Retirement Planning

Updated on 2023-08-29T11:59:59.958238Z

What is retirement planning?

Retirement planning is a process of setting up retirement income goals. A retirement plan is an essential requirement for people seeking independent retirement years. The scope of retirement planning is not only limited to planning goals but also achieving goals.

It involves analysing financial objectives, existing financial situation, and estimating future cash flows to incorporate a comprehensive retirement plan. Retirement planning reduces the risk of outliving savings.

When savings are exhausted, retirees are not able to maintain a similar lifestyle. Retirement planning also enables planning a course of action in the event of unforeseen events like death, disability etc.

It essentially refers to the formulation and implementation of strategies pertaining to investments, savings, and allocation of money. A comprehensive analysis of the person is undertaken that not only includes assets and savings but liabilities, future expenses and life expectancy.

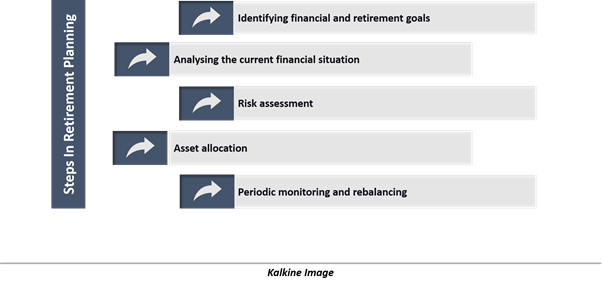

What are the steps in retirement planning?

Identifying financial and retirement goals

The first step is to enumerate financial and retirement goals. In this step, the retirement planner charts out the ambitions of the person. This step entails the kind of lifestyle a person envisages to lead in retirement.

Retirement planners try to list out all possible retirement goals, including retirement home, holiday planning, marriage planning, retirement time, family planning etc. The motive of this step is to form a base for retirement needs.

Based on the goals extracted in the first step, the planners formulate an appropriate strategy for the person. A successful retirement plan is formed based on goals listed in the first step.

Analysing the current financial situation

Financial health is as important as the physical health of a person. Retirement planners seek to test the financial health of the person. They analyse the cash inflows and outflows of the person to estimate the buffer funds.

This step also includes analysing the assets held with the person as well as liabilities. Overall commitments are analysed to assess the existing financial situation of the person. Retirement planners also consider insurance policies taken by the person.

They also analyse the savings, or any investments undertaken by the person. A detailed analysis is carried to unveil the risks and opportunities with the existing financial situation of the person.

Risk assessment

Risk assessment is necessary to plan for the unforeseen events. In this step, the planner also evaluates the risk-taking capacity of the individual. In retirement planning, the age factor plays a crucial role in assessing risk-taking ability.

A person seeking retirement planning in the 40s may not have similar risk-taking capacity compared to a person in 20s. The risk factor usually dictates the asset allocation and investment allocation strategy for the individual.

Further, the liabilities of the person are also evaluated extensively to provide potential cover for any expected risks. Retirement planners usually recommend having an emergency fund to cover any risk arising out of unforeseen events.

Asset allocation

Asset allocation holds a significant position in the process of retirement planning. It essentially refers to allocating funds to several asset classes to generate an adequate corpus for the retirement life. Money is simply an asset that could be applied to create wealth.

An individual is offered with a range of asset classes in the investment world, spanning from shares, to ETFs to bonds. The asset classes also include real estate, precious metals, fixed deposits, annuities etc.

Asset allocation framework is crucial to achieving prudence and flexibility. It allows generating risk-adjusted returns based on the risk-taking capacity of the individual. A sensible asset allocation framework is the key to achieve desired retirement goals.

Periodic monitoring and rebalancing

A retirement plan may get disrupted by the changes in the underlying conditions of an economy. Likewise, the plan is also equally sensitive to be disrupted by the potential changes in the financial health of the individual.

In the event of a disruption to a plan or financial situation, rebalancing comes to rescue. Individuals also monitor their retirement plan consistently. It is essential to maintain alignment with the goals, and any deviation from the plan should be altered effectively.

Why is retirement planning important?

In the simplest form, it is essentially the process of ensuring that when a regular income source is about to get constrained, one has sufficient wealth and income sources to support a desirable lifestyle.

Each person has ambitions, and retirement is perhaps the best time to fulfil those ambitions since working age limits the ability to spend time on ambitions. However, in the absence of a retirement plan, one may have accumulated sufficient funds to live the lifestyle.

Inflation eats out a lot of earning powers as purchasing power at the same amount of money depletes as inflation rises. Over a long term period, the power of compounding can effectively beat the inflation factor in wealth creation.

Retirement plan allows an individual to be self-sufficient in the later years of life when most of the loved ones are far away. It enables elderly people to be confident and self-dependent during their old age.