Leverage

Updated on 2023-08-29T11:57:37.066611Z

Leverage is defined as the use of fixed costs in a company’s cost structure, and it is typically directly proportional to the fixed cost and inversely proportional to the variable cost.

Financial analysts typically measure the fixed cost of a company to calculate its leverage as it often acts as a fulcrum for the company’s earnings.

The use of leverage typically magnifies the earnings of a company in both the positive side and the negative side; thus, in turn, increases the average risk of a company.

Leverage as a financial tool is typically used by both investors and companies to magnify the return profile of an investment.

Why is Understanding Leverage Important?

Leverage is a financial tool studied in capital budgeting analysis as the extent of leverage is a major deciding factor in determining the risk and return profile.

Furthermore, financial analysts typically discern information to reach a recommendation of buy/sell/hold by analysing management’s discussion on its operating and financial leverage.

Additionally, the valuation process requires the forecast of future cash flows while assessing the risk concerning the same and understanding the leverage for doing the same is a vital process.

Leverage

The use of leverage ideally increases the volatility of future cash flows; thus, it is a decisive factor in determining the risk as well. The leverage of a company ideally depends on the amount of fixed cost (or debt).

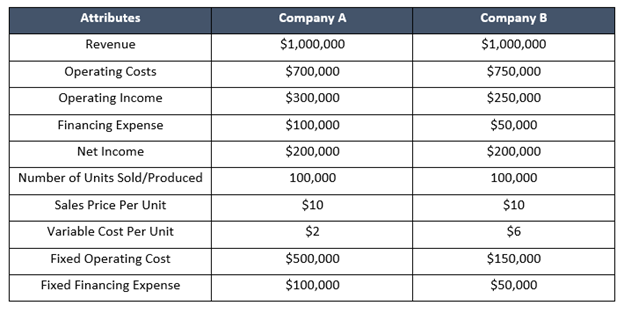

For example, suppose there are two companies A and B with the following cost structure:

While the business profile of both the companies in terms of accounting numbers look alike, the Company A uses a higher operating and financial leverage as compared to Company B with Company A having a high fixed operating and financial cost as compared to Company B.

Thus, the net income and future cash flow for Company A would vary considerably as compared to Company B with the change in the number of units produced.

For example, If Company A produces only 50,000 units, its operating income would fall in turn into a loss of $200,000 as compared to Company B, whose earning would just come to $0 with the same number of unit produced, i.e., 50,000 from 100,000.

The higher variability in the net income of Company A with respect to the number of units produced/sold is relatively very high as its fixed costs, i.e., fixed operating cost and fixed financing cost are relatively high as compared to Company B.

Business Risks and Degree of Operating Leverage

Busines risk of a company is ideally defined as the risk associated with operating earnings and is usually subdivided into two major categories, i.e., sales risk and operating risk.

Sales risk is the risk that a company would face concerning the price and quantity of the goods and services.

Going back to the above example, Company A and B both faced the sales risk scenario with the decline in the number of units sold when the net income for Company A turned into a loss of $200,000, and the net income for Company B reached $0.

Operating risk is ideally identified as the risk concerning the operating cost of a company, in particular, the fixed cost.

Operating risk is directly proportional to the fixed operating cost and is inversely proportional to the variable operating cost.

Understand Operating Leverage here:

In simple terms, companies having a high fixed operating cost cannot adjust to the change in the number of units/service sold; thus, are more susceptible to volatility in operating earnings.

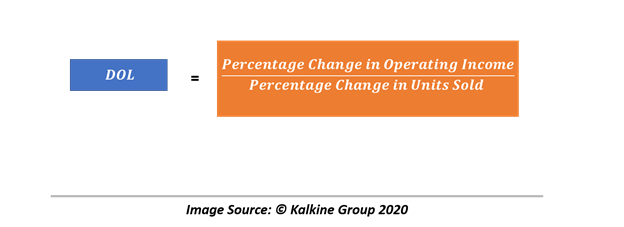

The volatility in operating income with regards to the change in the number of units sold and fixed operating cost could be measured by the Degree of Operating Leverage (or DOL).

DOL could be defined as the ratio of the percentage change in operating income with the percentage change in unit sold.

Financial Risk and Degree of Financial Leverage

Just like operating risk, the financial risk is the reflection on the fixed financing cost and more the fixed (debt) obligations a company has to pay, the more would be its financial risk.

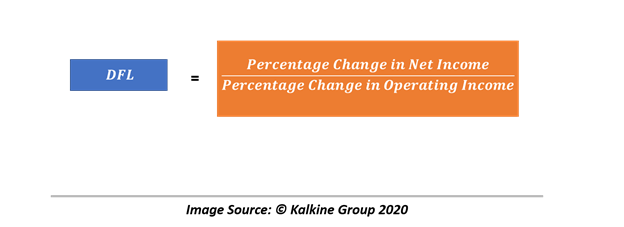

Financial risk can also be quantified in the same way as the operating risk in terms of the Degree of Financial Leverage (or DFL).

DFL is defined as the ratio of the percentage change in net income to the percentage change in operating income.

As financial leverage is more dependent upon the discretion of a company as compared to the operating leverage, that usually remains same for companies in an industry group, companies with higher tangible assets to total assets might be able to use higher Degree of Financial Leverage.

In simple terms, having more tangible assets provide creditors with higher confidence of recovery in case of a default, allowing them to extend large amounts to such companies.

Total Leverage

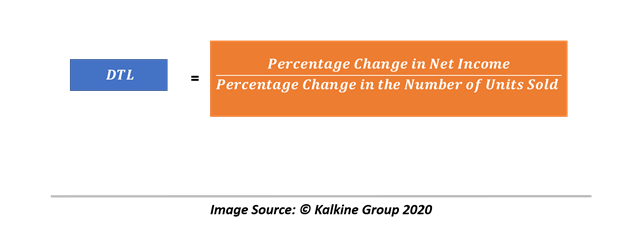

Total leverage of a company is the function of its operating leverage and financial leverage. The quantified factor which captures the same is the Degree of Total Leverage (or DTL).

DTL could be defined as the ratio of the percentage change in net income to the percentage change in the numbers of unit sold.