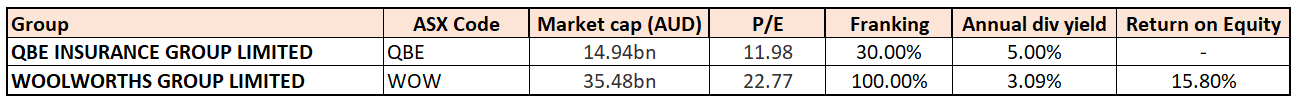

Stocks’ Details

QBE Insurance Group Limited (ASX: QBE)

Unfavourable position: QBE Insurance Group was seen to move up about 4.9% in last five days (as at January 24, 2018) despite the release of a weak trading update wherein a $US1.2 billion ($1.5 billion) full-year loss for FY17 has been indicated as a result of FY17 challenges including impact from various catastrophic events. The combined operating ratio (COR) guidance has also been lowered to 104% against the target range of 100 to 102% (level >100% indicates for an unprofitable underwriting business). Though the 2018 outlook includes a target COR range of 95-97.5% with target net investment return of 2.5-3%, QBE has highlighted many inadequacies in the near term.

The reduction in the US corporate tax rate to 21% is flagged to result in a $230m write down of the carrying value of deferred tax assets in its North American Operations. It has revised assumptions used to support the carrying value of North American goodwill leading to an impairment charge of around $700m. The group’s FY17 combined commission and expense ratio is expected to be around 32.5% while net investment return is estimated to be around 3.2% or $800m. Given the group’s underperforming businesses, QBE now plans to undertake a comprehensive program of work to improve both the level and consistency of performance along with a strategic review of Latin American Operations. These plans might unearth additional write-downs/ expenses to achieve the strategic goals. Given the scenario, we believe the stock is still “Expensive” at the current price of $10.94, and it would be better to look for other alternates including the below stock.

Woolworths Group Limited (ASX: WOW)

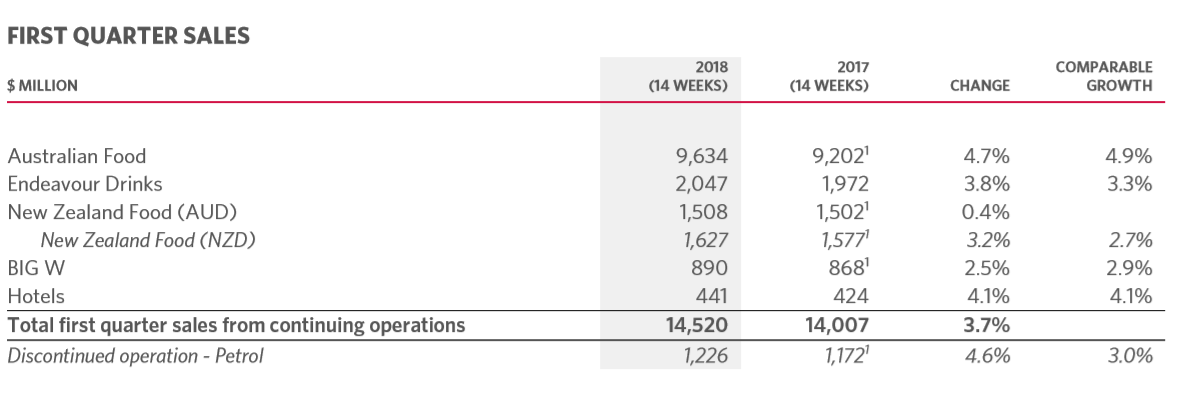

Tracking well on priorities for 2018: Woolworths Group recently announced few changes in the Board entailing Steve Donohue’s appointment as the New Managing Director of Endeavour Drinks. The group is tracking in line with its 3-5 years’ plan to improve value across customer, team and supplier experience. The group also upgraded store experience and completed 72 Renewals and 85 Light Upgrades in Woolworths Supermarkets during FY17 and sold out EziBuy and Home Improvement for sketching a better portfolio picture. It is worth noting that the dividend increased by 9.1% at the back of strong cash flow generation during the year and improved trading performance in the second half. The momentum has continued in the first quarter of FY18 on strategic priorities in all the businesses. Focus on digital arm, piloting of Express Delivery and improved customer satisfaction seem to provide good thrust. While the group expects more investment for New Zealand Food in 2018 and highlights improvement needs of BIG W, Australia Food and Endeavour Drinks are tracking well. Further, Woolworths’ record of strong like-for-like sales growth is expected to help the margin expansion.

Meanwhile, WOW that currently operates over 531 sites and has 12 sites in development, was taken aback by ACCC’s decision opposing the proposed acquisition of the Woolworths fuels business by BP, which supplies fuel to approximately 1400 BP-branded service stations throughout Australia. The determination that WOW is a vigorous and an effective competitor having an important influence on fuel prices and on price cycles in many markets throughout the country, overweighed other acquisition prospects. Another blow to the group has been that IMF Bentham is not proceeding with conditional funding of shareholder class action against WOW.

Meanwhile, the stock prices increased by 7.6% in the past three months (as at January 24, 2018). Given the company-wide efforts and targets set for the upcoming year while some temporary headwinds prevail, we have a “Buy” recommendation on the stock at the current price of $27.09

Quarterly Sales (Source: Company Reports)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.