Pairs Trading

Updated on 2023-08-29T12:01:22.143401Z

What is Pairs Trading?

A pairs trade occurs when an investor takes a long and short position in two highly correlated stocks. The stocks here are paired with one another for ploughing a higher rate of profits irrespective of the broader market movements. It is a trading strategy that uses both statistical and technical analysis. The strategy is market-neutral.

Summary

- A pairs trade involves taking a long and short position in two stocks with a high statistical correlation. It is a market-neutral trading strategy.

- It is a trading strategy that uses both statistical and technical analysis.

- A Pairs trader bets on two or more securities that are expected to diverge or converge in price. It indirectly results in Hedging.

Frequently Asked Questions (FAQ)

How Does a Pairs Trade Work?

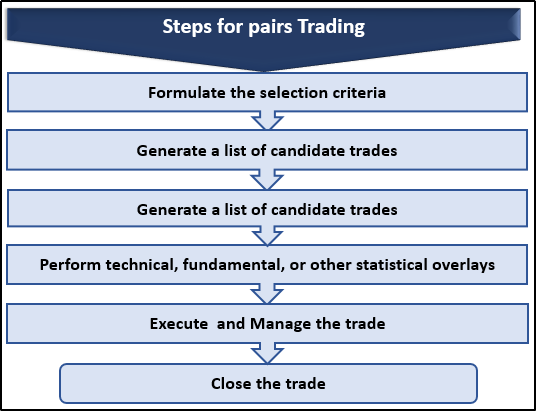

Pairs trading is a strategy that utilizes statistics to identify the relationship between two stocks. It helps identify the direction of the relationship and then execute a trade based on this analysis.

Copyright © 2021 Kalkine Media

A pairs trader uses his strategy to capitalize on existing market imbalances between two or more financial instruments like stocks or funds. To understand the relationship between the two instruments, the trader uses statistics, fundamental analysis, technical analysis, and probability. Then, using all of these tools, the pairs trader tries to find strong correlations between the chosen financial instruments.

The correlation established can be amongst stocks, sectors, indexes, or any other type of instrument. He/she then builds a foundation for further analysis. This is dissected to get into the roots of information that allows an efficient and method of executing successful trades. The trader tries to measure the spread using statistics. He then uses this to develop a tradable relation in unequal opportunities.

Pairs trader bets on two or more securities expected to diverge or converge in price, depending on his preference. The trader will either keep a larger or smaller spread amongst these securities. Divergence traders hope that the spread increases at the close.

While convergence traders want to see the spread decrease at close. Pairs trading thus needs a careful and knowledge backed method. Like any other trading strategy, it also has its ups and downs.

Pairs Trading Example

Suppose a pair trader finds out that the stock of Bank ABC is correlated to the stock of Bank XYZ. For example, the ABC bank stock is up 20 points, and XYZ bank is down 20 points. So now there is some correlation. It will therefore be measured and assessed by the trader. He will then use the pairs trading strategy to make market-neutral profits out of these banking stocks.