Investment Tax Credit

Updated on 2023-08-29T12:00:50.883264Z

What is Investment Tax Credit?

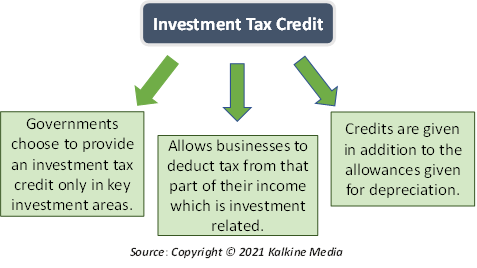

An investment tax credit is a tax-related incentive that allows businesses to deduct tax from that part of their income that is investment-related. These credits are given in addition to the allowances given for depreciation.

Investment tax credits are offered as a percentage deduction at the time when the asset is being purchased. Governments also use tax incentives to make investments more profitable for firms. Most governments opt for investment tax credits, even though there has not been evidence supporting the fact that these benefits encourage investments.

Governments may also choose to provide an investment tax credit only in key investment areas like sustainable energy. This means that amount spent on the purchases of equipment and assets that belong to a certain sector is tax-deductible.

Summary

- An investment tax credit is a tax incentive that lets individuals and businesses save up on tax on that part of their income that is investment-related.

- This incentive is offered as a percentage deduction at the time of the purchase of the asset.

- Governments may choose to provide an investment tax credit to promote investment in key areas like renewable energy.

Frequently Asked Questions (FAQs)

How did the concept of investment tax credit emerge?

Investment tax credits were first rolled out in 1962 in the United States. Since then, an investment tax credit has been offered in varying amounts across geographies and sectors. The initial intent of the incentive was to protect the domestic business from foreign competition. However, currently, the credit is offered for reasons that are very different.

In 1985, the investment tax credit given was 10% of the purchasing price based on the life of the asset. The credit has been reduced from the tax related bill in the credit form. The credit has not witnessed any sort of depreciation. The 1986 tax reform act cancelled investment credit for property placed in service after the 1st of January 1986.

The American Recovery and Reinvestment Act of 2009 changed how the ITC was applied. It expanded the credit to allow owners of renewable energy projects which qualified for the production tax credit to make an irrevocable election to claim the ITC. This allowed ITC to become available for projects that were not previously eligible like biomass and wind projects.

How is investment tax credit calculated?

The calculation of investment tax credit can be done by multiplying the net capital investment amount made during the year that was taxable by the investment tax credit percentage, annualized. The mentioned percentage is estimated by dividing the SBT of the tax that was applicable during the year by the rate of 2.3%. The resulting amount is then multiplied by the adjusted and appropriate gross receipts percentage as required.

Why is investment tax credit needed?

The primary goal of adopting investment tax credit is to promote investment. Investment is a key driver of economic growth for any country. Investment holds two important functions in a macroeconomy. The first one being the short-run fluctuations brought along by the volatility of a business investment, and the second one being the efficient allocation of capital among firms in the long run.

As the views regarding the structure of the economy, ITC has been adopted for varied reasons to falling somewhere in the middle of short-run stabilization and long-run allocation goals.

Income tax credit offers an edge over depreciation allowance by imparting immediate value and by being a better fit as a fiscal policy tool. Depreciation allowances are subject to uncertainty related to the discount rates which may be caused by inflation. Thus, ITCs are a preferred fiscal policy instrument over depreciation allowances.

Businesses also need investment to expand so that they can develop partnerships with other businesses or individuals coming from various industries. Many firms can be able to achieve international recognition by investing with partners and would allow them to open new windows.

What are the challenges associated with an investment tax credit?

- ITC is non-refundable: This aspect makes ITC valuable to a taxpayer only if there exists a current tax liability. This challenge is met by solutions like carryback and carryforward provisions. However, the delay in realizing the credit ends up making the ITC less valuable. This can be a big disadvantage for firms relying on internal funds for investing.

- Impact of tax life: Higher tax life brings greater benefit. For instance, a tax life of 4-6 years receives 1/3rd of the ITC, while a tax life of 6-8 years receives 2/3rd of the ITC. Full credit may be given only for a tax life above 8 years.

- Limited coverage: Since ITC can be availed on only certain types of investments, businesses may be often compelled to reassign assets as equipment or special purpose tools.

These shortcomings make the scope of ITC limited. Therefore, the full impact of an ITC has not been observed on the overall investment on the macroeconomic level.

What are the targeted areas where governments offer investment tax credit?

The reasons for adopting investment tax credits have changed dynamically. Now the reason for using ITCs is more centered around pollution control, energy conservation, green technology, and other economic development methods.

Some of the areas where investment tax credits are deployed include Reforestation Credit, Solar Energy Investment Tax Credit, Rehabilitation Tax Credit, and Federal Business Energy Investment Credit.

Tax credits are increasingly being used in solar thermal processes, solar thermal electric, solar water heat, solar space heat, fuel cells, biomass wind, geothermal pumps, and geothermal direct use.