further funds to the seeking firm.

Working Capital Turnover Ratio

Working capital turnover is a metric that indicates how well a company uses its cash to support sales and expansion. Working capital turnover, also known as net sales to working capital, analyses the link between the funds necessary to finance a company's operations and the revenues generated to keep operations going and turn a profit.

Asset Turnover Ratio

The asset turnover ratio or the total asset turnover ratio compares the value of a company's assets to the value of its sales or revenues. The asset turnover ratio is a metric that measures how effectively a corporation uses its assets to produce income.

A company's ability to generate revenue from its assets is measured by its asset turnover ratio. The higher the asset turnover ratio, the more efficient it is. On the other hand, if a company's asset turnover is minimal, it is a bad sign.

Accounts Payable turnover Ratio

The accounts payable turnover ratio is a liquidity ratio that measures how fast company pays off its creditors over an accounting period. It also calculates the amount of fixed asset investment required to sustain a certain level of sales. It can be impacted using analysis, capacity management, manufacturing outsourcing, and other factors.

Why does stock market index fund have Low Turnover Rate?

It is to be noted that the value of turnover ratio can be higher or lower, depending upon i) Type of mutual fund, ii) the portfolio manager's investing style, iii) investment objective.

For instance, a stock market index fund will have a low turnover rate because it imitates a financial market index. The equity indices used as benchmarks for privately managed funds do not change that frequently. This is not the case with bond funds which have a high turnover. One of the inherent qualities of bond investments is active trading. The turnover for a large-cap value stock fund is usually lower as compared to the small-cap growth stock.