ResMed Inc (ASX: RMD)

.png)

RMD Details

Growth in revenue but expenses also on the rise:ResMed Inc (ASX: RMD), a healthcare leader with award-winning medical devices and cutting-edge cloud-based software applications for sleep apnea, chronic obstructive pulmonary disease (COPD) and other chronic diseases, saw its share price surging 3% on October 30, 2017 as the group filed form 10Q for QTR ended September 30, 2017.

Primarily, there has been a 13% growth in net revenue compared to the three months ended September 30, 2016 at the back of an increase in unit sales of devices, masks and accessories, while a decline in average selling price capped the growth slightly. Gross margin was 58.4% for the three months ended September 30, 2017 compared to 57.8% for the three months ended September 30, 2016. The group also enhanced its diluted earnings per share to $0.60 per share compared to $0.54 per share for the three months ended September 30, 2016. The group’s cash and cash equivalents totalled $811.1 million with total assets of $3.5 billion and stockholders’ equity of $2.0 billion as at September 30, 2017.On the other hand, the group’s expenses have also expanded with selling, general and administrative expenses rising by 12% while Research and Development Expenses soared by 9%, majorly owing to movement of international currencies against the U.S. dollar.

While the group has a 10% adjusted EPS growth over the last five fiscal years with 77% free cash flow been returned to shareholders over the last rolling five years, pressure is mounting up on expenses side. The group has also reported for a high total other (loss) income, net for the three months ended September 30, 2017, of $4.1 million against a loss of $1.2 million for previous corresponding period owing to an increase in interest expense due to higher borrowings and foreign currency losses. RMD stock is already trading at higher levels and looks “Expensive” at the current price of $10.97

Estia Health Ltd (ASX: EHE)

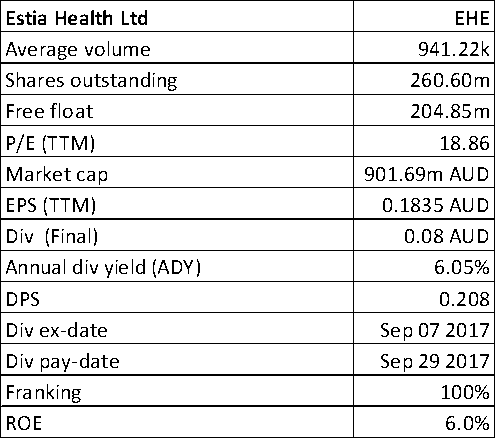

EHE Details

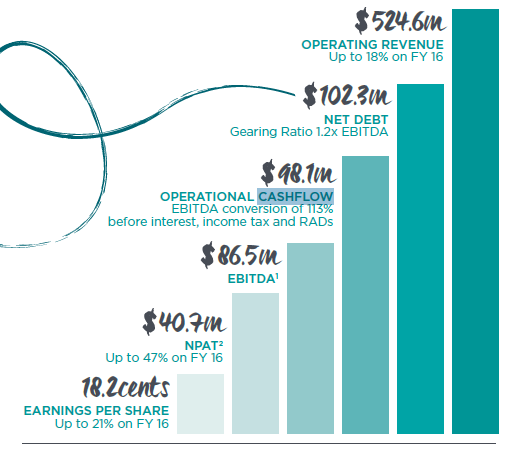

Improving performance while some headwinds still prevail: Estia Health has enjoyed a good FY17 with many transformations and a renewed board and management team. The company’s strategy to continually divest non-core assets while emphasising on developing new homes has been working well.EHE has reduced its debt to half (to $102.3 million) with a reduced gearing. About $4.9 million has been invested in significant refurbishments covering five homes during FY17. Further, purchase of a greenfield site at Sunshine Cove in Queensland for $6.5 million and investments with regards to maintenance of capital expenditure and facility enhancement are expected to provide some growth. The group has highlighted a strong pipeline of development opportunities expected to drive performance in FY18 along with considerations of few acquisitions of smaller portfolio or single facilities.The renewal of $330 million loan facilities with Westpac and CBA until August 2020 is enabling the group have flexibility through the phases including development and refurbishment of existing homes.

EHE stock rose 3% on October 30, 2017 with some positive sentiments. Recently, Vinva Investment Management has become a substantial holder for the group. While long term fundamentals may seem to appear, some level of uncertainty still prevails with regards to funding scenario, suspension of dividend reinvestment plan and extent of growth prospects. We put an “Expensive” recommendation at the current price of $3.55, and would review the stock later.

FY17 Performance (Source: Company Reports)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.