Nanny Tax

Updated on 2023-08-29T11:54:49.041052Z

What do you mean by Nanny Tax?

A Nanny Tax is a federal tax paid by a household employer who employs domestic helpers and pays salaries above a certain threshold. At present, if an employee is paid cash wages of $2,300 or more, then, in that case, social security and Medicare taxes must be withheld at a rate of 15.3%. This 15.3% is divided equally between the employer and the employee, each paying half (7.65%). Besides, if an employer pays cash wages of $1,000 or more per quarter to an employee, they must pay a 6% unemployment tax on yearly cash wages up to $7,000.

Summary

- Nanny Tax refers to the tax paid by an individual who employs a household employee and pays a salary above a certain threshold.

- At present, if an employee is paid cash wages of $2,300 or more, then, in that case, social security and taxes must be withheld at a rate of 15.3%.

- Parents who hire babysitters for their children must pay Nanny Tax if they exceed the 2000 dollars wage threshold.

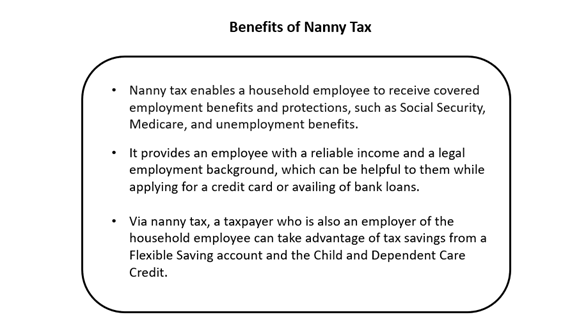

- Via Nanny Tax, a taxpayer who is also an employer of the household employee can take advantage of tax savings from a Child and Dependent Care Credit.

Frequently Asked Questions (FAQs)

When is a household employer exempted from paying Nanny Tax?

Image Sources: © Rummess | Megapixl.com

In real life, the Nanny Tax would imply that if you are an employer, have someone working in your home for more than $2000 a year; then this tax may apply to you. This is because a nanny, by default, is a household employee; this could be your Gardner, maid, babysitter, or anyone working in your house who works under you for fixed hours and to who you pay an annual payment of more than $2000.

However, few exemptions mean that an employer does not need to pay this tax if they are their spouse, parents, or third party under age 18. Yet another exception is where you do not have to withhold this tax can be independent contractors. Independent contractors can have multiple clients and customers; they come to your house with their equipment and pay them a service charge, which means you are paying a landscape company or paying a service or maid company. You could have a different person show for your house each week, but they are a third-party contractor that services multiple people. It is to be noted that an employer cannot employ an illegal immigrant as a household helper.

As per the law, all domestic workers like cooks, gardeners are subject to Nanny Tax. In addition, if a household or individual pays their employee more than $1000 in a calendar quarter, they must pay a federal unemployment tax (FUTA) tax. State unemployment taxes have different thresholds for different US states.

How will a taxpayer calculate the amount they have to pay as Nanny Tax?

The Internal Revenue Service (IRS) considers a household helper as a taxpayer's household employee. Since the taxpayers are regarded as employers, they are bound to pay Social Security and federal and state unemployment taxes on the salaries they are paying to their employees. There may also exist state-level Nanny Taxes in certain countries. For example, suppose that if an individual pays a Gardner $50 per weekend, the taxpayer must pay Nanny Taxed (52 weekends ÷ year x $50 = $2600). Noticeably, the Nanny Tax will not be applicable if the Gardner is the employer’s parent/spouse or below 18 years of age.

Similarly, the employer is not liable to pay Nanny Tax if the Gardner is employed via an employment agency i..e third party. In this case, the agency is the employer, and hence it holds the responsibility to pay the associated tax to the employee. Through Nanny Tax, an employee receives employment benefits and protection such as social security. Besides, it provides an employee with a reliable income and a legal employment background, which can be helpful to them while applying for a credit card or availing of bank loans. In addition, via Nanny Tax, a taxpayer who is also an employer of the household employee can take advantage of tax savings from a Child and Dependent Care Credit.

Image Source: © Designer491 | Megapixl.com

How does a household employee pay Nanny Tax?

- The household employer must collect from the employee – their social security number filled Form I-9 with a valid identification number and federal W-4 form.

- The employer needs to get a tax ID number: The household employers must obtain a Tax ID number from the concerned tax department of that States.

- Calculate taxes withheld of worker & employer taxes: Based on the salary paid to household employees, the taxpayer must calculate taxes withheld of worker and employer taxes. Later, to avoid any penalties arising from non-payment of taxes, the employers will pay withheld tax along with their income tax.

- File the return: The employer needs to file the return quarterly, annually, monthly as per the prevailing law of that state.

- Provide Form W-2 to the household employees at the end of Jan each year so that employees can use it to file their tax returns: In January, each year, the employer must provide a Form W-2 to the employee and file a W-2 Copy A and W-3 with the Social Security Administration.

- Employers need to fill schedule H with their federal income tax. Also, send Form 1040 about the estimated payment to IRS four times a year.

What are the benefits of Nanny Tax?

Source: Copyright © 2021 Kalkine Media

What are the consequences of not paying the Nanny Tax?

If a taxpayer fails to pay employment taxes, then this may invite punishments and penalties. Furthermore, if an individual wrongfully portrays a household employee as an independent contractor, then the taxpayers can be charged with tax evasion. At present, the withholding amount for social security taxes is fixed at 6.2%, whereas the rate of medicare taxes is set at 1.45%. This, if added, amounts to 7.65% withheld from all-cash salaries.

When did Nanny Tax gather more attention?

Concerning the payment of Nanny Taxes, A stunning revelation in 1993, popularly known as Nannygate, had forced Bill Clinton’s nominee for United States Attorney General, Zoë Baird, to withdraw her nomination. This was after it came to light that she and her husband had violated federal law by employing two illegal immigrants as a Nanny and chauffeur for their young child and not paying the employment taxes. Similarly, yet another Nannygate-like controversy erupted in Sweden in the year 2006. In 2006, it came into the limelight when several Swedish Prime Minister Fredrik Reinfeldt’s cabinet members had hired domestic workers but failed to pay the required taxes.