Exchange-traded funds

Updated on 2023-08-29T11:54:23.611024Z

What are ETFs?

ETFs are similar to funds where pooled money of investors is managed by a fund manager, who runs the ETF. These funds invest in equity, debt, commodity or any other asset class, depending on its offering.

Good read: Mastering the Basics of Investing in ETFs

Price of the ETF is based on a value of net assets in the fund and is subject to change each trading day consistent with underlying changes in the value of net assets. Since ETFs are traded in markets just like shares, the quoted price of an ETF either reflects a discount to its NAV or a premium to its NAV.

Investors have flocked to ETFs because of low-cost proposition and opportunity to take exposure in a specific pool of assets, which are professionally managed by an investment team with the investment manager.

Some ETFs are also used as a proxy to define sentiment in an underlying sector, commodity or index since ETFs are actively traded in market hours, incorporating the latest information in prices. Fund management businesses have continued launching new and innovative ETFs, which have seen great demand over the past.

Read: Gold ETFs register massive capital influx; while PDI, GPP, ERM, AME, RED Under Investors’ Lens

Large and popular ETFs have also defied liquidity problems because of large scale investor participation. But it remains a problem with lesser-known ETFs with small market participation. ETFs also pay distributions to the holders that are either derived through interest income, dividend income or capital gain.

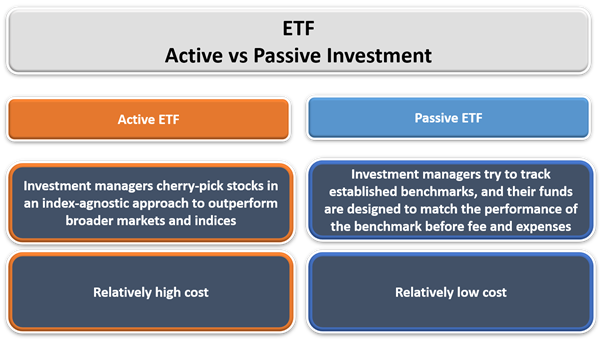

Active and Passive ETFs

With ETFs markets growing strongly as ever, there remains a divide between active fund managers and passive fund managers. Passive investment strategies have grown immensely popular among market participants over time. This strategy is cost effective. Many seasoned investors such as Warren Buffett, John C Bogle- founder of the Vanguard Group have endorsed passive ETFs.

Active ETFs do not track a benchmark, and performance is not tracked to any given index. These funds are based on countries, sectors, market capitalisation, asset classes, etc., and active investment management allows a manager to beat the returns delivered by broader markets or indices.

If you look at the great investors like Warren Buffet, Philip Fisher or Peter Lynch, they have set themselves as a preamble for active investors, and their record of delivering sustainable returns over the long term continues to attract investors to active alleys of markets.

Since Passive ETFs are designed to match returns of respective benchmarks, there is no scope of delivering outperformance no guarantee that fund will not underperform the benchmark. However, the expenses charged to investors are relatively lower compared to Active ETFs.

Passive ETFs are cheaper than Active ETFs because the use of resources is limited in the former. Since they are designed to match the benchmark and its underlying securities, trading in Passive ETFs is mostly automated running on algorithms, and stock picking is not required, thereby no research.

Read: ETFs: Investors Up the Ante and ETFs Run the Show for Long-Term Returns

ETFs based on asset classes and style

Sector ETFs: These are the most common type of ETFs in market. Sector ETFs track specific sectors like Information Technology, Consumer Staples, Consumer Discretionary, Metal & Mining. These are similar to index funds but are actively traded in stock exchanges.

Equity ETFs: Equity ETFs may include equity-focused Sector ETFs. As the name suggests equity, these funds invest in stocks independently or are benchmarked to a specific index. Perhaps, Equity ETFs are the most common ETFs.

Fixed Income ETFs: These funds invest in fixed income instruments and pay distributions out of the interest earned on bonds. Further Fixed Income ETFs can be separated as investment-grade ETFs, high-yield ETFs, Government bond ETFs.

Commodity ETFs: Commodity ETFs invest in physical commodities like precious metal, agricultural goods, natural resource. These funds include products like Gold ETFs, Oil ETFs, Grain ETFs, Silver ETFs.

Good read: Investing in Commodity ETFs

Short ETFs: Also known as inverse ETFs, these funds are designed to benefit when the benchmark is falling. Short ETFs hold short positions in the benchmark index futures or constituents of the index to benefit from fall in value or prices.

To know more about short selling read: Minting Money While the Asset Price Tanks; Enter the World of Short Selling

Leveraged ETFs: Leveraged ETFs use derivatives to amplify the returns and risks of a fund. These are also called geared ETFs. Leveraged ETFs may also hold equity or bonds along with the derivatives to amplify the net asset value movement of funds.

Do read: All You Need to Know About Exchange Traded Funds

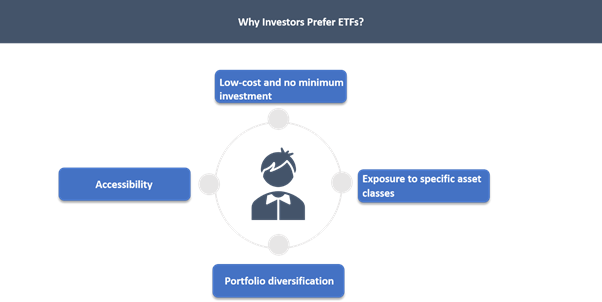

Why investors prefer ETFs?

Passive investment vehicles continue to appear compelling to a large investor base, and there are numerous reasons driving the demand for passive investment vehicles.

Low-cost and no minimum investment: ETFs have lower expenses compared to traditional mutual funds, and most of the funds have no minimum investment criteria. As a result, the market for ETFs has grown strong, due to its reach to investors with limited capital.

Must read: Mutual Funds vs. ETFs: Which Are Better?

Exposure to specific asset classes: Investors with large portfolio also use ETFs to enter to into specific asset classes like Gold ETF or Commodity ETF, but not limited to sector ETFs, theme-based active ETFs like technology, mobility, e-commerce etc.

Portfolio diversification: ETFs provide investors with an opportunity to diversify a portfolio of concentrated stocks by including exposure to specific sectors, indices, and commodities. More importantly, the diversification is available at a low-cost investment, which further drives the need for ETFs in a portfolio.

Accessibility: It is perhaps the most compelling value ETFs provide to investors. Since ETFs are available on stock exchanges like shares, investor participation remains strong, and some popular ETFs boast high liquidity levels.

Read: Confused on How to Invest in ETFs? We Have Some Tips!

Further read: 6 Reasons to look at ETFs