Crypto Token

Updated on 2023-08-29T12:01:45.270897Z

What is crypto token?

A cryptocurrency token is a computer coded alphanumeric string that links real data on a blockchain. In other words, it is a hash of a transaction on a blockchain that can relate to the specific transaction. For example, a cryptocurrency token may describe a digital asset like a collectible or a unit of value. The tokens can be handy for blockchain security or other utility needs. One popular cryptocurrency token is Bitcoin native to the bitcoin blockchain. Each bitcoin has a unique alphanumeric or cryptographic code that can identify all available transactions related to it.

Summary

- A cryptocurrency token may describe a digital asset like a collectible or a unit of value and can be handy for blockchain security or other utility needs.

- The functionality of tokens is wider than receipt and payment; they can represent equity, smart contracts, security or even gaming.

- Some coding knowledge can help in creating crypto tokens, there is no penalty attached to them, and any interested person can invest in them.

Frequently Asked Questions (FAQ)

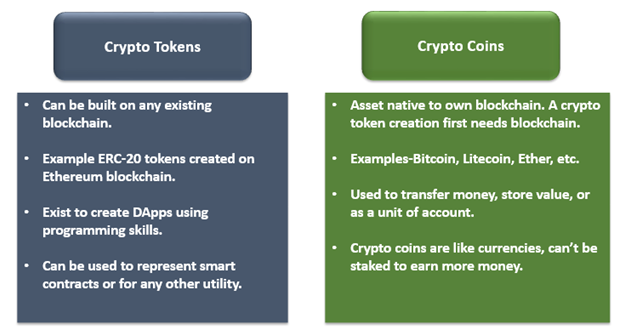

How are crypto tokens different from crypto coins?

Often used interchangeably, these two have a few important distinctions-

Source: Copyright © 2021 Kalkine Media

As understandable, crypto coins have limited utility compared to crypto tokens. Crypto coins are a subset of crypto tokens. The functionality of tokens is wider than receipt and payment; they can even represent equity, smart contracts, security, or gaming benefits. While coins are more so just money, Crypto tokens serve a broader purpose.

How do crypto tokens work?

‘Tokenisation’ is the process of creating crypto tokens and allocating value to them. The crypto tokens, in essence, represent an existing digital or physical asset. Crypto tokens symbolise a set of rules, and every token belongs to the blockchain address. Any person who holds the private key for that blockchain address has access to the respective token. That person is thus the owner or custodian of that crypto token. The custodian may or may not be the crypto token developer. However, it is the developers who have the right to publish their tokens on a cryptocurrency exchange.

Every cryptocurrency token, therefore, represents a tradable good. The tradable commodities are coins, contracts, in-game items, a share in a company or any voting rights. Due to this, few people refer to them as crypto assets or crypto equity. Tokens are created to provide security to the underlying assets. If something happens, the crypto tokens get frozen. No cryptocurrency tokens are movable until the unfreezing happens.

Crypto tokens are released for public use via an initial coin offering (ICO) similar to securities initial public offering (IPO). The tokens are publicly available for buying even after the ICO has ended. Anyone can create a new token if they have the know-how. It is not at all difficult; some coding knowledge can help in creating them. There is no penalty attached to creating a crypto token. Once created, any interested person can invest in or fund the token using existing crypto coins native to the blockchain or platform.

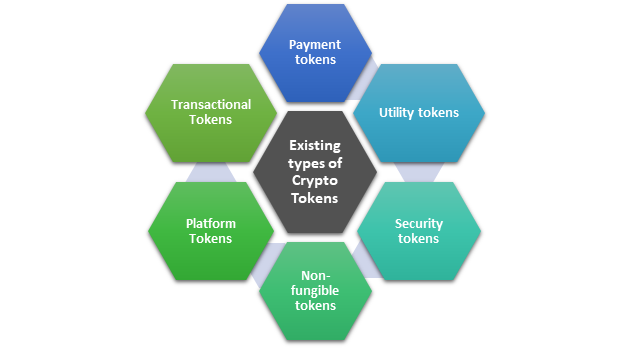

What are the types of crypto tokens?

Existing crypto tokens are of the following types based on their characteristics:

Source: Copyright © 2021 Kalkine Media

- Payment tokens are like crypto coins and function as a medium of exchange, store of value, or a unit of account. Popular existing cryptocurrencies like Bitcoin, Dogecoin, Litecoin, etc., are payment tokens. A similar feature to fiat currencies is that payment tokens gain or lose value based on the supply and demand of the token. The creator demand and lower supply increase value, during lower demand and greater supply decrease value. However, the supply of crypto payment tokens can be regulated by the platform.

- Utility tokens give access to the blockchain-based product or service. For example, Polkadot tries to eliminate the complex and costly crypto mining process and enable DApps (Decentralised App) and smart contracts.

- Security tokens represent traditional assets like stocks and shares, which can be converted into a digital token on the blockchain—these tokens holders have ownership rights. Many regulators are controlling how security tokens are issued and traded. These have come into existence from the emerging needs of security. These serve as direct, on-chain symbols of real-world securities as on-chain instruments.

Source: © Noipornpan | Megapixl.com

- Non-fungible token is a digital symbol of a unique asset not having a standard value. As the name suggests, holders can’t exchange non-fungible tokens for another directly. The data represented by these cannot be duplicated or altered.

- Platform tokens utilise the blockchain infrastructure or the so-called platform to deliver a DApp for different uses. These benefit from the blockchains they are built upon, gaining enhanced security and supporting transactions.

- Transactional tokens serve as units of account and are exchanged for transactions related to goods and services. These are like any other currencies, but in some cases, provide additional benefits. The only difference is that transactions can take place without a traditional intermediary or central authority. But all transactional tokens are not currencies. They can even be smart contracts used for transactions.

Another upcoming type of crypto token is the Governance token- This represents a decentralised protocol that keeps going deeper into the mechanism and keep evolving with the need to refine the decision-making processes critical to them. These on-chain governance systems allow stakeholders to collaborate, debate, and vote on how the system will be managed. Governance tokens are currently the base of blockchain-based voting systems and are often used to support any proposed changes or vote on proposals. Another emerging type is the in-game crypto token used as a part of a web developed game. The world of cryptocurrencies is vast and, most importantly, still evolving.

A trending crypto token example:

When Paris St Germain, the French football club, included crypto tokens as a part of Lionel Messi’s remuneration package. As a welcome sign to the club Messi, the ace footballer, was given fan tokens. It was a method to promote crypto tokens.