Days Sales Outstanding

Updated on 2023-08-29T11:54:17.191357Z

What is Days Sales Outstanding?

Days Sales Outstanding (DSO) is the average count of days a firm takes to convert credit sales to cash. It represents the amount of time taken to convert receivables into cash. It is denoted in days and can be computed on a month, quarter or year-end. It is an essential component of the calculation of a company’s cash conversion cycle. In addition, it is essential for measuring how liquid a firms’ current assets are.

Summary

- Days sales outstanding (DSO) is precious for individuals wanting to gauge the efficiency of a business and the quality of its receivables.

- It shows the amount of money stuck with debtors and the number of receivables already collected.

- Lower DSO means faster conversion of sales into cash, thus better cash management and operational efficiency.

Frequently Asked Questions (FAQ)-

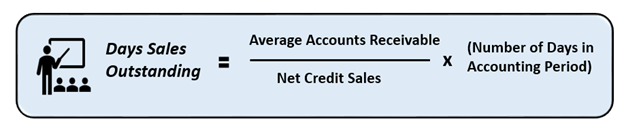

How is Days Sales Outstanding (DSO) computed?

Days sales outstanding (DSO) is the average number of days for which credit sales remain outstanding. At an individual debtor level, it shows how quickly the debtors pay off their debt. It is useful to gauge the cash flow issues at the debtor firm’s end. DSO shows the efficiency of the collections team and how well receivables are managed.

Source: Copyright © 2021 Kalkine Media

If the Days sales outstanding result is very close to the number of days granted to debtors for payment, it shows that a firm has a tough credit policy. Cash sales are not included in the DSO calculation since zero days are waiting to receive the cash. Therefore, it is not actually sales outstanding, but sales realized in cash.

Example-

Suppose Crude Ltd. sold 10,000 barrels of oil for US$50 million in December 2021. In December, the total credit sales were worth US$25 million, and the remaining half was sold for immediate cash. Also, at December end, the average accounts receivable balance was US$ 8 million.

Using the the above numbers reported by Crude Ltd., the DSO will be calculated using Formula's previously mentioned Formula. As a result, we will get a DSO of 10 days, given 31 days of December. This means the credit sales in December will take on an average of 10 days to get converted into cash for ready use in business.

How is Days Sales Outstanding (DSO) interpreted?

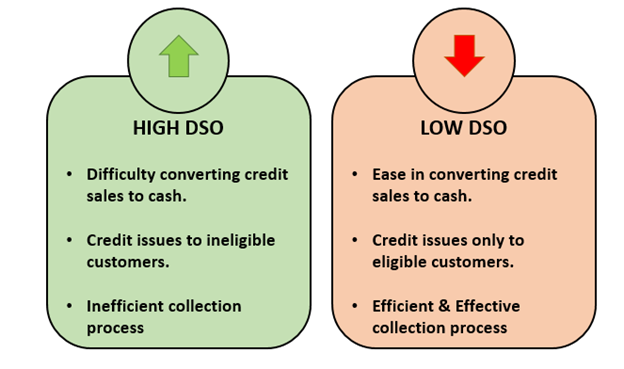

Source: Copyright © 2021 Kalkine Media

The higher the DSO value harder it is for firms to translate receivables to cash. But this interpretation may not stand true for businesses with a large capitalization as they have enough capital available, and there is no hurry for immediate cash conversion. The delay then is tolerable to some extent. But for smaller businesses, quick collection means available funds for operational or inherent expenses.

A low DSO indicates the efficiency of the receivables collection process. In addition, it shows that the firm has a very stringent credit policy. But this may sometimes negatively affect sales as often customers look for extended credit terms and may prefer a seller offering such leniency.

What are the uses of Days Sales Outstanding (DSO)?

- DSO helps determine the liquidity of a business’s current assets.

- It shows how effective the collection team is.

- It is useful to build financial models and forecasts

- A good indicator of debtors’ cash flow position.

- DSO is used internally to monitor the amount of cash put in receivables.

- A good reflector of Debtor payment policies.

- Analysts can use DSO as a trend line to reasonably compare liquidity over time.

- It is a useful metric to decide the acquisition value of a business.

- It acts as a premature warning indication of financial troubles.

What are the Limitations of DSO?

- DSO, if not compared with similar industry firms, can be wrongly interpreted.

- It doesn’t consider the capital size and business model but focuses only on sales and collection.

- There is no standard DSO number; it varies from industry to industry.

- Only used to study the credit component of entire sales revenue.

- Not a good indicator of liquidity for firms having lower credit sales.

- It is not the sole and perfect indicator of debtor and collection efficiency.

- Sales volumes shake DSO and may change the interpretation previously assigned to it.

How can a company improve its DSO?

- Regular monitoring of DSO levels is the first step towards a business’ financial health.

- Required strictness or leniency must be incorporated in collection processes to make a difference.

- A firm should stress on upfront receipt of cash on sales.

- Efforts must be made towards customer satisfaction to get cash as quickly as possible from them.

- Firms must avoid showing debt leniency to customers with poor credit ratings or a bad track record.

- Review of receivables and debtors on a regular interval is a must for the collections team.

- Multiple payment modes like cash, cheques, online banking, card swipes, etc., must be allowed to the customers.

- Customers should be encouraged to automate payments on receipt and booking of invoice.

- Advance payments can be called for to ensure some part of receivables is cashed.

What is the ideal DSO number for a business?

There is no ideal DSO ratio that can be considered as the ideal debt-equity ratio of 2:1. It totally depends on the type of industry ca firm is operational in. Thus a good DSO ratio for a mining company may be entirely different from a technology company that works on a contract revenue basis. The revenue recognition principle also affects the DSO ratio as sales recognized may increase or decrease based on it.

Often on a very generic understanding, 45 days DSO is considered ok as there only a delay of one month and fifteen days in the collection of funds. However, it may not be true for all types of business. Measuring the average time required to convert receivables to cash when tracked over time is the best way to develop an ideal DSO number for any firm.